Gold Price Analysis: XAU/USD bulls likely to face an uphill task towards $1875 – Confluence Detector

Gold (XAU/USD) continues its advance and sits at weekly tops near $1870, cheering the progress on a $900 billion covid relief aid package. Congressional negotiators are “closing in on” the stimulus package, having discussed the contents of the package while setting aside the key issues of contention.

Further, the upbeat market mood amid hopes for a Brexit deal and dovish Fed weighs on the safe-haven US dollar, underpinning the sentiment around gold ahead of the key US employment data.

How is gold positioned on the charts?

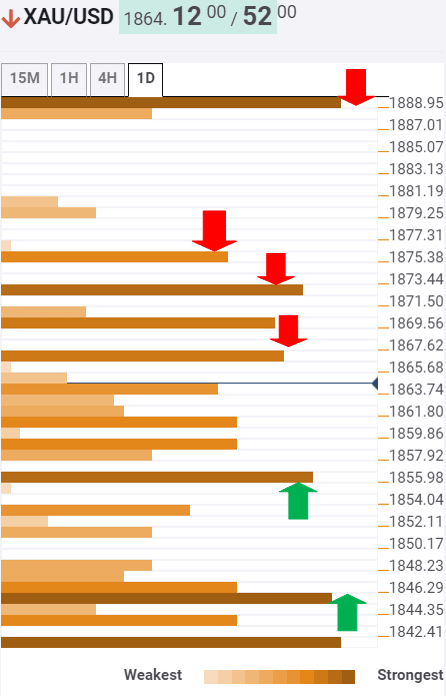

The Technical Confluences Indicator shows that the XAU/USD pair needs to scale above the critical resistance at $1867.62 for the additional upside. That level is the one-week high reached earlier in the session.

The next significant resistance awaits at $1870, the intersection of the Pivot Point one-week R1 and Bollinger Band one-week Upper.

The buyers will then challenge the $1873 barrier, which is the SMA50 one-day, on its way to the previous week high of $1875.

A sharp rally towards the Fibonacci 38.2% one-month at $1889 cannot be ruled if the bulls find acceptance above the previous week highs.

Alternatively, the bull will continue to find strong support at $1856, the convergence of the Fibonacci 38.2% one-week and SMA10 four-hour.

A minor cushion at $1853 could slowdown the declines. That level is the meeting point of the SMA50 one-hour and Fibonacci 61.8% one-day.

Meanwhile, the level to beat for the XAU bears is the confluence of the SMA5 one-day and the previous day low at $1845.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.