Gold hits record high of 3,703 ahead of Fed decision

- Gold extends gains and reaches a record high despite stronger US Retail Sales and Industrial Production in August.

- Weak labor data support the Fed’s dovish tilt; markets await policy decision and dot plot guidance.

- US–China trade talks advance as Trump plans meeting with Xi, adding geopolitical support for Gold.

Gold price advances during the North American session after hitting a record high of $3,703 on Tuesday, poised to continue to trend up as traders await the Federal Reserve’s (Fed) monetary policy decision on Wednesday. At the time of writing, XAU/USD trades at $3,689, up 0.27%.

Bullion edges higher as traders shrug off strong US data, focusing on Powell, SEP and rates outlook

The yellow metal extended its gains as traders shrugged off good economic data from the United States (US), which reaffirmed that American households' spending remains solid, following August’s Retail Sales report. Additionally, Industrial Production improvement in August challenges the markets’ narrative that the economy is slowing down and that rate cuts are needed.

Despite this, the latest jobs data is to blame as the main reason for the Fed Chair Jerome Powell's dovish pivot at the Jackson Hole Symposium. In addition to the monetary policy decision, the Federal Open Market Committee (FOMC) will reveal the Summary of Economic Projections (SEP), in which lies the infamous dot plot” used by Fed officials to depict their stance on the path of interest rates.

Regarding geopolitics and trade, talks between China and the US seem to progress, while the US President Donald Trump said that he will meet his Chinese counterpart Xi Jinping on Friday.

Daily digest market movers: Gold rallies as US yields tumble

- According to a report released by the US Commerce Department on Tuesday, US Retail Sales for August exceeded market expectations. Retail Sales rose by 0.6% MoM in August, matching July's figure and exceeding forecasts of 0.2%. Sales for the Control Group, used to calculate Gross Domestic Product (GDP) figures, expanded by 0.7% MoM, up from July’s print of 0.5%.

- US Industrial Production expanded in August, “reflecting a modest gain in manufacturing activity and a decline in utilities,” revealed Bloomberg. Production in factories grew 0.1% MoM, exceeding July’s 0.1% MoM contraction.

- The US Senate confirmed Trump's nominee to the Federal Reserve, Stephen Miran, on Monday, who was sworn in and will be at the FOMC’s two-day meeting.

- Traders' focus shifts to the Fed’s decision on Wednesday. Market participants had fully priced in a quarter of a percentage point cut, though a tiny minority eyes a 50-bps rate cut.

- Banks like the Deutsche Bank expect the Fed to cut interest rates by 25 bps in all three meetings this year, meaning that the Fed funds rate will reach the 3.50%-3.75% range.

- The US Dollar Index (DXY), which tracks the buck’s performance against a basket of six currencies, plummets 0.74% to 96.62.

- US Treasury yields remain steady, with the 10-year Treasury note up flat at around 4.03%. US real yields—calculated by subtracting inflation expectations from the nominal yield—hold firm at 1.660% at the time of writing.

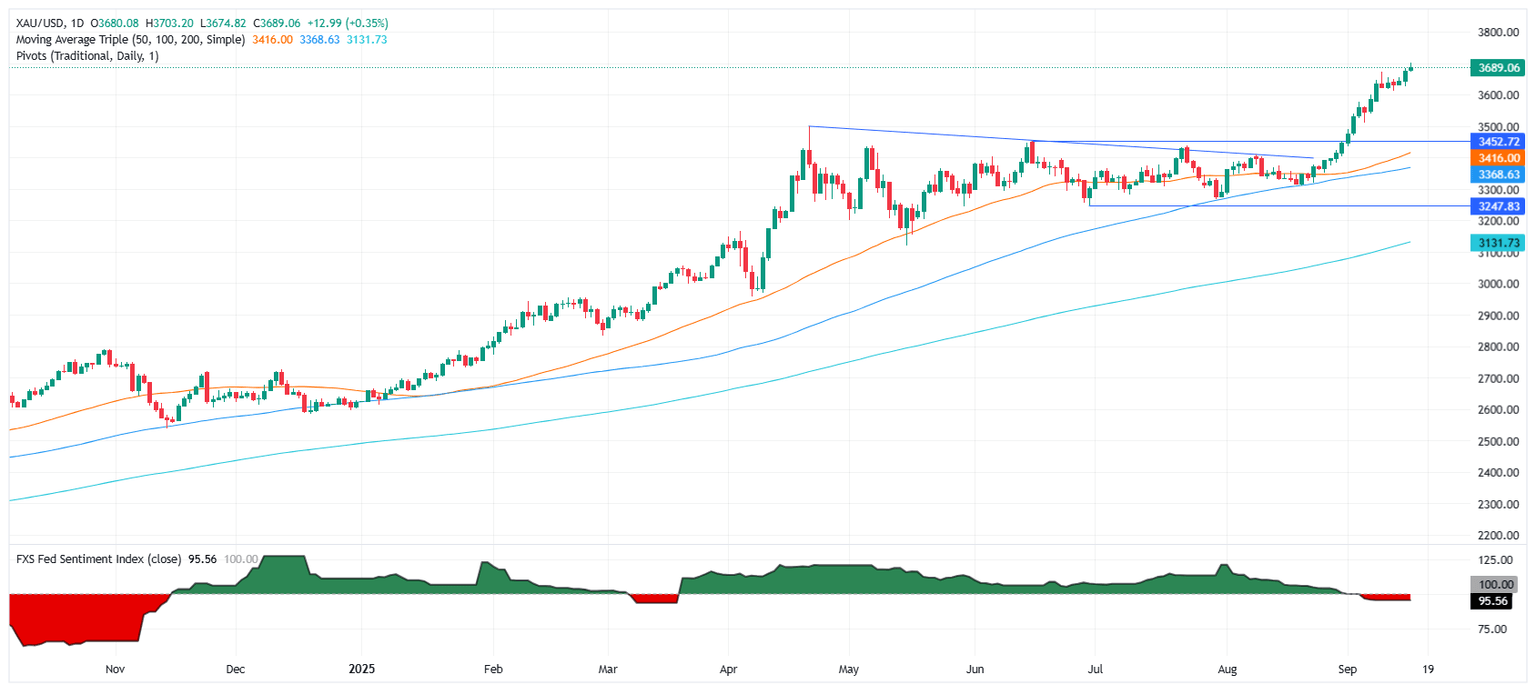

Technical outlook: Gold price hovers near $3,690 as bulls target record high

Gold price reached a record high at $3,703 before retreating below $3,680 to finally recover near $3,690. The non-yielding metal seems set to challenge the all-time high and extend its gains towards $3,750 and $3,800.

The Relative Strength Index (RSI), although flashing overbought signals, suggesting limited room for further upside in the near term, remains bullish.

On the flip side, if XAU/USD tumbles below $3,650, expect a test of the September 11 low of $3,613. If those two levels are taken, $3,600 would be up for grabs.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.