Gold extends the range play as traders await Fed decision and forward guidance

- Gold struggles to build on the overnight bounce from a one-week low.

- Traders opt to wait for the outcome of a two-day FOMC policy meeting.

- Dovish Fed expectations weigh on the USD and support the commodity.

Gold (XAU/USD) extends its sideways consolidative price move through the early European session and trades just below the weekly high touched earlier this Wednesday. The US Dollar (USD) has dropped to a fresh low since late October amid rising bets for more interest rate cuts by the Federal Reserve (Fed). This, along with the cautious market mood and geopolitical uncertainties, turn out to be other factors acting as a tailwind for the precious metal.

The XAU/USD bulls, however, seem reluctant to place aggressive bets and opt to wait for the outcome of a two-day FOMC meeting. The key focus will be on updated economic projections and Fed Chair Jerome Powell's speech, which will be looked for cues about the future rate-cut path. This, in turn, will drive the USD and the non-yielding Gold, warranting caution before positioning for an extension of the overnight bounce from a one-week low.

Daily Digest Market Movers: Gold traders await Fed rate-cut cuts before placing directional bets

- The US Federal Reserve is scheduled to announce its decision at the end of a two-day policy meeting later this Wednesday and is widely expected to cut interest rates by 25 basis points despite sticky inflation.

- In fact, the US Commerce Department reported last Friday that inflation, as measured by the Personal Consumption Expenditure (PCE) Price Index, remained above the Fed's 2% annual target in September.

- Fed officials, however, argue that slow hiring, modest economic growth, and subdued wage gains are likely to cool inflation in the coming months, backing the case for more policy easing by the central bank.

- The expectations seem unaffected by the upbeat US Job Openings and Labor Turnover Survey (JOLTS) released on Tuesday, which indicated continued demand for workers and labor market resilience.

- The Labor Department's monthly JOLTS report showed that the number of job openings on the last business day of September rose sharply to 7.658 million, while for October it stood at 7.67 million.

- Meanwhile, the US Dollar struggles to capitalize on its recent move up witnessed over the past week or so amid dovish Fed expectations, offering some support to the non-yielding Gold on Wednesday.

- President Volodymyr Zelenskyy said on Monday that Ukraine would not cede land to Russia and accept painful concessions to end the war. This further offers support to the safe-haven precious metal.

- Traders await more cues about the Fed's rate-cut path before placing fresh directional bets. Hence, the focus will be on updated economic projections and Fed Chair Jerome Powell's press conference.

Gold remains confined in a familiar range; downside potential seems limited

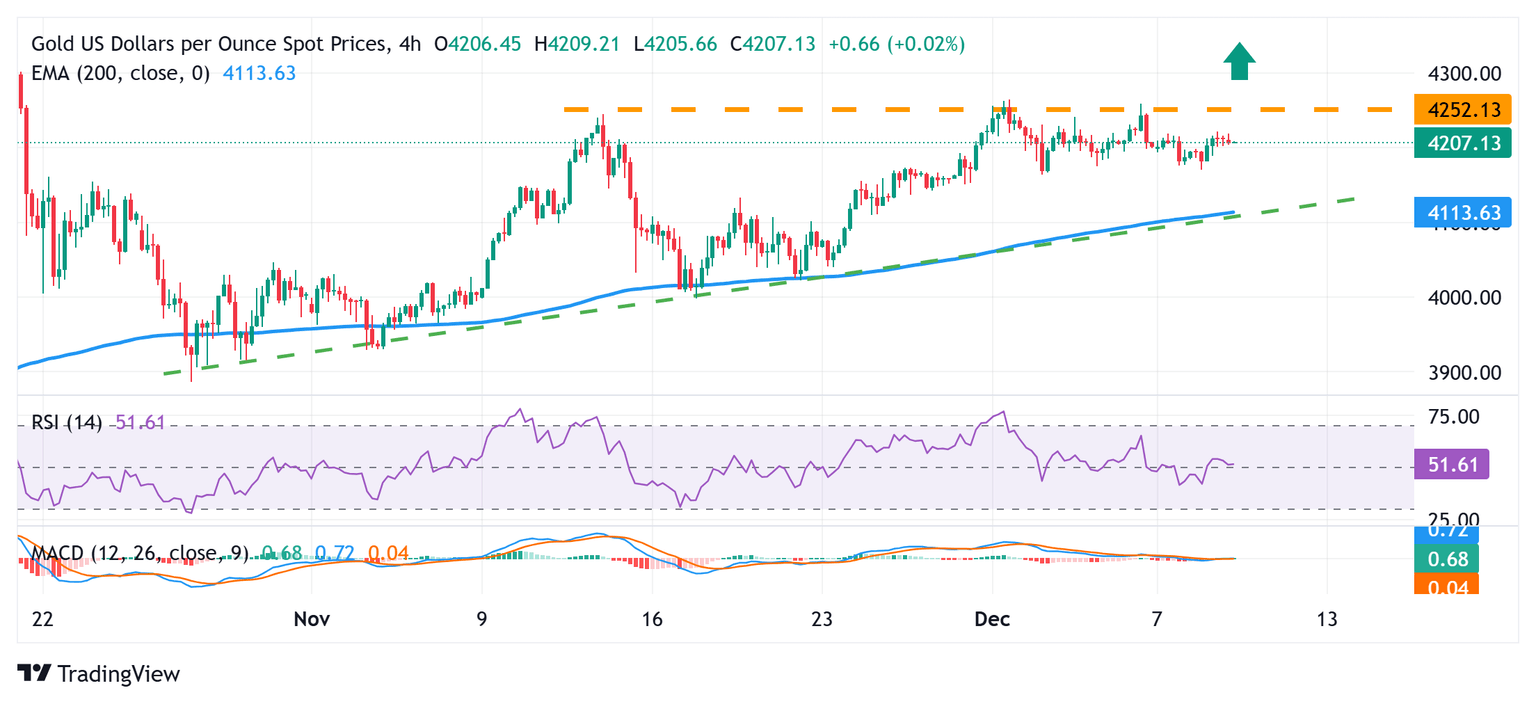

The XAU/USD pair has been oscillating in a familiar band over the past two weeks or so. Moreover, the overnight bounce from the vicinity of the trading range support and the subsequent move up favor bullish traders. However, neutral oscillators on the daily chart make it prudent to wait for a sustained strength above the $4,245-4,250 barrier before positioning for further gains. The momentum might then lift the Gold price to the $4,277-4,278 intermediate hurdle en route to the $4,300 mark.

On the flip side, weakness below the $4,200 round figure might continue to attract some buyers near the $4,170-4,165 region, or the trading range support. A convincing break below could make the Gold price vulnerable to accelerate the fall towards testing the $4,115 confluence – comprising an ascending trend-line extending from late October and the 200-period Exponential Moving Average (EMA) on the 4-hour chart. Some follow-through selling will be seen as a key trigger for bearish traders and pave the way for deeper losses.

Economic Indicator

FOMC Press Conference

The press conference is about an hour long and has two parts. First, the Chair of the Federal Reserve (Fed) reads out a prepared statement, then the conference is open to questions from the press. The questions often lead to unscripted answers that create heavy market volatility. The Fed holds a press conference after all its eight yearly policy meetings.

Read more.Next release: Wed Dec 10, 2025 19:30

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.