GBPUSD Price Analysis: Bulls rally into resistance, but eye last week's highs

- GBPUSD bulls move in on Monday to cash in on weakness in the US dollar and yields.

- Cable has reached close to last week's high but may be facing headwinds at resistance.

Cable (GBPUSD) rose on Monday, supported by a risk-on sentiment across markets. there are signs of some easing of market conditions following last week's mixed Nonfarm Payrolls report that shows that the Unemployment Rate rose to 3.7%. This has fuelled hopes that the much sought-after Federal Reserve pivot could be on the horizon. Consequently, Us yields are stalling as the following technical analysis will show and GBPUSD is gathering pace on the bid.

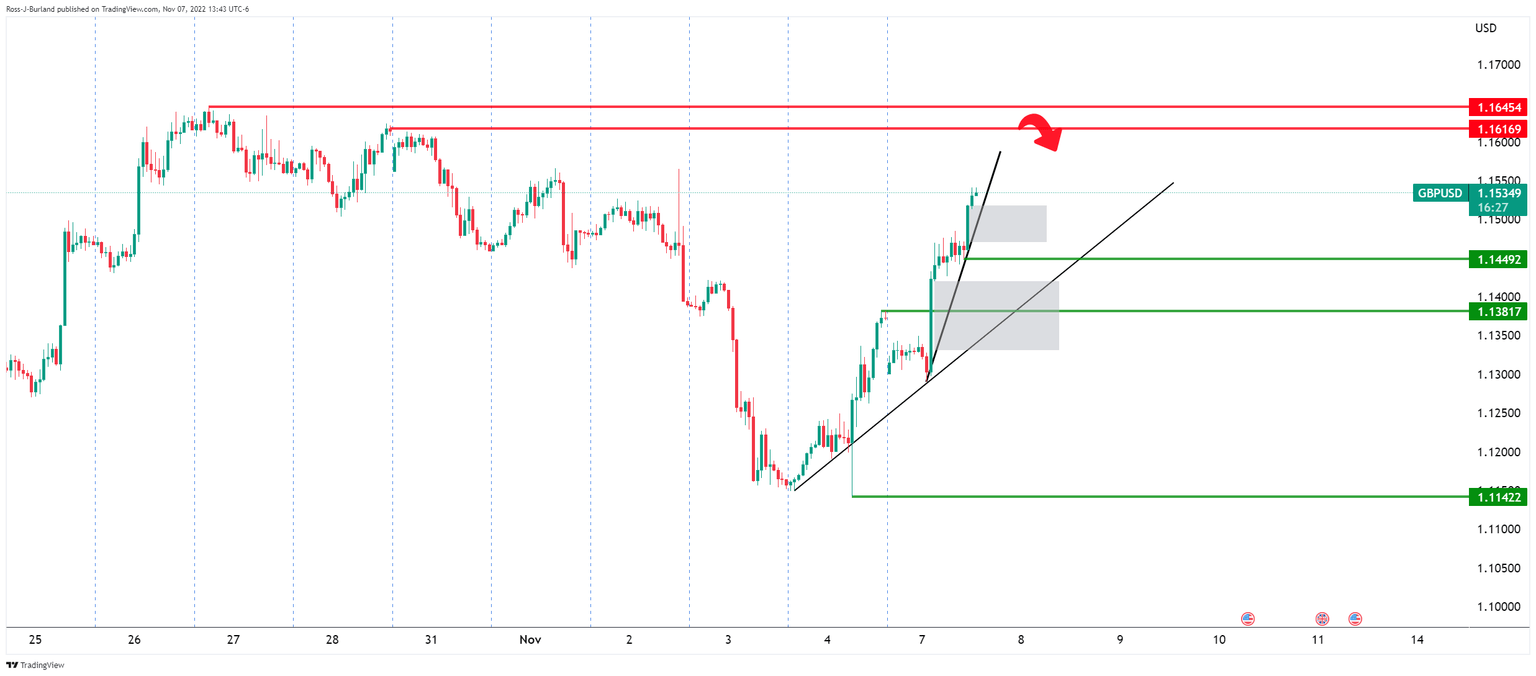

GBPUSD H1 chart

The hourly charts show the price firmly bid with eyes towards last week's highs and then last month's highs in the 1.1616 area and 1.1645s.

