GME Stock Forecast: GameStop sinks despite NFT marketplace buzz building

- NYSE:GME fell by 3.56% during Friday’s trading session.

- GameStop’s NFT Marketplace is getting closer to launching.

- GameStop is entering the NFT market just as interest is beginning to wane.

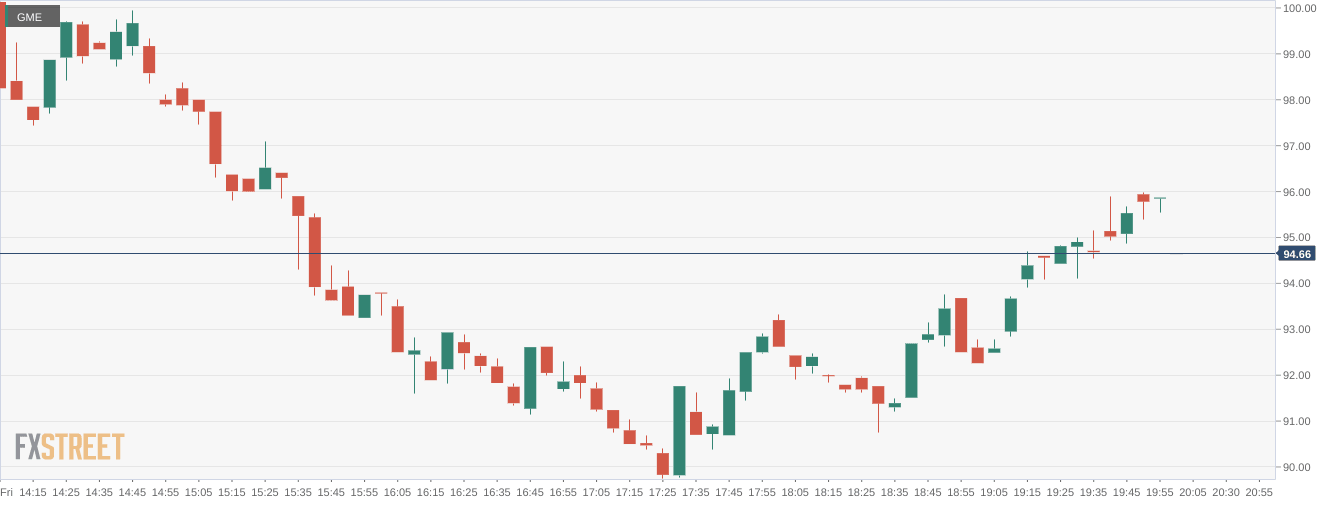

NYSE:GME failed to continue any upward momentum from Thursday’s session, and closed the trading week at a 3.2% loss for the week. On Friday, shares of GME dropped by 3.56% and closed the session at $95.66. The markets were in flux on Friday as the monthly OPEX day caused the markets to whipsaw throughout the day. The Dow Jones managed to eke out an 8 basis point gain by the close, while the S&P 500 edged higher by 0.01% after briefly dipping into bear market territory for the year. The NASDAQ fell by 0.30% as the only major index to close the session in the red.

Stay up to speed with hot stocks' news!

There was a lot of buzz on social media on Thursday night as the GameStop NFT Marketplace sent out a tweet. The tweet from the account @GamestopNFT simply said GM! (good morning) but many took it as a sign that the NFT marketplace was coming online. It was even revealed that the GameStop NFT Marketplace Beta site had been discovered although there was nothing functional as of yet. The NFT Marketplace is one of the major catalysts for GameStop’s digital transformation, and the company needs to execute or face more downward pressure on the stock.

GameStop stock price

Unfortunately for GameStop, it took so long to get the NFT Marketplace online that it missed the peak of the NFT explosion. With the crypto markets dipping into their own bear market as the price of Bitcoin and Ethereum continue to fall, NFTs have also taken a hit to their popularity. It’s likely the hype will return one day, but for now, GameStop runs the risk of having a less than stellar launch similar to the one that Coinbase (NASDAQ:COIN) had earlier this year.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet