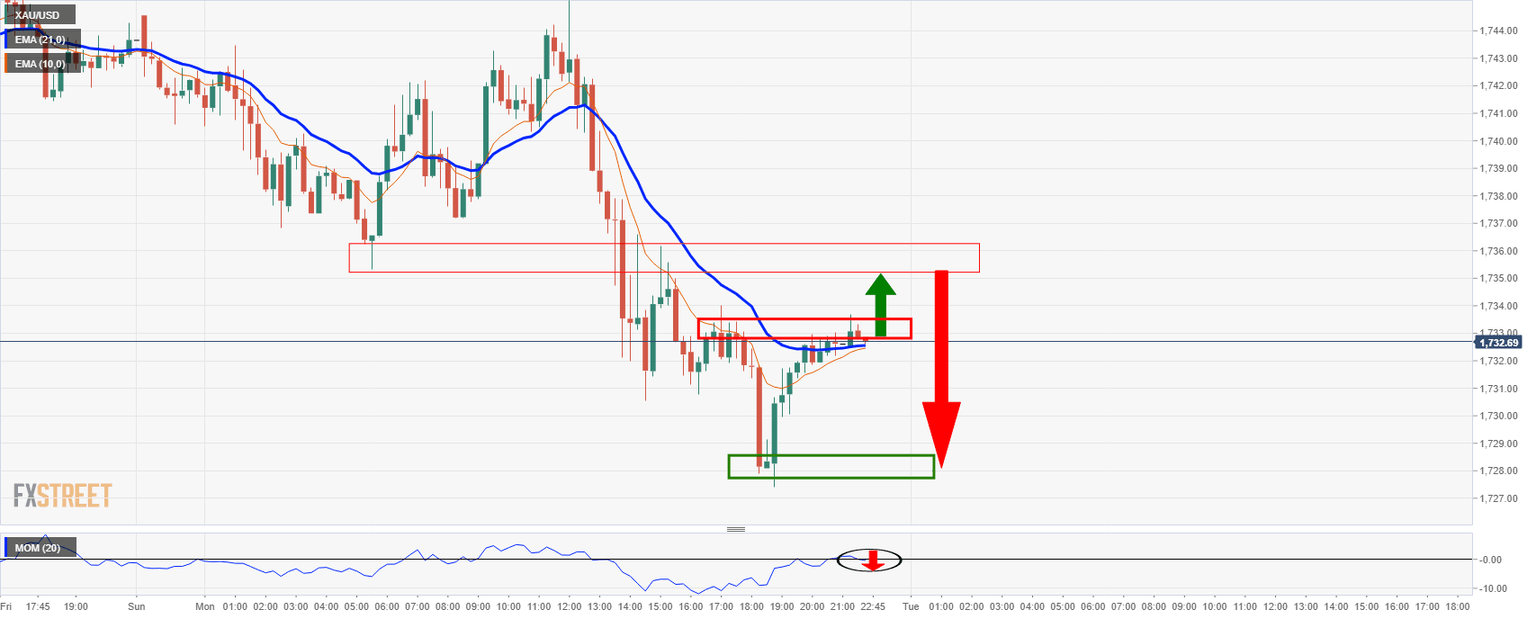

Gold Price Analysis: Bears ready to pounce following key break of support

- XAU/USD bears are lurking at a critical level of resistance.

- Considerable downside prospects are exposed on a downside continuation.

Gold is correcting from a significant area of support as pressures mount in general and the focus can be on an optimal shorting point as price meets a significant area of confluence.

The following illustrates where price meets a 38.2% Fibonacci retracement meeting prior support.

Hourly chart

15-min chart

According to the 15-min time frame, there are prospects of a meanwhile upside correction before heavy supply applies.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.