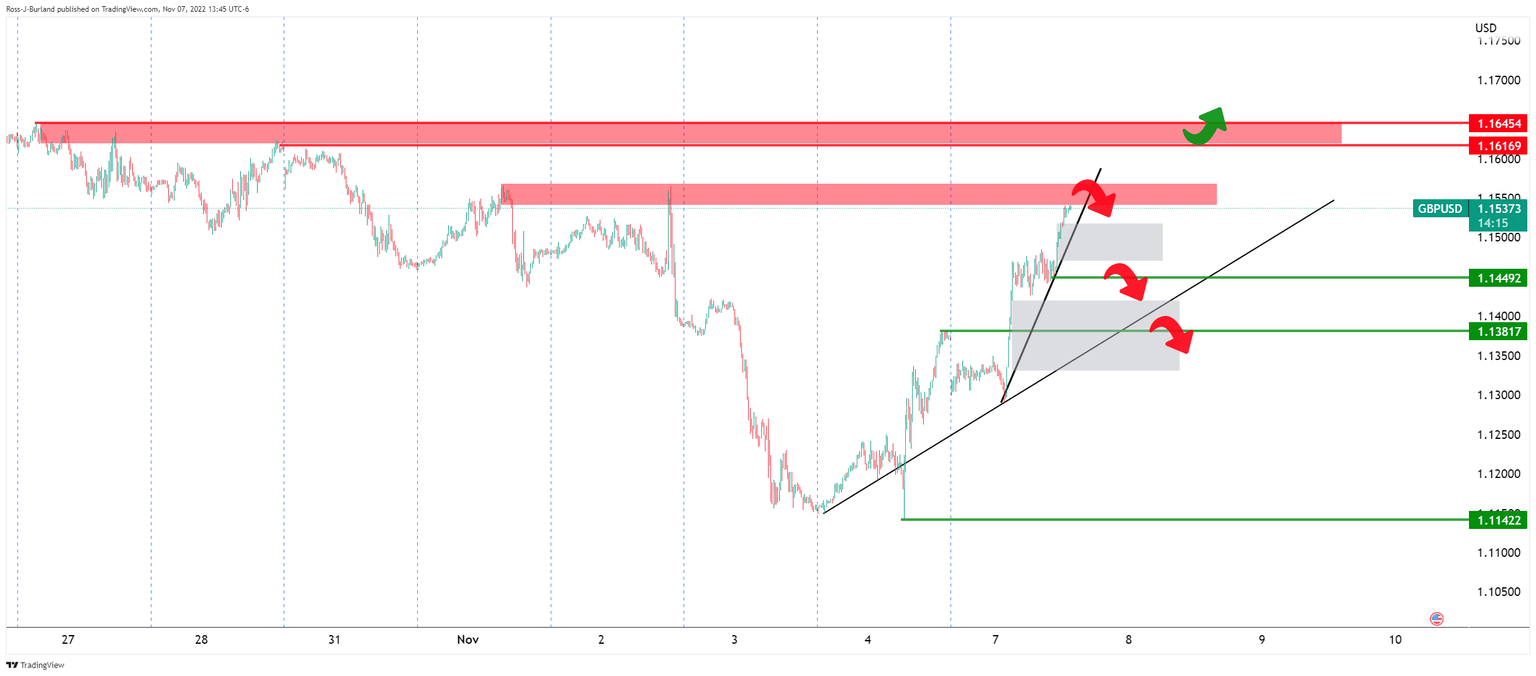

GBPUSD M15 chart

Cable is stretched at this juncture into a resistance area on the 15-min charts. A move below the current micro trendline will set the stage for a move back onto to test structure at 1.1450.

