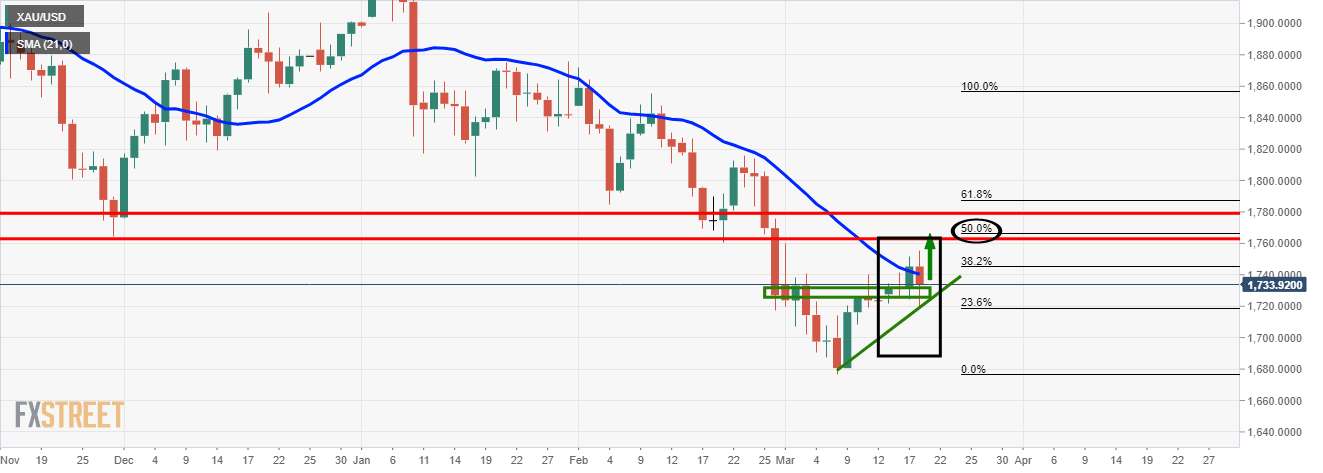

Gold Price Analysis: Bulls holding firm within familar bullish territory

- Plenty of risk fundamentals in the mix to start the week.

- Gold bulls remain above critical support and confluence of a turning-bullish 21-SMA.

Despite the weaker footing that risk sentiment had started on, US stocks are firm and the US dollar remains mixed against the G10, pressured in New York trade on Monday.

Consequently, gold prices are a touch bid on the session albeit down some 0.35% on the day.

At the time of writing, XAU/USD is trading at $1,739, recovering from a low of $1,727.34 but below the high of the day, $1.747.04.

There have been a number of headlines from the weekend news which weighed on risk appetite in both Asia and the start of the European session.

Firstly, the Turkish lira crisis drove flows away from high-beta risk and supported the yen and US dollar.

Turkey's President, Tayyip Erdogan, startled financial markets by replacing the central bank governor, sending the lira on a tailspin as investors cashed in on the surprise 2.00% rate hike in anticipation of a loser money regime under the new leadership.

Elsewhere, the coronavirus dramas continue to deepen.

Many EU countries are moving towards extending lockdowns and threatening to block vaccine exports to the UK.

This raises the risk of a serious diplomatic row if the EU goes ahead in withholding vaccines to the UK, a risk that will hang in the balance of markets for which could be supportive to gold, the ye and US dollar.

As for the economic impact of the lockdown, German Chancellor Markel is moving towards extending lockdowns for another four weeks.

France is already under stricter restrictions since March 20th.

As for the Federal Reserve, speakers are back this week following a blackout that led up to the FedereralOpe Market Committee meeting.

Despite the dovish outcome, rates have continued to rise and the market continues to price towards earlier tightening which is at odds with the Fed’s Dot Plots showing steady rates through 2023.

''If this timetable continues to accelerate, the Fed may have to push back more forcefully against any notions of tightening coming sooner rather than later,'' analysts at Brown Brothers Harriman argued. ''At the margin, enhanced Fed tightening expectations should help boost the dollar, as other central banks are likely to follow the Fed much later.''

That being said, it is highly unlikely that any new ground will be broken this week by Fed speakers on the Fed's policy stance following last week's FOMC meeting.

As for US/Sino geopolitics, the White House said it was evaluating its next steps toward China after testy talks in Alaska last week between key US and Chinese officials and sanctions over alleged abuses in Xinjiang announced earlier on Monday.

"We continue to have grave concerns about China's crimes against humanity and genocide on Uighurs in Xinjiang," White House spokeswoman Jen Psaki said. When pressed about future sanctions, Psaki left the door open.

"We will be evaluating what the appropriate next steps are in close coordination with our allies around the world," she said.

Gold technical analysis

As per a series of prior bullish analysis, the price continues to be on the path towards a 50% mean reversion of the weekly bearish trend.

Prior analysis, daily chart

Live market, daily chart

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.