Gold price holds above $3,130 as Trump unleashes tariff barrage

- XAU/USD stable after 0.71% rally; Dollar weakness balances rising US yields amid global trade tensions.

- Trump announces new tariffs: 10% on all imports, 25% on autos, affecting China, EU, Vietnam, Japan, UK.

- Gold climbs 23% from November low, driven by safe-haven demand amid tariff uncertainty and a weakening Dollar.

- Economic data takes a backseat; market focus shifts to upcoming ISM Services PMI, NFP, and Powell’s speech for direction.

Gold price extended its gains on Wednesday, posting gains of 0.71%, yet as Thursday’s Asian session begins, the golden metal remains unchanged. At the time of writing, XAU/USD trades at $3,136, virtually unchanged.

US Liberation Day is finally here. US President Donald Trump announced that the US will impose 10% tariffs on all imports and 25% duties on automobiles. These duties become effective on April 3.

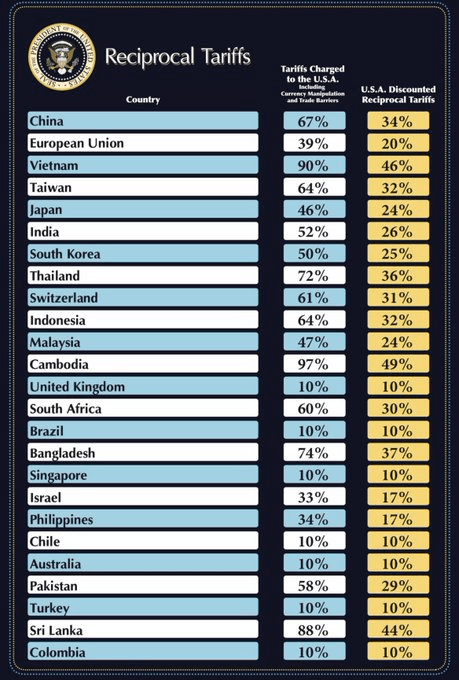

In addition, reciprocal tariffs are being imposed on selected countries

Additionally, he announced reciprocal tariffs would be applied to certain countries. China’s being hit with 34% duties, the European Union with 20%, 46% to Vietnam, 24% to Japan, and 10% to the United Kingdom.

