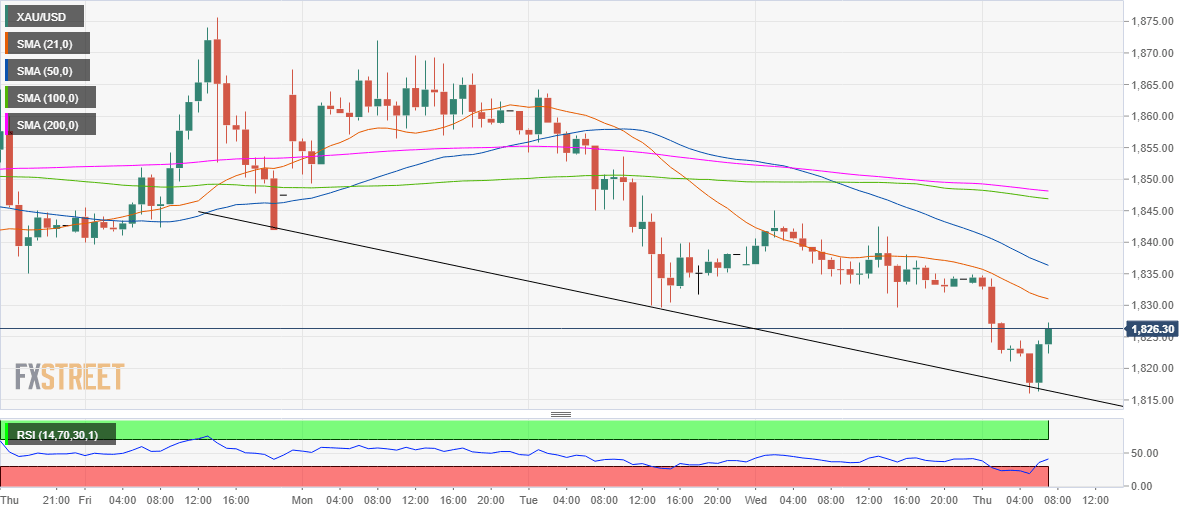

Gold Price Analysis: XAU/USD bounces back above $1820, downside bias still intact

- XAU/USD attempts a bounce after finding bids at $1816.

- Bearish 21-HMA is the level to beat on the road to recovery.

- RSI bounces off oversold conditions but remains bearish.

Gold (XAU/USD) bears have taken a breather in early European trading, prompting a rebound towards the critical bearish 21-hourly moving average (HMA) at $1831.

Acceptance above the latter could accelerate the recovery towards the next resistance at the 50-HMA of $1836.

Powerful resistance around $1848 could likely keep the further recovery elusive. That level is the confluence of the 100 and 200-HMAs.

To the downside, a breach of the four-day-old falling trendline support at $1816 could trigger a steep drop towards the January 18 low of $1803.

Further down, the November 30 high of $1790 could come to the rescue of the XAU bulls.

The relative strength index (RSI) has bounced-off from the oversold territory but remains below the 50 level, keeping the sellers hopeful.

Gold Price Chart: Hourly

Gold Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.