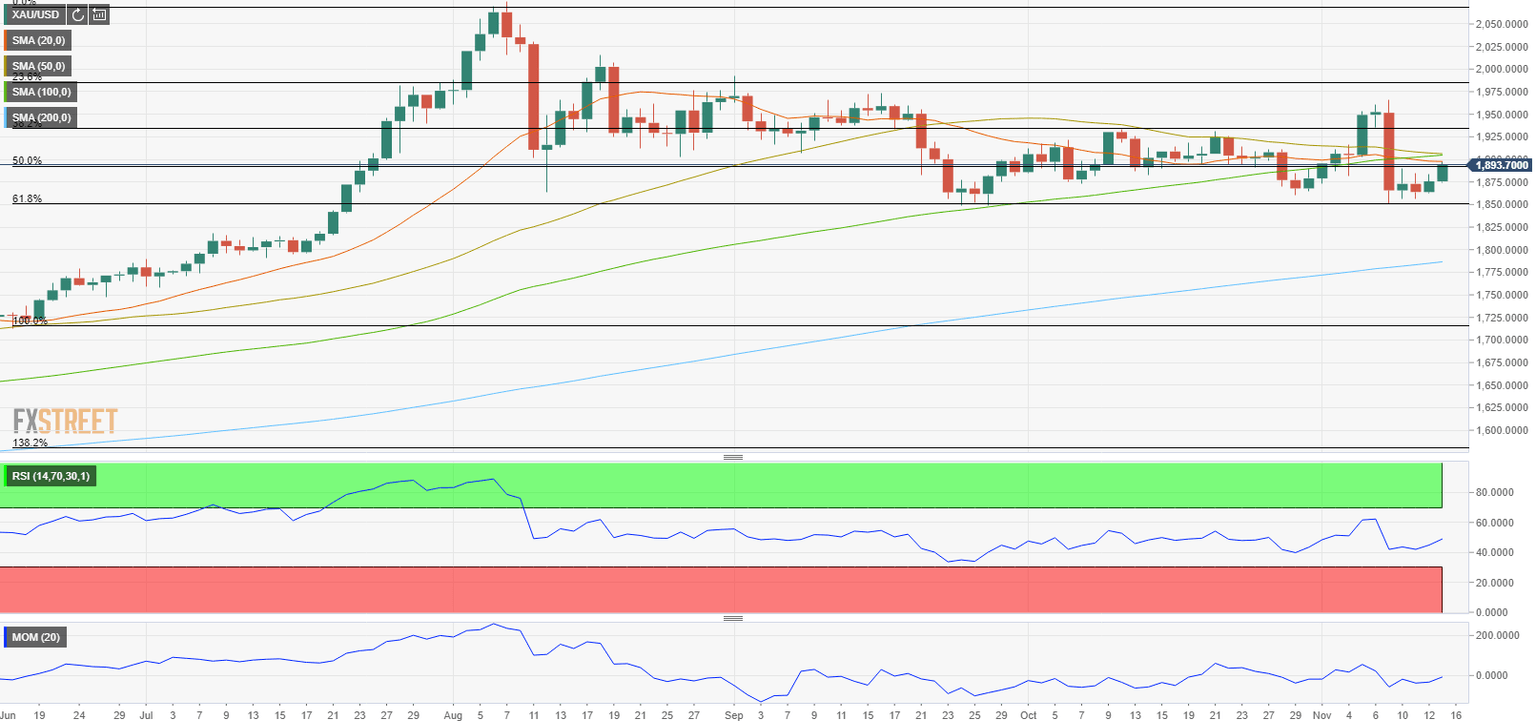

Gold Price Analysis: XAU/USD closes in on critical resistance near $1,900

- Gold is rising for the second straight day on Friday.

- Strong support at $1,850 remains intact following Monday's drop.

- Several moving averages reinforce resistance area near $1,900.

Following Monday's sharp decline, the XAU/USD pair fluctuated in a relatively tight range and struggled to make a decisive move in either direction. However, the pair broke above its consolidation channel on Friday and rose to a four-day high of $1,896.90.

Gold technical outlook

The Relative Strength Index (RSI) on the daily chart is currently testing 50, suggesting that the near-term bearish outlook is turning neutral on the back of Friday's rebound. However, a cluster of key moving averages above the price shows that buyers may remain reluctant to commit to an extended climb.

Both the 50-day and the 100-day SMAs are currently located near $1,900 psychological level, forming a critical resistance in that area. Only a daily close above that level could open the door for additional gains. $1,930 (Fibonacci 38.2% retracement of the June-August uptrend) could be seen as the next target on the upside.

Supports, on the other hand, are located at $1,874 and $1,850 (Fibonacci 50% retracement). With a break below $1,850, sellers could look to take control of XAU/USD.

Gold daily chart

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.