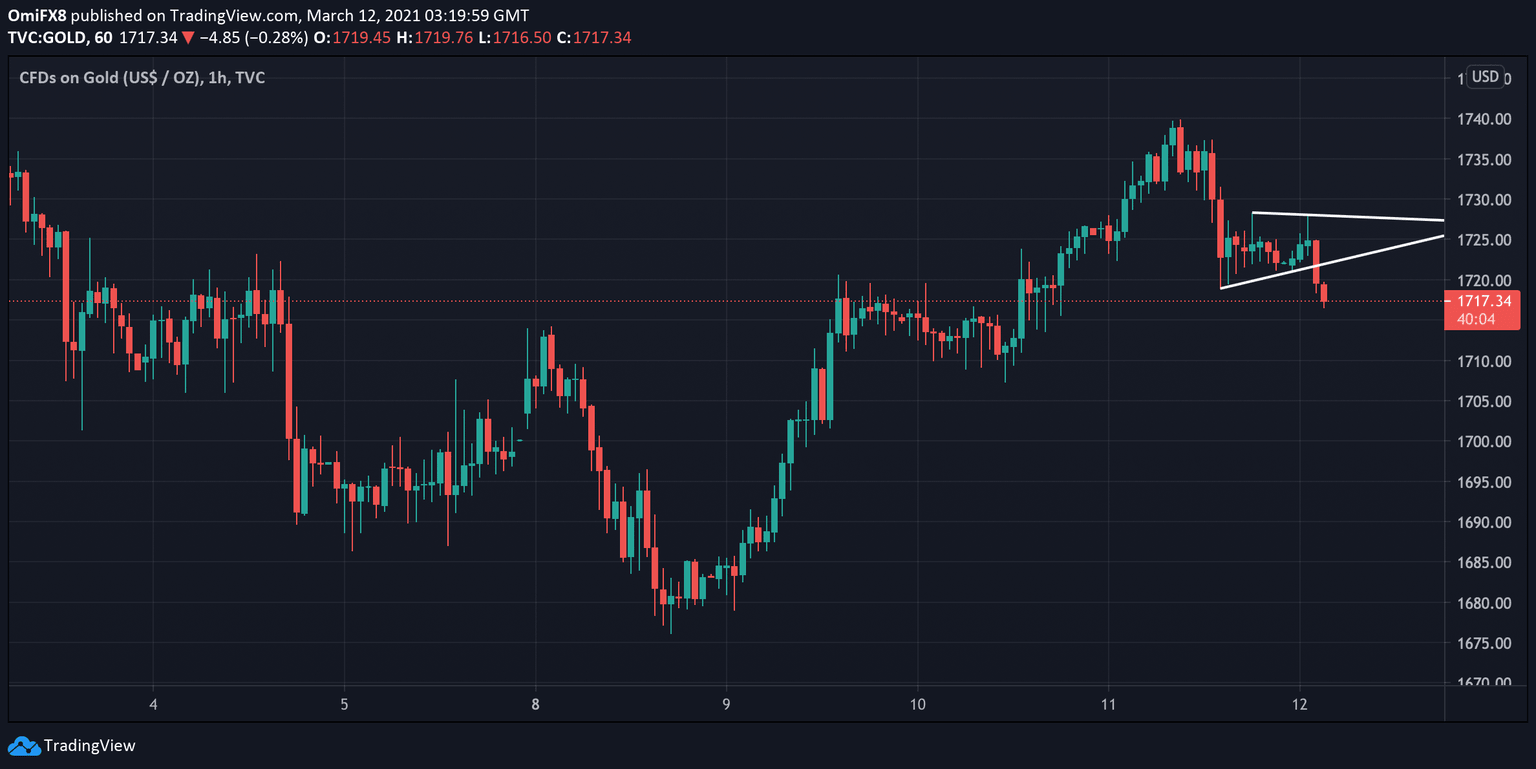

Gold Price Analysis: XAU/USD dives out of a triangle pattern on the 15-min chart

Gold is currently trading near $1,717 per ounce, representing a 0.25% drop on the day.

The 15-minute chart shows the metal has dived out of a narrowing price range, or triangle pattern, opening the doors for an extension of the pullback from Thursday's high of $1,740.

That, alongside the bearish view put forward by the long upper wick attached to Thursday's candle, suggests scope for a re-test of the recent low of $1,676.

A close above Thursday's high of $1,740 is needed to invalidate the selling pressure.

Hourly chart

View: Bearish

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.