GME Stock Forecast: GameStop advances on Monday in fourth consecutive session

- NYSE: GME gained 0.50% during Friday’s trading session.

- GameStop’s stock split hasn’t moved the needle so far.

- KuCoin announces that it is introducing NFT ETFs for investors.

UPDATE: GameStop stock has advanced 3% to $35.02 one hour into Monday's session to start the week. If GME can hang on, this would be the fourth session in a row that the stock advanced. GME shares intially sank after the 4-for-1 stock split on July 22. About 4,100 call contracts expiring August 5 for the $35 strike price have traded on Monday morning. This is a healthy level for a contract that expires in five sessions. The contract last traded for $1.28.

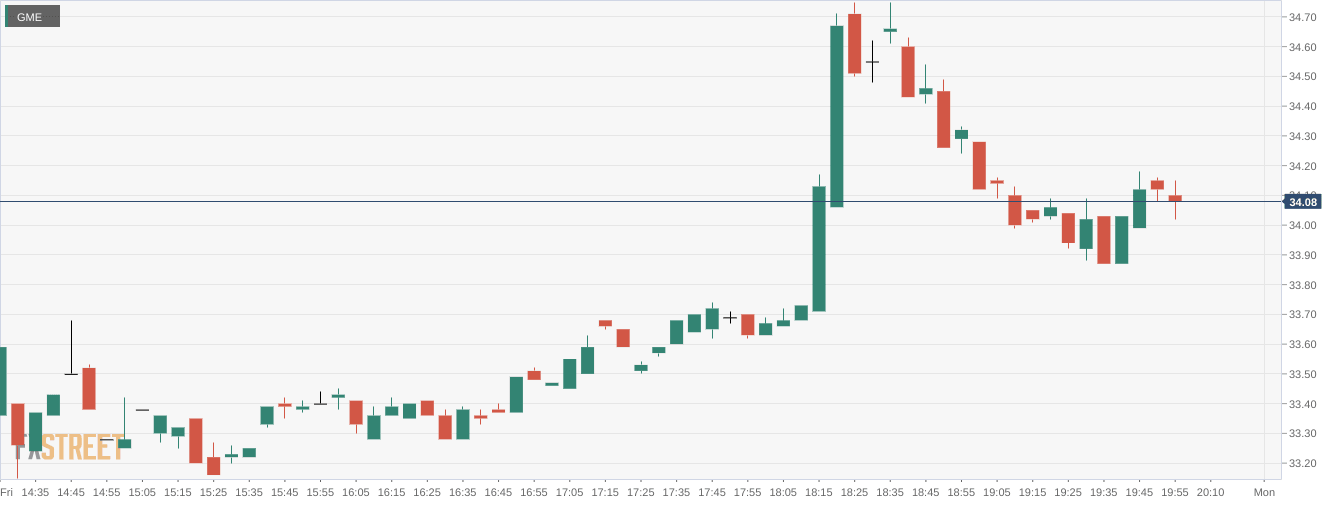

NYSE: GME extended its recent win streak to three straight days as the stock finally begins to see a rebound from its post-split selloff. On Friday, shares of GME added 0.50% and closed the trading week at $34.01. Stocks extended their rally following the Fed rate hike on Wednesday, and all three major indices also posted gains for the third straight day. Overall, US markets saw their best month of trading since 2020. To close the week, the Dow Jones added a further 315 basis points, the S&P 500 gained 1.42%, and the NASDAQ led the way with a 1.88% rise during the session.

Stay up to speed with hot stocks' news!

GameStop’s stock split was supposed to be a rallying call for retail investors. It made the stock price more palatable for smaller traders, and GameStop was likely hoping to capitalize on the headlines. Unfortunately, a stock split in a bear market is not the bullish catalyst that it is in a bull market. The stock sold off following the 4 for 1 split, which barely moved the needle for GameStop. While it has erased some of those losses during this week’s rally, the GameStop split came and went without much fanfare.

Gamestop stock price

In NFT news, crypto exchange KuCoin has revealed that it is offering its users the ability to invest in NFT ETFs. It allows investors to own fractional shares of blue-chip NFTs, some of which are worth millions of dollars. Would GameStop offer something like this in the future given its recent NFT Marketplace launch? With NFT prices still remaining high, fractional ownership could be the wave of the future.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet