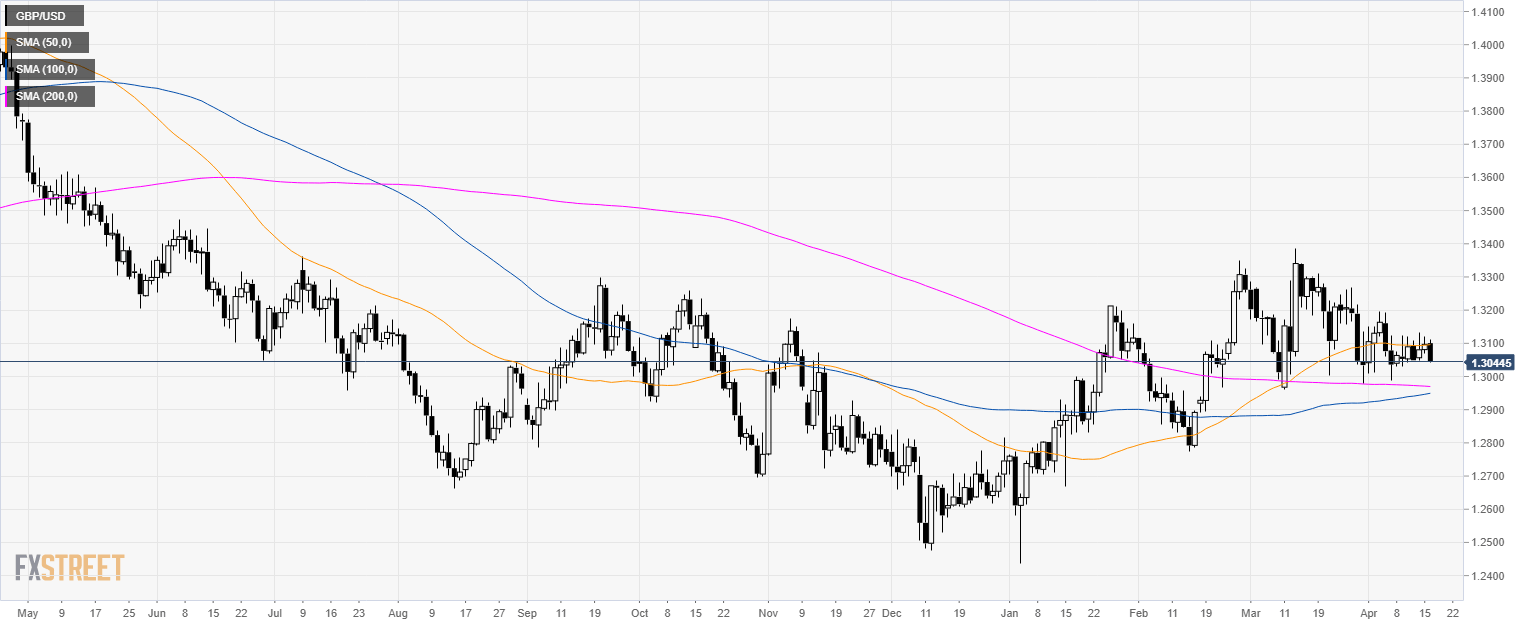

GBP/USD Technical Analysis: Cable drops to weekly lows near 1.3040 level

GBP/USD daily chart

- GBP/USD is consolidating below the 50-day simple moving average (SMA).

- GBP/USD is trading below its main SMAs suggesting a bearish momentum in the medium-term.

GBP/USD 30-minute chart

- The market could find some short-term support here at 1.3040 level.

- If broken then the next pit-stop for bears become 1.3000 the figure.

- Resistance is at 1.3080 level.

Additional key levels

Author

Flavio Tosti

Independent Analyst