GOEV Stock News: Canoo Inc plunges as Tesla drags down electric vehicle stocks

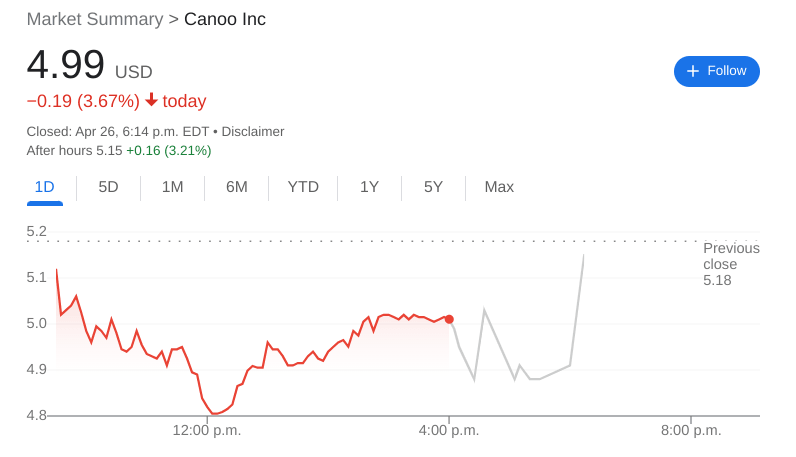

- NASDAQ:GOEV fell by 3.67% during Tuesday’s trading session.

- Tesla drops by 12% as shareholders react to Twitter deal.

- EV competitors announce some major milestones and deals as GM reported earnings.

NASDAQ:GOEV erased most of its gains from Monday as the broader markets reversed back lower in a big way on Tuesday. Shares of GOEV dropped by 3.67% and closed the bearish session at $4.99. Any positive momentum from the close of Monday’s session was clearly lost overnight, as all three major averages spiraled downwards ahead of major earnings from big tech companies this week. The Dow Jones plummeted by 809 basis points, while the S&P 500 fell by 2.81%. The NASDAQ led the way lower yet again as the tech-heavy index tumbled by 3.95% hitting a new low-water mark for 2022.

Stay up to speed with hot stocks' news!

Of course, the major catalyst on Tuesday was Tesla (NASDAQ:TSLA) shares tumbling by 12.18% following the news that CEO Elon Musk is acquiring Twitter (NYSE:TWTR). The news certainly did not sit well with investors, and it did not help that India rejected Tesla’s plan to import vehicles from the Shanghai GigaFactory due to the government favoring local production. Tesla has been looking to enter the Indian market for years but so far has been unable to penetrate the country. The only potential solution would be for Tesla to build a GigaFactory in India, but the company prefers to do a soft launch first to test the demand of the market.

GOEV stock forecast

There were some major announcements in the EV industry on Tuesday. Lucid (NASDAQ:LCID) announced a 100,000 vehicle order from the Saudi government over the next ten years. Saudi Arabia’s Public Wealth Fund owns 62% of Lucid’s shares. General Motors (NYSE:GM) announced its earnings on Tuesday and while the company beat on earnings per share, it lagged in quarterly revenues. The company did announce there are nearly 140,000 reservations for its 2023 Chevrolet Silverado Electric truck, which will go head to head with the Ford (NYSE:F) F-150 Lightning which started production this week.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet