GBP/USD Technical Analysis: Strangling near 1.2700

- GBP/USD continues to cycle around intraday inflection levels, currently digging in near 1.2700 after failing to jumpstart moves in either direction on Wednesday.

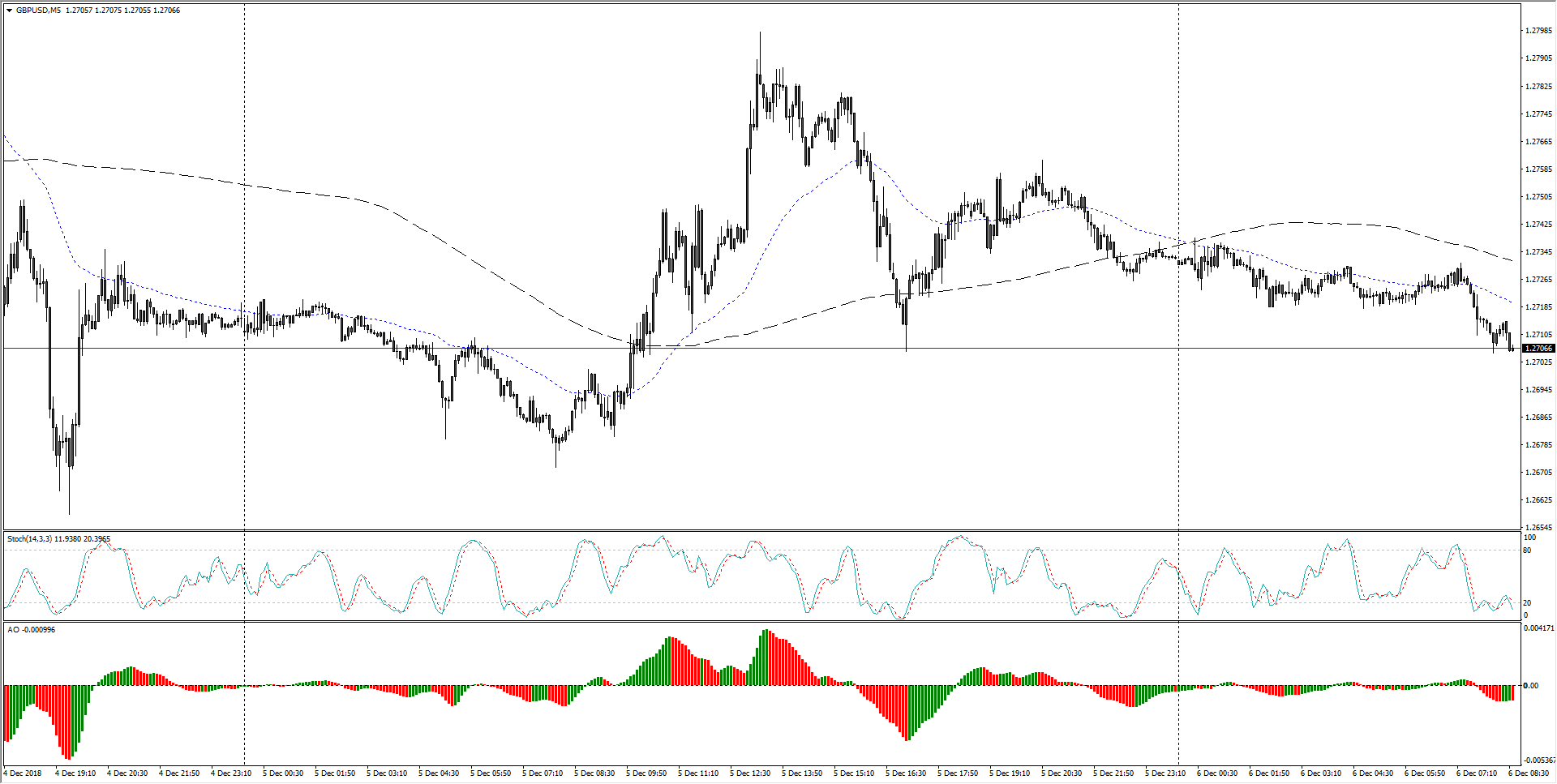

GBP/USD, 5-Minute

- The past two weeks have seen the Cable moving in a sluggish downtrend, marked by consolidation periods separated by rough chop, but the pair continues to see downside movement from the 200-period MA.

GBP/USD, 30-Minute

- 4-hour candlesticks have the Cable setting up for a bearish break of previous support just below the 1.2700 handle, and short-sellers will be looking to time a break-and-retest of the significant level with Tuesday's upcoming Brexit vote to push the GBP/USD pairing into a faster downtrend.

GBP/USD, 4-Hour

GBP/USD

Overview:

Today Last Price: 1.2711

Today Daily change: -20 pips

Today Daily change %: -0.157%

Today Daily Open: 1.2731

Trends:

Previous Daily SMA20: 1.2831

Previous Daily SMA50: 1.2944

Previous Daily SMA100: 1.2964

Previous Daily SMA200: 1.3298

Levels:

Previous Daily High: 1.2798

Previous Daily Low: 1.2672

Previous Weekly High: 1.2864

Previous Weekly Low: 1.2725

Previous Monthly High: 1.3176

Previous Monthly Low: 1.2723

Previous Daily Fibonacci 38.2%: 1.275

Previous Daily Fibonacci 61.8%: 1.272

Previous Daily Pivot Point S1: 1.2669

Previous Daily Pivot Point S2: 1.2608

Previous Daily Pivot Point S3: 1.2543

Previous Daily Pivot Point R1: 1.2796

Previous Daily Pivot Point R2: 1.286

Previous Daily Pivot Point R3: 1.2922

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.