Global economic outlook 2026: Financial system risk, trade, public debt [Video]

![Global economic outlook 2026: Financial system risk, trade, public debt [Video]](https://editorial.fxsstatic.com/images/i/Global-Concept_3_XtraLarge.png)

The global and European economies have been resilient in recent years even accounting for the modest global slowdown of 2025. But risks for the recovery are rising, underscoring a negative medium-run global macro and credit outlook.

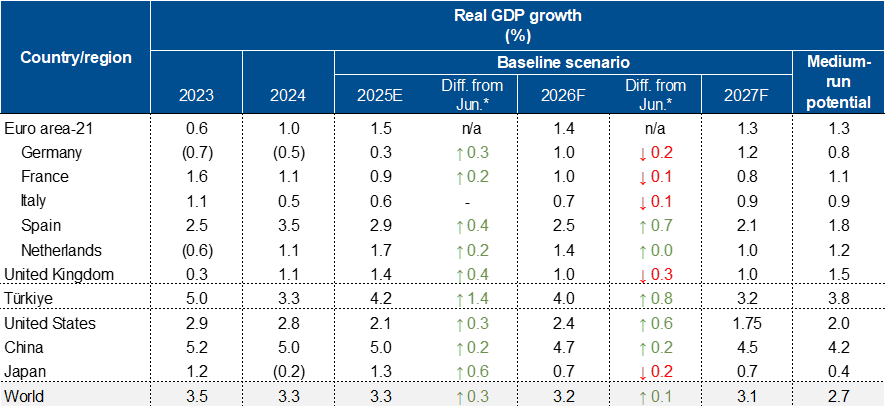

Scope Ratings (Scope) has slightly revised up its global growth estimate for 2025 since June forecasting. The agency now sees global growth of 3.3% for this year before a resilient 3.2% next year.

Euro area-21 growth expectations remain moderate: 1.4% next year after the 1.5% this year.

A pick-up is foreseen in the German economy (to 1.0% growth next year) alongside moderate growth in France (1.0%) and Italy (0.7%).

The European economy nevertheless continues to be buoyed by strong recovery across much of the periphery. Ireland is forecast for 3.0% growth next year, with Spain at 2.5%, Portugal (2.1%) and Greece (2.0%). Growth in parts of central and eastern Europe bolsters the regional economy, including growth of 3.2% in 2026 in Bulgaria after euro accession. Meanwhile, the UK economy may grow a moderate 1.0% next year.

Scope has revised US growth up to around 2% for this year before the US economy grows an above-potential 2.4% next year. The rating agency projects growth of 4.7% for next year in China after the economy achieves its 5% growth target for this year, supported by the recent temporary easing in US-China trading tensions.

Scope’s growth projections, summary

%, projections as of December 2025.

*Changes compared with June 2025’s Global Economic Outlook. Negative growth rates presented in parentheses. Source: Scope Ratings forecasts, regional and national statistical offices, IMF.

Negative tilt to macro risk

Nevertheless, the balance of medium-run risks for the global economic and credit outlook remains tilted to the downside. Four factors are relevant here:

Financial-system risks driven by elevated valuations across multiple asset classes and a long-standing expectation of corrections in rising markets; leverage risks in the non-bank financial intermediation sector including in private credit, risks in the less-regulated artificial intelligence and cryptocurrency sectors; higher borrowing rates for longer; and US and global financial deregulation.

Protectionist and volatile global trade policies spearheaded by the US but also affecting the policies of other governments.

Many governments face intensifying budgetary and public debt challenges, which may facilitate market re-appraisals of sovereign risk.

Heightened geopolitical uncertainties, including Russia’s continuing war in Ukraine and fragilities in the Middle East.

US policy shifts pose global risks

Recent US policy has had significant effects on the global economy. Pro-cyclical tax cuts, rate reductions and deregulation may present near-term support for the US and global economy, but at the cost of raising longer-run economic imbalances.

The unwinding of post-war alliances and the war in Ukraine have prompted greater European defence expenditure and increased associated risks for sovereign debt sustainability while amplifying the chance of greater geopolitical fragility. The US decisions to halt foreign aid and review its participation in international financial institutions have raised concerns for developing economies. A reversal of climate commitments exacerbates natural-disaster risks for vulnerable countries.

Elevated borrowing rates and financial deregulation undermine longer-run financial resilience. Scope sees higher steady-state borrowing rates lasting for longer. This is although many central banks continue easing policy, while institutions such as the ECB are on hold and the Bank of Japan gradually tightens. Sustained higher borrowing rates interact adversely with elevated market valuations and financial deregulation.

Sector Outlooks across the rating franchises entering 2026 range from negative for the sovereign asset class, to balanced for financial institutions, to modestly positive for sub-sectors of structured finance.

Author

Dennis Shen

Scope Ratings

Dennis Shen is Chair of the Macroeconomic Council and Lead Global Economist of Scope Ratings, the European rating agency, based in Berlin, Germany.