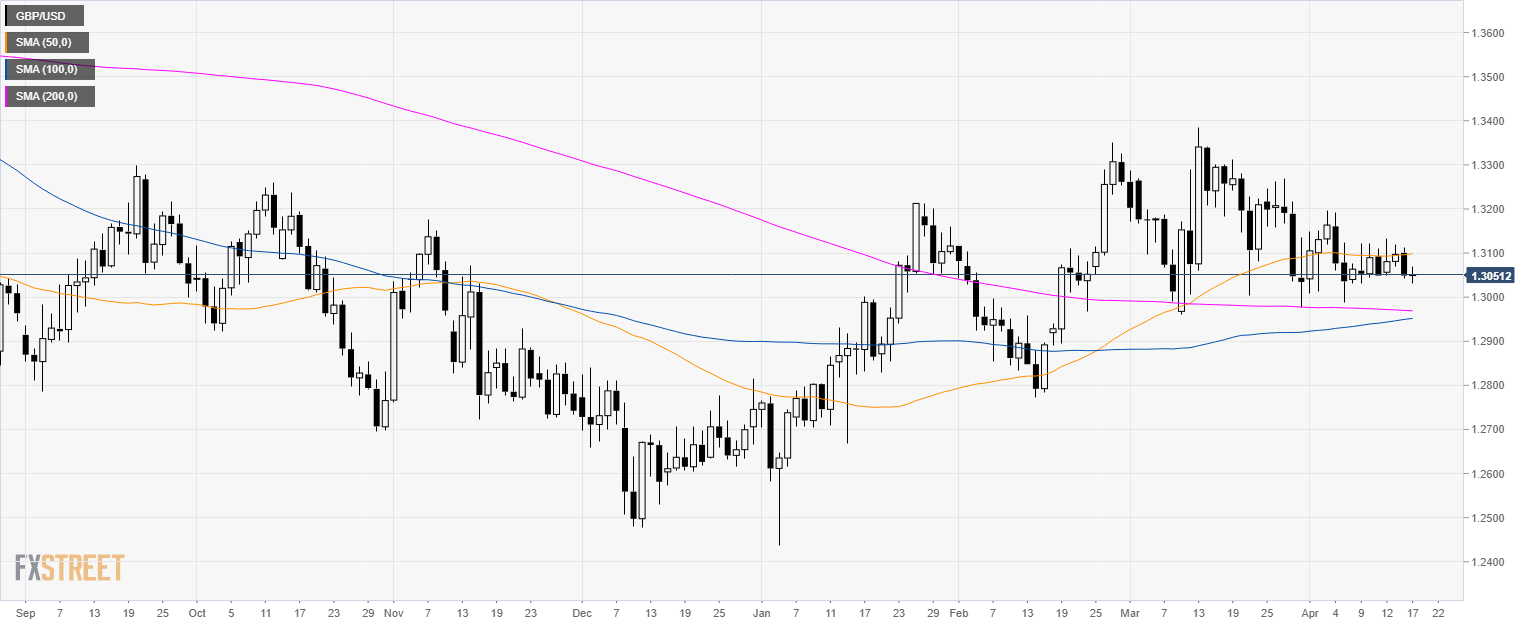

GBP/USD Technical Analysis: Cable trapped in a wedge pattern

GBP/USD daily chart

- GBP/USD is consolidating below 1.3100 and the 50-day simple moving average (SMA).

- GBP/USD is trapped in a wedge pattern.

GBP/USD 30-minute chart

- As mentioned yesterday, the market found some support at the 1.3040 level.

- The market might remain in range between 1.3040 and 1.3080 in the New York session.

- Bulls need a break of 1.3080 to reach 1.3120 level while bears need to break below 1.3040 to reach 1.3000 the figure.

Additional key levels

Author

Flavio Tosti

Independent Analyst