GME Stock Forecast: GameStop slips lower after Ryan Cohen abruptly ends meme stock short squeeze

- NYSE:GME fell by 3.80% during Friday’s trading session.

- Bed Bath and Beyond fell a further 40% after RC Ventures sold its stake on Thursday.

- Meme stock traders are not happy with Cohen’s decision to sell BBBY.

NYSE:GME slumped lower again on Friday as the original meme stock closed the week with a near 10% loss. Shares of GME dropped by a further 3.80% and closed the trading session at a price of $36.49. All three major indices closed the week in the red, snapping the S&P 500’s four-week winning streak. Additional comments from the Fed reiterated its hawkish stance on interest rates for what could be the remainder of the year. Overall, the Dow Jones dropped by 292 basis points, while the S&P 500 and the NASDAQ tumbled by 1.29% and 2.01% respectively during the session.

Stay up to speed with hot stocks' news!

The meme stock short squeeze that has been dominating financial headlines came to an abrupt end. GameStop Chairman Ryan Cohen sold all of this stake in BBBY, causing the stock to tank by a further 40.54% on Friday. Cohen held a 10% stake in the company and recently ignited the short squeeze by buying a large amount of out of the money call options for January of 2023. On Thursday, it was revealed that Cohen’s firm RC Ventures sold its entire stake and call options at a massive profit.

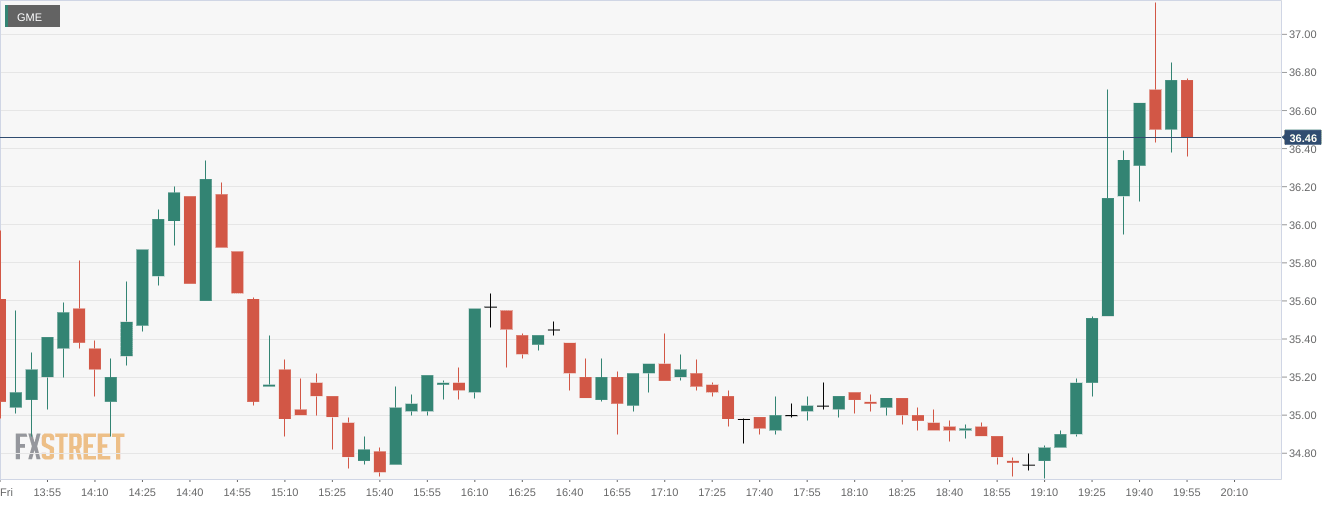

GameStop stock price

Understandably, this move by Cohen has raised the ire of meme stock traders around the world. When you zoom out, the whole order of events actually looks like a well orchestrated pump and dump scheme. While Cohen did nothing wrong and did a nice job of taking profits on this unlikely squeeze, meme stock traders are still upset that he decided to sell high and ignore the rule of having diamond hands.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet