Gold Price Analysis: Bulls to face an uphill task beyond $1950 – Confluence Detector

Having closed above the critical $1933 barrier, Gold treads waters amid the China data disappointment and retreat in the US Treasury yields across the curve. Meanwhile, the US dollar holds onto Thursday’s rebound, with the upside capped by the US fiscal impasse and jittery markets ahead of the critical US Retail Sales data.

Despite gold’s $200 rebound from three-week lows, the bright metal remains on track for a 4% weekly drop, snapping the nine-week winning streak. Let’s take a look at technical levels to gauge where the price is headed in the upcoming session.

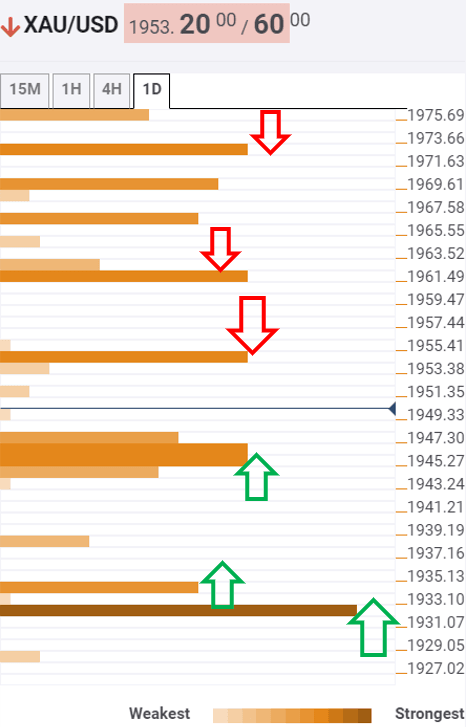

XAU/USD: Key resistances and supports

The tool shows that gold is holding well above a bunch of support levels aligned at $1945, which is the convergence of the Fibonacci 38.2% one- critical day, previous low on four-hour and Bollinger Band four-hour Middle.

The next cushion is seen at $1934, where the Fibonacci 61.8% one-day and SMA50 one-hour coincide.

The recovery momentum will likely remain intact as long as the price holds above the robust support at $1933/32 (Fibonacci 23.6% one-month).

To the topside, a clearance of the immediate hurdle at $1954, the intersection of the Fibonacci 23.6% one-day and SMA10 one-hour, will call for a test of the previous week low at $1960.

The further advance will likely be staggered, given minor resistance levels are stacked up at regular intervals on its way to $1972, the pivot point one-week S1.

Here is how it looks on the tool

About the Confluence Detector

With the TCI (Technical Confluences Indicator) tool you can easily locate areas where the price can find a support zone or resistance zone and make trading decisions. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points each time. If you are a medium- and long-term trader, this tool will allow you to know in advance the price levels in which a medium / long-term trend can stop your travel and rest, where to undo positions or where to increase your position.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.