GBP/USD Technical Analysis: Set to continue breakdown into fresh 18-month lows

- GBP/USD trading into 12680 after slipping the 1.2700 handle in Wednesday's early Asia market window.

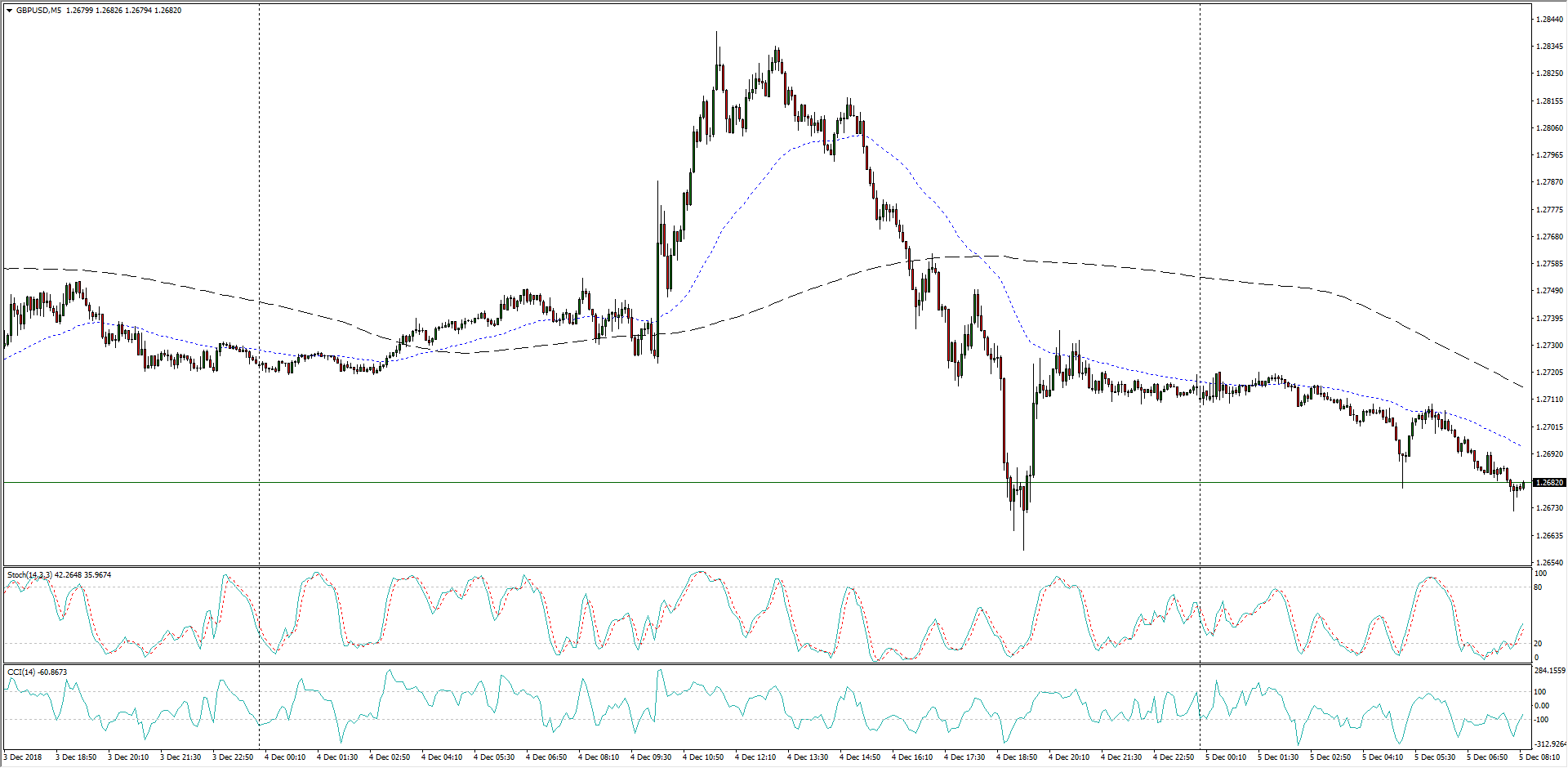

GBP/USD, 5-Minute

- The Cable remains grudgingly bearish despite frequent swings to the upside, fueled largely by fundamental flows on Brexit.

GBP/USD, 30-Minute

- Steep declines have been the hallmark of GBP/USD over the last quarter, but the tick into a new 18-month low at 1.2658 may have opened the door to further downside for the Cable.

GBP/USD, 4-Hour

GBP/USD

Overview:

Today Last Price: 1.2681

Today Daily change: -30 pips

Today Daily change %: -0.236%

Today Daily Open: 1.2711

Trends:

Previous Daily SMA20: 1.2852

Previous Daily SMA50: 1.2952

Previous Daily SMA100: 1.2968

Previous Daily SMA200: 1.3304

Levels:

Previous Daily High: 1.284

Previous Daily Low: 1.2659

Previous Weekly High: 1.2864

Previous Weekly Low: 1.2725

Previous Monthly High: 1.3176

Previous Monthly Low: 1.2723

Previous Daily Fibonacci 38.2%: 1.2728

Previous Daily Fibonacci 61.8%: 1.2771

Previous Daily Pivot Point S1: 1.2633

Previous Daily Pivot Point S2: 1.2555

Previous Daily Pivot Point S3: 1.2452

Previous Daily Pivot Point R1: 1.2815

Previous Daily Pivot Point R2: 1.2918

Previous Daily Pivot Point R3: 1.2996

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.