Gold pushes higher on simmering Russia-Ukraine tensions

- Gold edges higher on Wednesday due to safe-haven flows from continued geopolitical tensions.

- Upside is capped due to stronger USD amid less dovish interest rate expectations in the US.

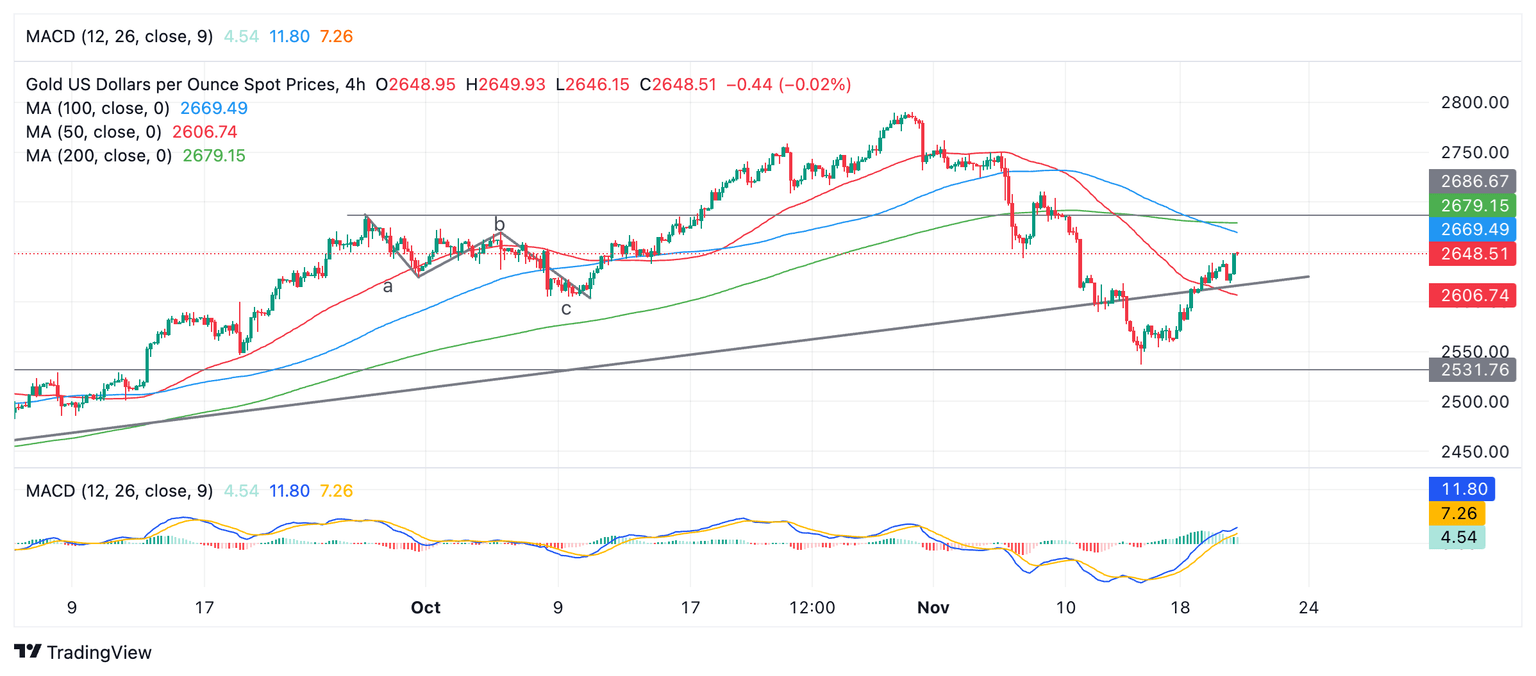

- XAU/USD starts a new short-term uptrend on the 4-hour chart.

Gold (XAU/USD) recovers after a weak start to trade in the $2,640s during the US session on Wednesday as geopolitical tensions in the Ukraine theatre of war ratchet up and drive fresh safe-haven flows into the precious metal.

Gold had a weak start due mostly to the effect of a stronger US Dollar (USD), and since Gold is mainly priced and traded in USD, this automatically has the effect of lowering its price, all other things being equal.

Gold stalls in the middle of recovery

Gold recovered over $100 in value from eight-week lows in the $2,540s at the beginning of the week as a result of increased safe-haven flows. This came on the back of a ratcheting up of geopolitical tensions after Russia amended its conditions for using its nuclear armaments. The move was interpreted as a warning to Ukraine and its allies following the decision of US President Joe Biden to allow Ukraine to use US-made long-range ATACMS (Army Tactical Missile System) missiles to strike targets in Russia.

US Dollar on the rise

Gold trades higher on Wednesday but it had a weak start due to a strengthening US Dollar.

The Greenback is seeing gains as markets price in a lower probability – of now around 60% – of the Federal Reserve (Fed) cutting interest rates in December. Previously, markets had been 100% sure the Fed would go ahead with at least a 25 basis point (bps) (0.25%) rate cut. However, since President-elect Donald Trump won the US presidential election – and due to recently robust US macroeconomic data – the probabilities have steadily fallen. The Fed keeping interest rates elevated is positive for the US Dollar since it increases foreign capital inflows.

The main cause of the strengthening Dollar is Trump’s proposed economic and trade policies. These include increasing or placing tariffs on imports, which will effectively push up their prices, causing inflation and keeping interest rates high; lower taxes, which will increase spending power, thereby also pushing up inflation; and a more relaxed regulatory environment.

Technical Analysis: XAU/USD extends short-term uptrend

Gold recovers above a major trendline on Wednesday as it extends its short-term trend higher. Given the principle of technical analysis that “the trend is your friend,” the odds favor more upside to come.

XAU/USD 4-hour Chart

A break above the daily high at $2,642 will probably indicate an extension of the trend higher. The next target to the upside lies at $2,686, the September 26 high.

The precious metal is in a downtrend on a medium-term but an uptrend on a long-term basis, raising risks of moves both higher or lower in line with these broader cycles.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.