GBP/USD Technical Analysis: No end in sight for December's consolidation range

- After jaunts up and down the charts, GBP/USD finds itself trading the week roughly back where it started, near 1.2650.

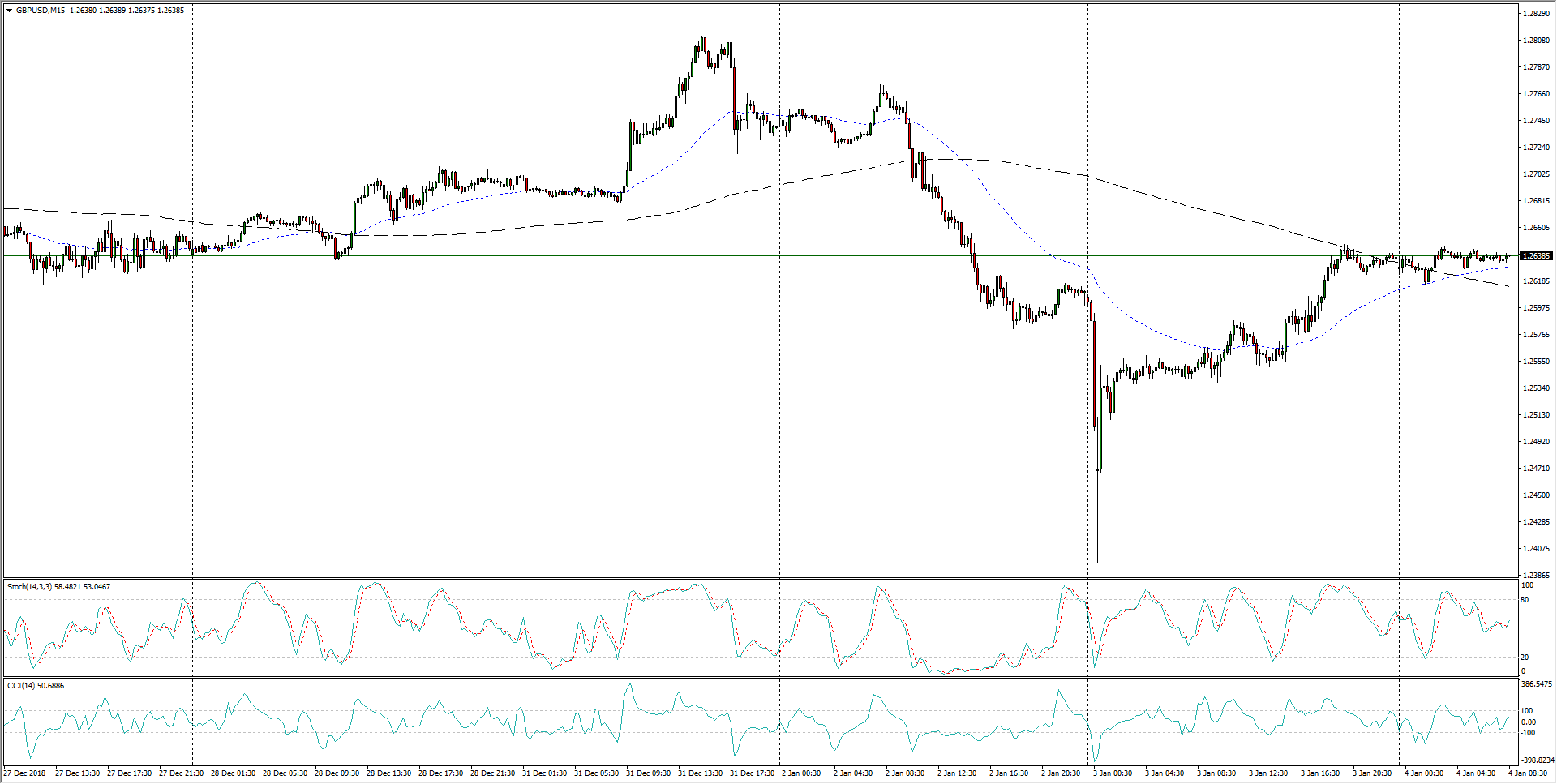

GBP/USD, 15-Minute

- December has been hall-marked by consolidation for the Cable, broken up by frequent whipsaws that tend to go nowhere over time, leaving the major pair biased towards the middle.

GBP/USD, 1-Hour

- The previous quarter shows GBP/USD in a firm downtrend, likely due to continuous bearish pressure from Brexit proceedings, and although the last couple of swing lows could be supporting a medium-term bullish reversal, traders will be waiting for a decisive break of levels beyond 1.2700 before hopping into any major bidding positions.

GBP/USD, 4-Hour

GBP/USD

Overview:

Today Last Price: 1.2636

Today Daily change: 1.0 pips

Today Daily change %: 0.00791%

Today Daily Open: 1.2635

Trends:

Previous Daily SMA20: 1.265

Previous Daily SMA50: 1.2775

Previous Daily SMA100: 1.2898

Previous Daily SMA200: 1.3162

Levels:

Previous Daily High: 1.2648

Previous Daily Low: 1.2438

Previous Weekly High: 1.2778

Previous Weekly Low: 1.2616

Previous Monthly High: 1.284

Previous Monthly Low: 1.2477

Previous Daily Fibonacci 38.2%: 1.2568

Previous Daily Fibonacci 61.8%: 1.2518

Previous Daily Pivot Point S1: 1.2499

Previous Daily Pivot Point S2: 1.2363

Previous Daily Pivot Point S3: 1.2289

Previous Daily Pivot Point R1: 1.271

Previous Daily Pivot Point R2: 1.2784

Previous Daily Pivot Point R3: 1.292

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.