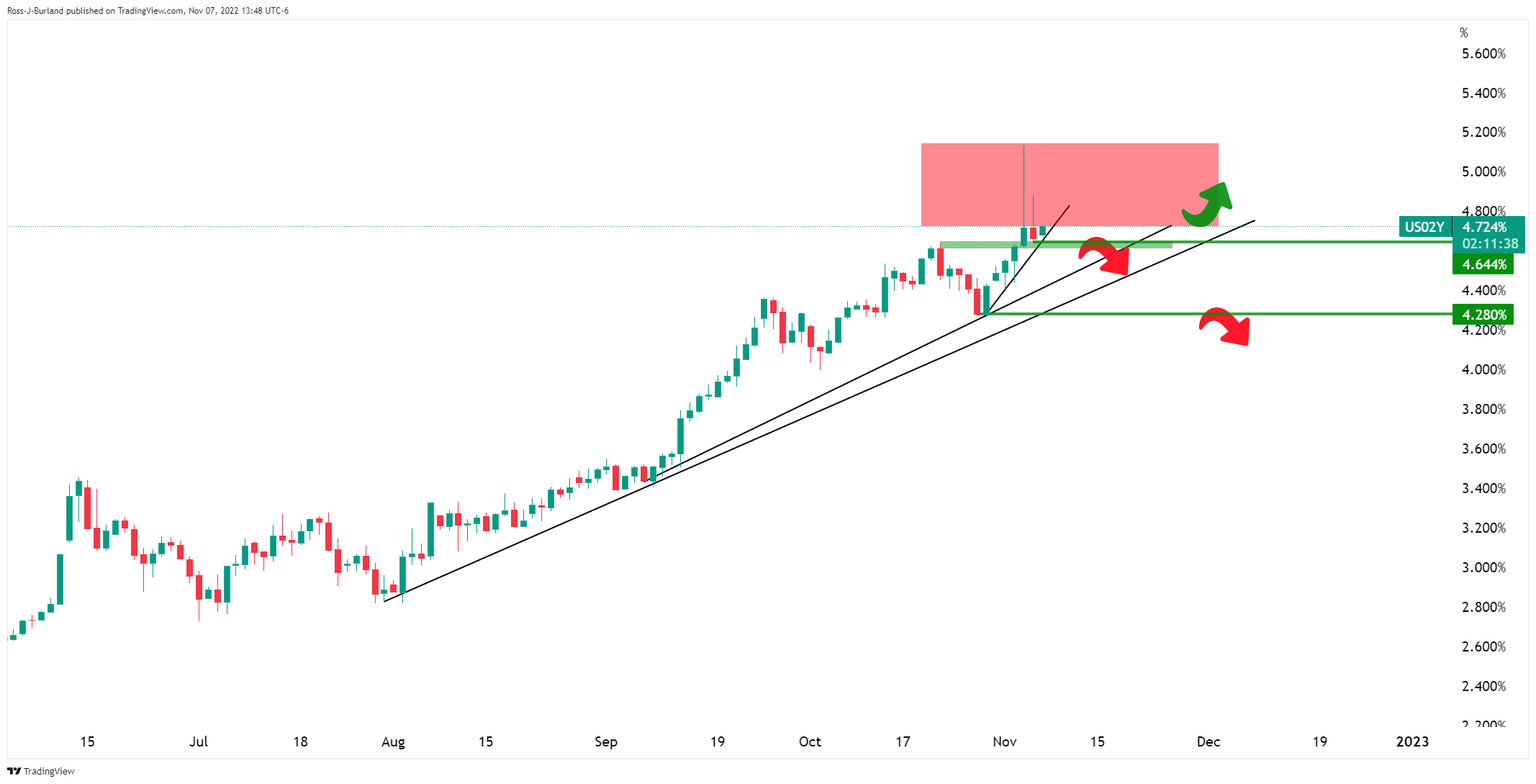

US 2-year yields

The daily chart shows that there could be some stalling to come from the 2-year yields given the recent wicks and lower highs. A break of the current support near 4.644% opens risk of a significant move lower to test the trendline supports. In turn, such a switch in yields would likely dent the greenback and support Cable higher.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.