GME Stock Forecast: GameStop tumbles as meme stock rally is halted in its tracks

- NYSE:GME fell by 7.09% during Tuesday’s trading session.

- GameStop, AMC, and Bed Bath and Beyond all see their winning streaks stopped.

- Coinbase sinks as it misses on second quarter earnings revenue.

NYSE:GME saw its nine-day winning streak snapped on Tuesday as the red-hot meme stock sector cooled off alongside the broader markets. Shares of GME dropped by 7.09% and closed the trading session at $40.37. Stocks retreated on Tuesday as all three major indices declined ahead of the key July CPI Report that is being released on Wednesday. Continued weakness in semiconductor stocks also contributed to a weak day of trading for tech stocks. Overall, the Dow Jones edged lower by 58 basis points, while the S&P 500 and the NASDAQ dropped by 0.42% and 1.19% respectively during the session.

Stay up to speed with hot stocks' news!

Meme stocks cooled off on Tuesday as GameStop, AMC (NYSE:AMC), and Bed Bath and Beyond (NASDAQ:BBBY) snapped their recent streaks. As is usually the case for meme stocks, there was no real catalyst for either the surge or the sudden dropoff. Given how much the stocks have risen over the past few days, it is likely investors are taking some profits from their sudden windfalls.

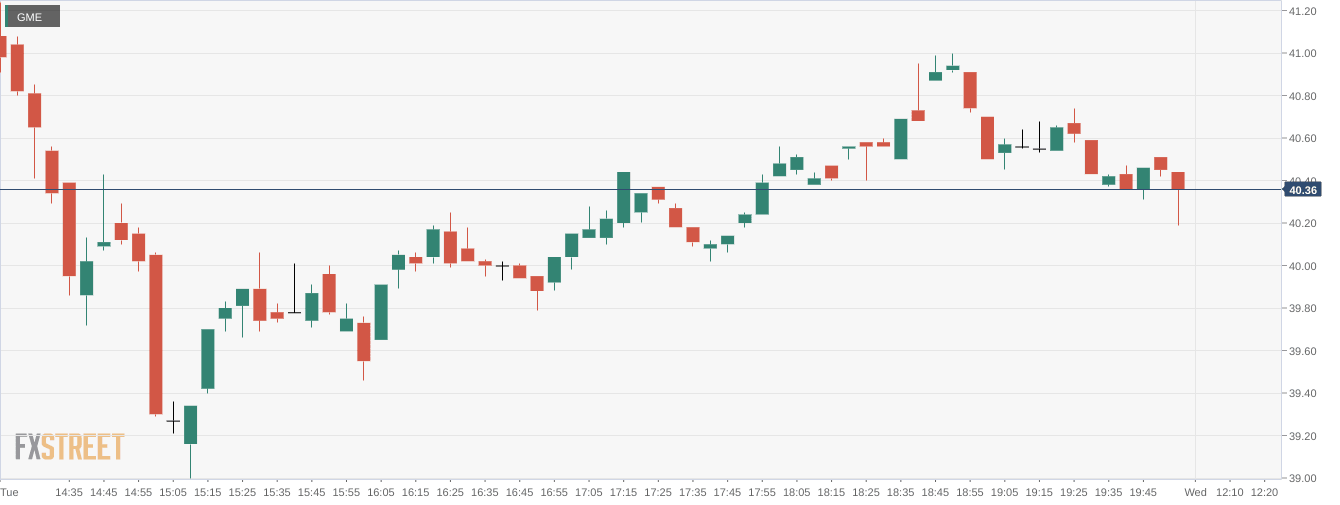

GameStop stock price

One of GameStop’s chief rivals in the NFT Marketplace industry reported its earnings on Tuesday after the markets closed. Crypto exchange Coinbase (NASDAQ:COIN) saw its stock fall by nearly 11% during intraday trading and a further 5% after the markets closed. The crypto winter has been terrible for business and this was reflected in Coinbase’s earnings report. Amongst the details included missing on both the top and bottom lines compared to Wall Street expectations and seeing its operating profit of $874 million from the quarter last year to an operating loss of more than $1 billion in the most recent quarter.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet