Gold Price Analysis: XAU/USD eyes $1,863 as House Democrats greenlight stimulus – Confluence Detector

Gold has been shining on hopes of a fiscal stimulus package – which seems more real. Democrats and Republicans are moving forward, and President Donald Trump's response is awaited. The precious metal is benefiting from hopes of significant expenditure coming from Uncle Sam.

House Democrats have greenlighted a bipartisan fiscal stimulus plan coming from moderate Senators. While the package is worth only $908 billion, it may reach higher levels. Moreover, markets were positively surprised to see progress in Washington during the lame-duck session – and still await more in January, when President-elect Joe Biden takes office.

How is XAU/USD positioned on the technical graphs?

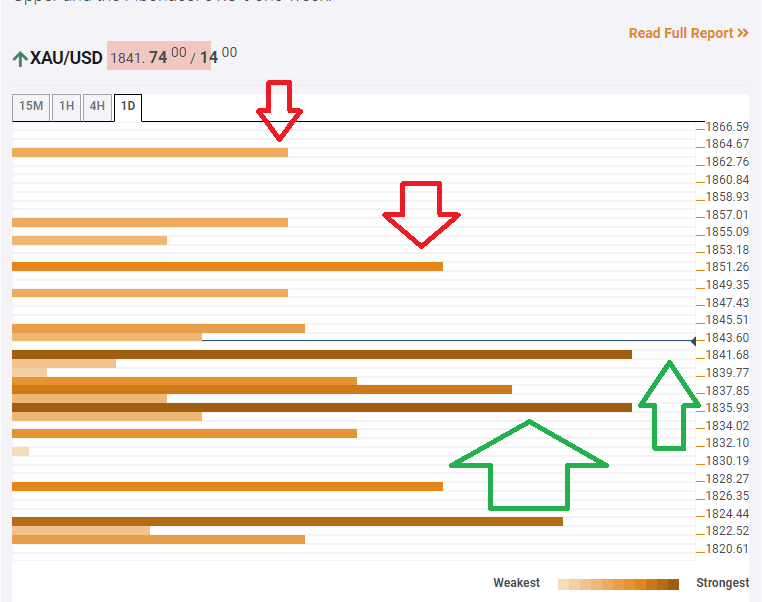

The Technical Confluences Indicator is showing that Gold has overcome two substantial resistance lines that now serve as support. The first one is $1,841, which is the convergence of the Fibonacci 38.2% one-month and the Simple Moving Average 5-15m.

Stronger support awaits at $1,835, which is a juncture of lines including the previous 4h-low, the SMA 50-15m, the Bollinger Band 15min-Lower, and more.

Looking up, the first noteworthy cap is at $1,851, which is the confluence of the Pivot Point one-week Resistance 1 and the BB 4h-Upper.

The upside target for XAU/USD is $1,863, where the Pivot Point one-day Resistance 1 hits the price.

XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.