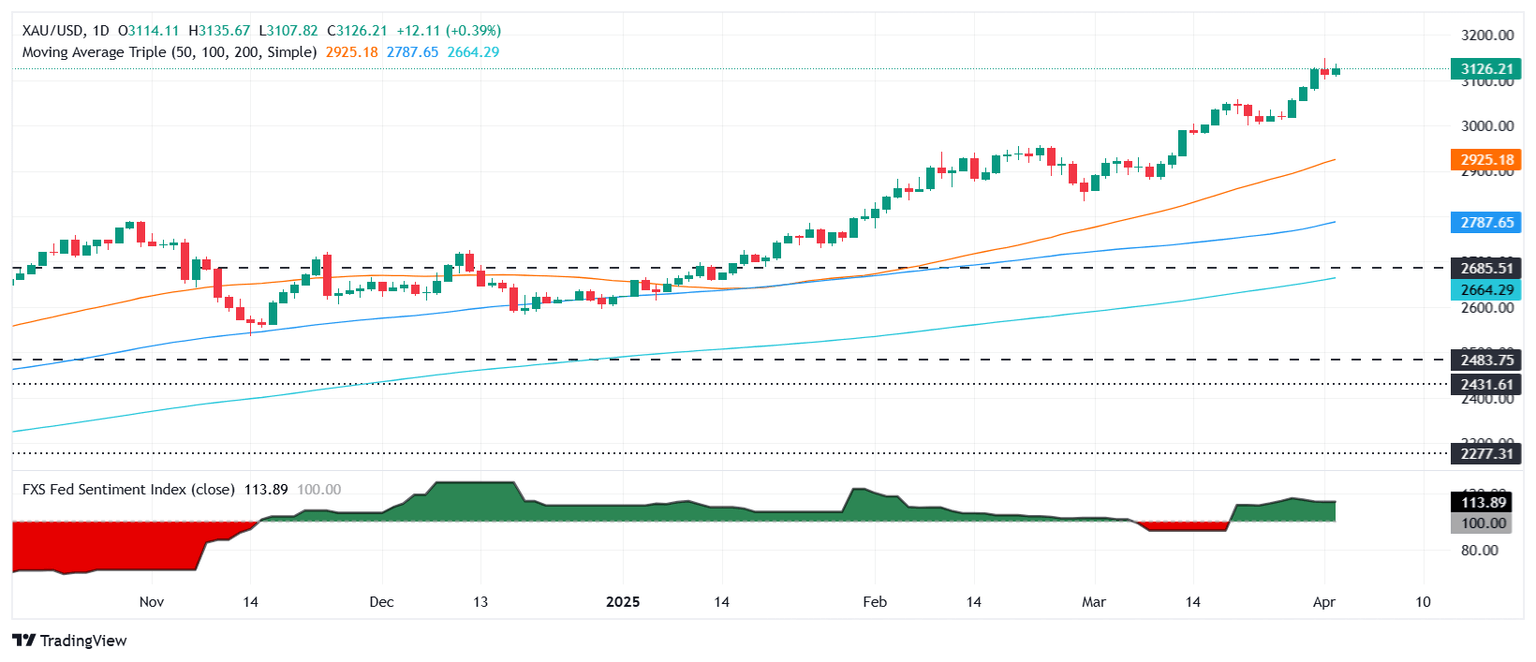

Since US President Donald Trump won the election, Gold prices initially dipped before rallying and gaining over 23% from the November 14 low, when XAU/USD hit $2,536.

Bullion prices have extended their gains despite rising US yields. However, the broad weakness of the US Dollar (USD) kept Gold prices holding firm above the $3,100 mark.

US economic data has taken a backseat amid tariff jitters. ADP revealed that private companies hired more people than expected, while Factory Orders expanded above estimates but showed some signs of slowing down.

Ahead this week, traders are focusing on the ISM Services PMI for March, Nonfarm Payroll figures, and Fed Chair Jerome Powell's speech.

Daily digest market movers: Gold price edges up amid high US yields

- The US 10-year T-note yield rises three basis points to 4.19%. US real yields edge up three bps to 1.862%, according to US 10-year Treasury Inflation-Protected Securities (TIPS) yields.

- The ADP National Employment Report for March showed that businesses added 155K jobs, beating expectations of just over 105K and significantly higher than February’s 84K increase, signaling continued strength in private sector hiring.

- Meanwhile, Factory Orders rose 0.6% MoM in February, slightly above the 0.5% forecast, though slowing from January’s 1.8% surge.

- Looking ahead, Donald Trump is expected to announce reciprocal tariffs on US trading partners during an address in the White House Rose Garden, a move likely to stir market volatility and global trade tensions.

- The latest estimate from the Atlanta Fed's GDP Now model indicates that the GDP for Q1 2025 is expected to contract by 3.7%, down from the 2.8% estimate on March 28.

- Money market futures pricing in more than 73 basis points of interest rate cuts by the Federal Reserve (Fed).

XAU/USD technical outlook: Gold price retreats from all-time highs near $3,150

The uptrend in Gold prices remains intact; however, buyers' lack of commitment to push prices to record highs keeps the yellow metal trading sideways. The Relative Strength Index (RSI) is above the 70 level, indicating overbought territory. Traders should note that, due to the strength of the trend, the most extreme reading can reach 80. Therefore, further upside is anticipated.

If XAU/USD stays above $3,100, buyers maintain control. An extension of the rally would trigger a breach of the record high at $3,149, followed by the $3,200 mark. Conversely, a drop below $3,100 would expose the March 20 high, which has since become support at $3,057, followed by the $3,000 mark.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.