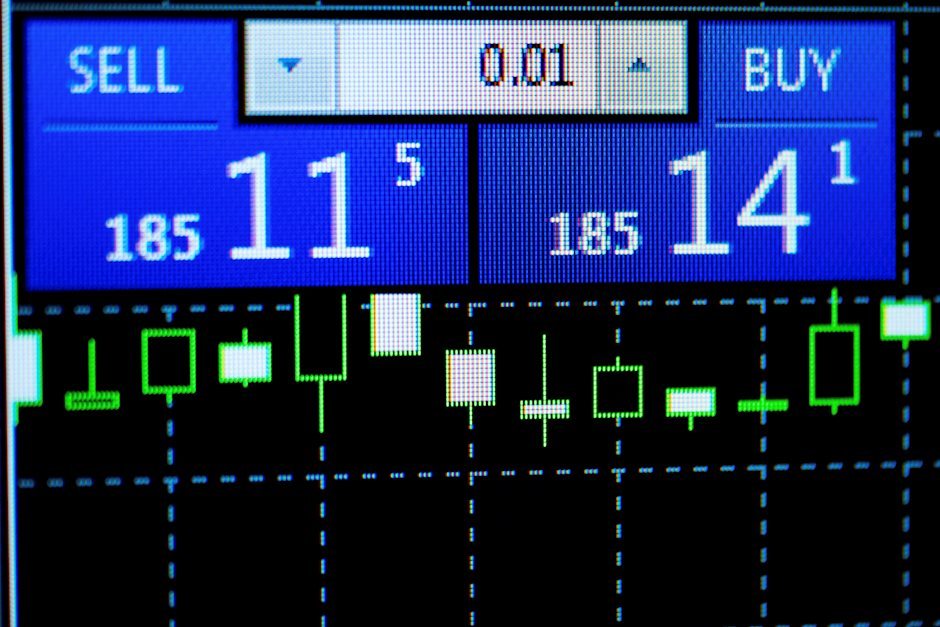

GME Stock Price: Gamestop edges higher to start the week as Reddit interest rises again

- NYSE:GME gained 1.15% during Monday’s trading session.

- GameStop tops social media sentiment on Reddit to start the week.

- GameStop is anticipated to report its third-quarter results on December 8th.

NYSE:GME investors are likely relieved to see some green to start the week after the popular meme stock fell by over 12% last week. Shares of GameStop gained 1.15% on Monday and closed the first trading day of the week at $202.01. While the stock has had a bit of a pullback as of late, it is still trading above both its 50-day and 200-day moving averages, which shows a generally bullish long-term uptrend. Despite its gains, GameStop still lagged the broader markets as the S&P 500 and NASDAQ rose by 1.32% and 1.88% respectively, while the Dow Jones managed to recover some of its losses from Friday by gaining 236 basis points during the session.

Stay up to speed with hot stocks' news!

GameStop was a popular and trending stock on the familiar r/WallStreetBet Reddit forums over the weekend, as meme stock investors spoke of loading up after its recent dip. The holiday season is always a popular time to talk about GameStop, as the company adds high sales numbers during its Black Friday and Cyber Monday events. The stock also closed last Monday’s session at $247.55, so undoubtedly many were looking at GameStop’s shares as being on sale as well.

GME stock news

GameStop did announce that it is expecting to report its third-quarter financial results after the closing bell on December 8th. Shareholders will be looking to the call for an update on the ongoing digital transformation of the company. There has been recent chatter about jobs that GameStop has posted, including some that require experience in the field of NFTs and work with the Ethereum Blockchain.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet