GBPJPY settles near 196.00 after volatile Monday, falls back from 34-year high

- GBP/JPY hit three-decade high at 200.60 before steep pullback.

- Guppy covers plenty of ground, declines nearly 700 pips from day’s high.

- Possible Yen intervention to blame for broad-market JPY slide.

The GBP/JPY tumbled nearly 3.5% from the day’s 34-year peak at 200.60, rallying to its highest bids since August of 2008 before a rapid pullback, sending the pair down nearly 700 pips on Monday before markets recovered to the 196.00 technical region.

The Bank of Japan (BoJ) is believed to have intervened in global FX markets, sending the Japanese Yen (JPY) tumbling across the entire currency market. Investors will need to wait for official confirmation, but news outlets are citing unnamed sources that the BoJ stepped into the FX market while Japan was shuttered for the Showa Day holiday.

Monday was blank on the economic calendar for both the Yen and the Pound Sterling (GBP) with UK data traders faced with strictly low-tier data all week from the UK. On the JPY side, markets will be looking ahead to the BoJ’s latest Meeting Minutes, which are slated to publish early Thursday.

It’s a short trading week for the Yen; besides the Monday holiday closure, Japanese markets will also be dark on Thursday in observation of Japan’s Constitution Day, while Friday is yet another holiday in Japan for Children’s Day.

Guppy traders will be forced to wait until next week’s rate call and Monetary Policy Report from the Bank of England (BoE), which is slated for next Thursday.

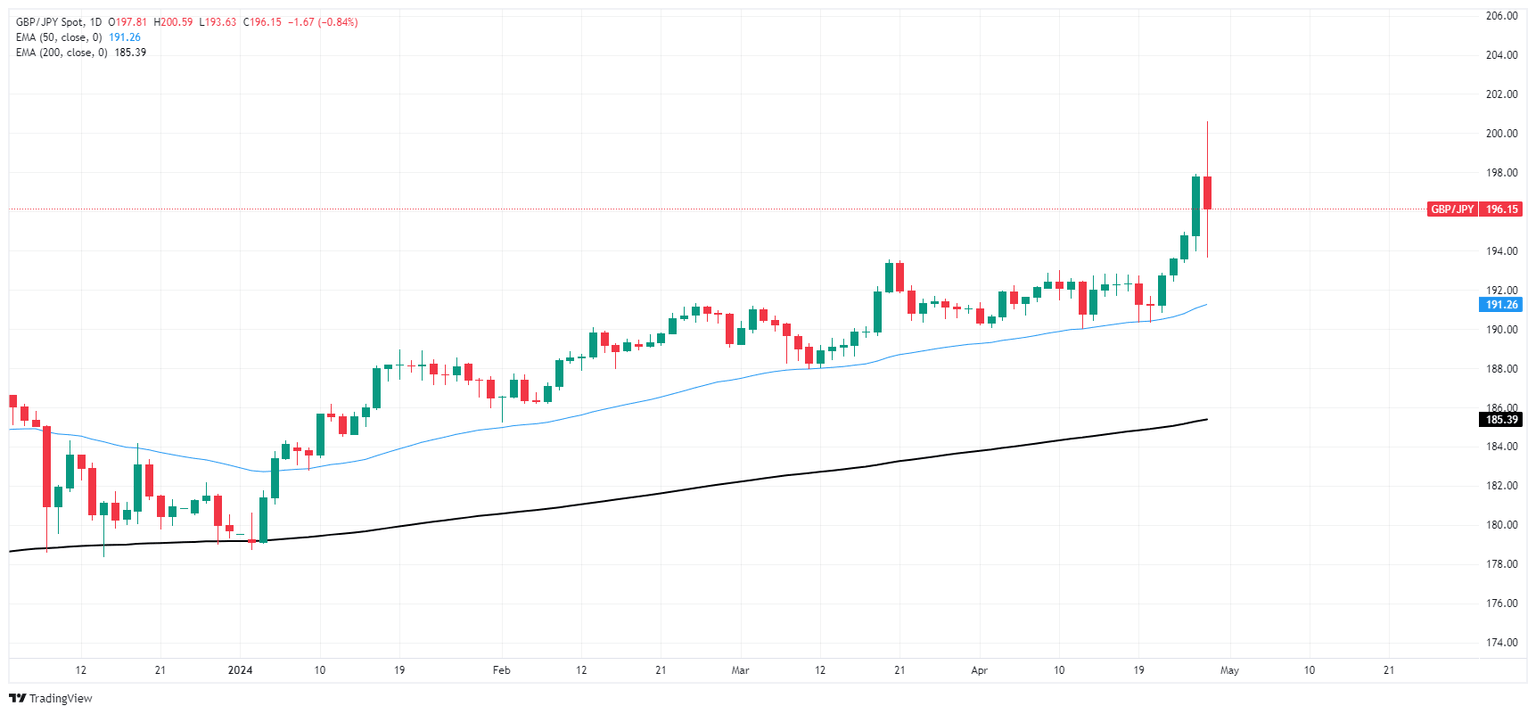

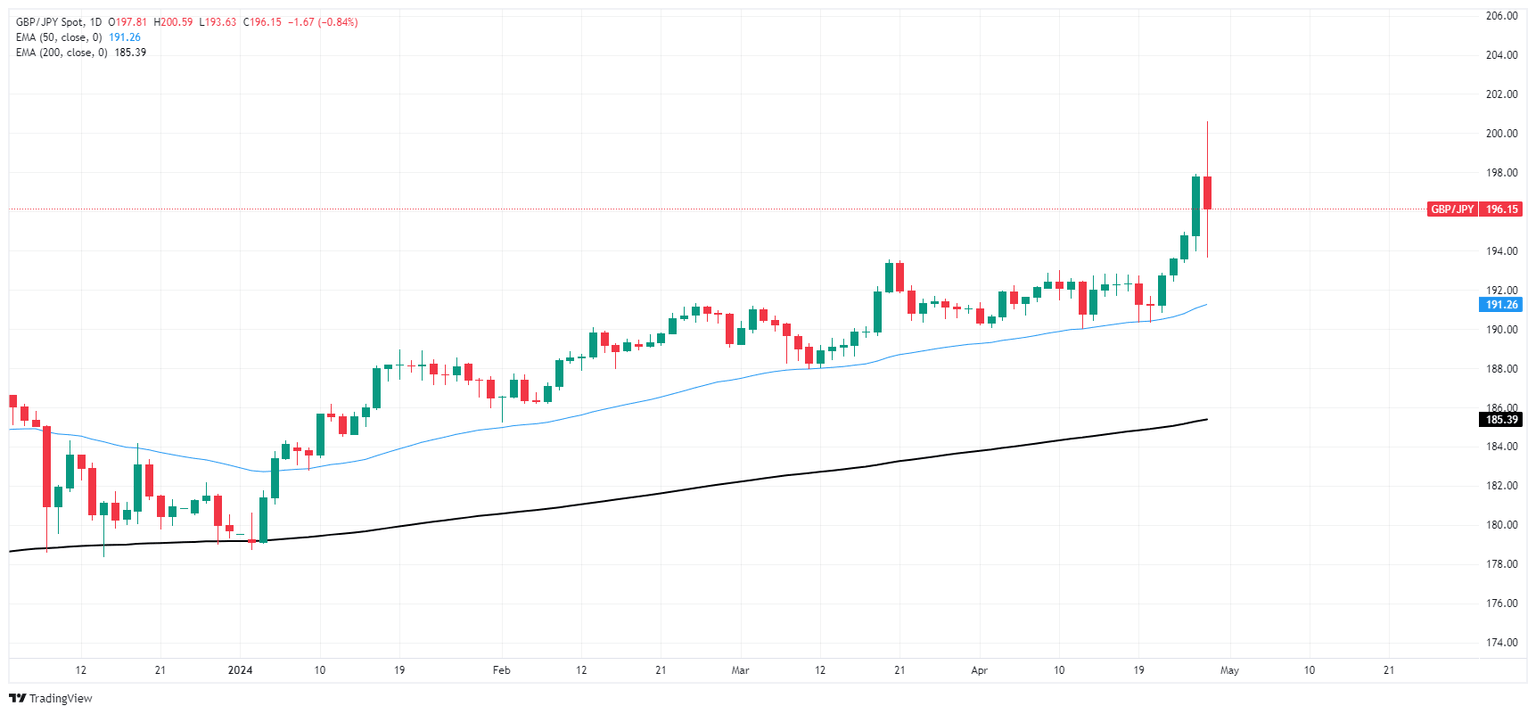

GBP/JPY technical outlook

The Guppy saw one of its largest single-day trading ranges on Monday, peaking at 200.60 before tumbling back below 194.00. The pair has settled at the 196.00 handle, and traders will be keeping a close eye on the pair as they gauge whether the pair will snap its long-running bull streak.

The GBP/JPY is still on pace to close in the green for the month. The pair has closed bullish for all but three of the last 16 consecutive trading months.

Topside technical barriers remain limited as the pair grapples with multi-decade highs, and the most meaningful price floor will be the 200-day Exponential Moving Average (EMA), far below current price action at 185.16.

GBP/JPY hourly chart

GBP/JPY daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.