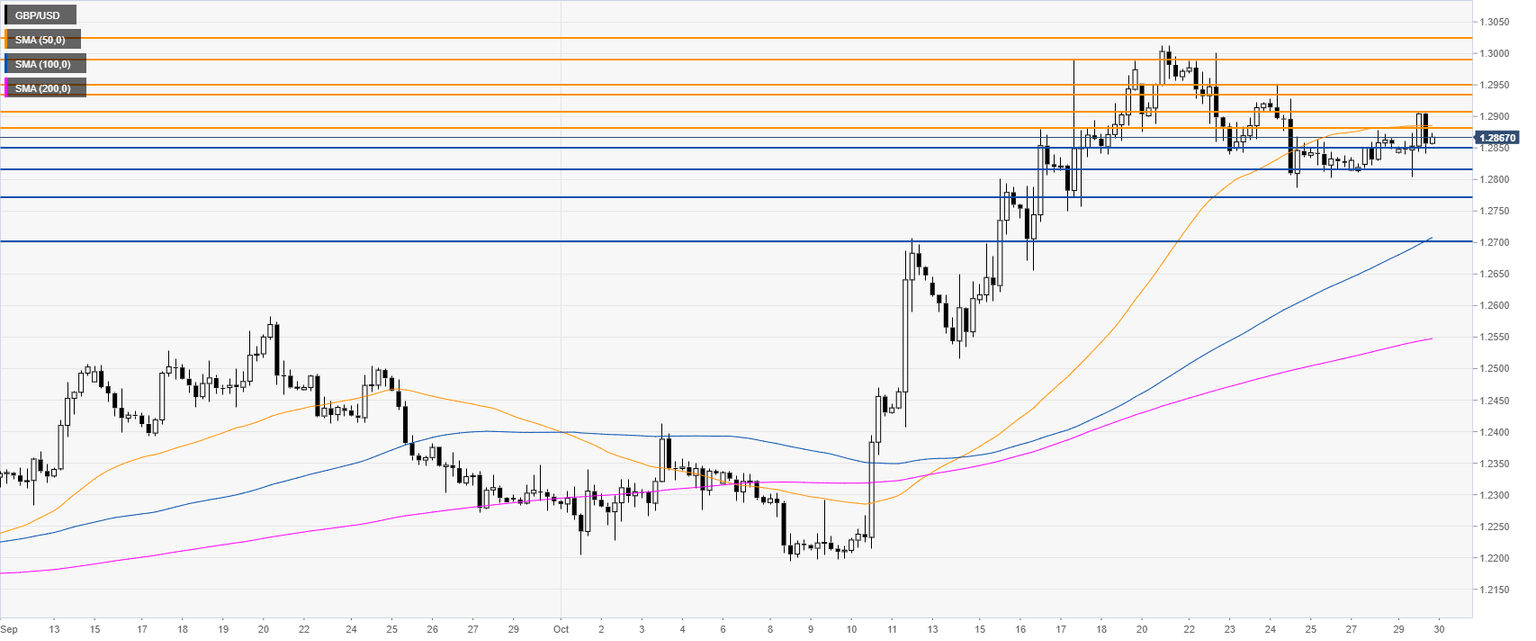

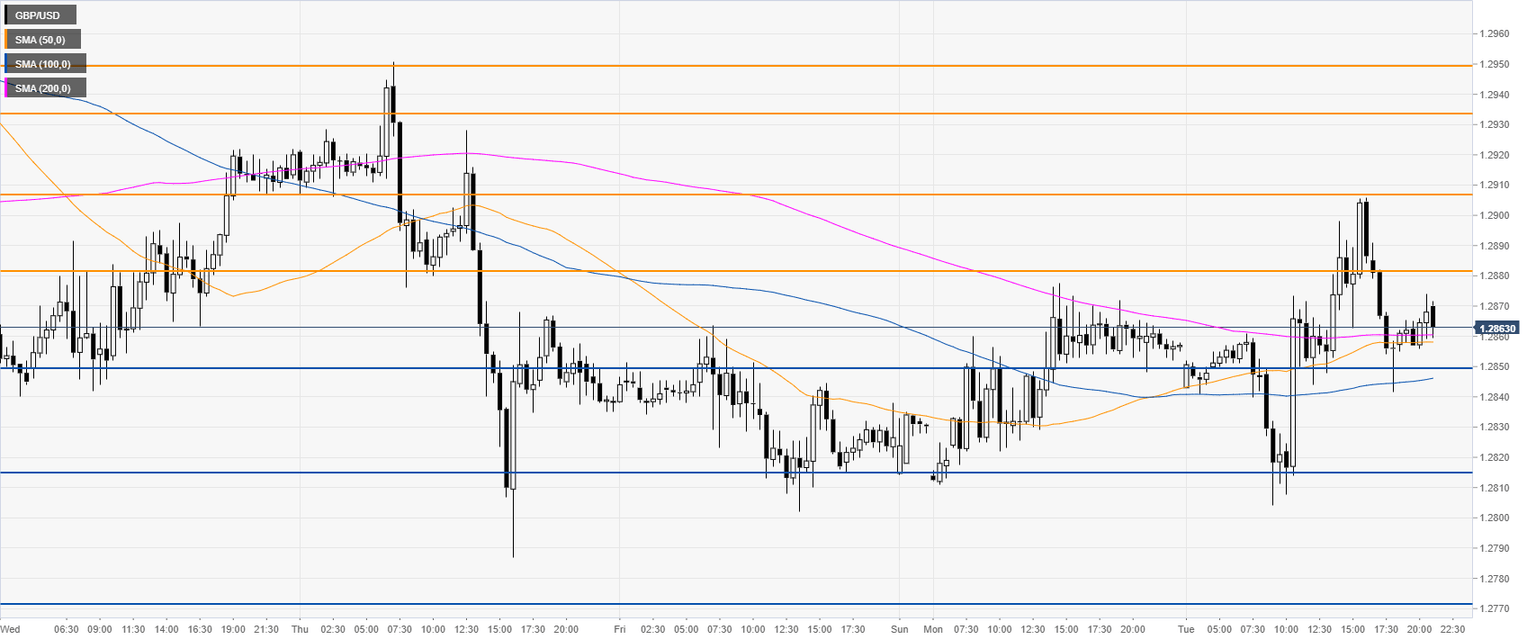

GBP/USD technical analysis: Cable rolling into the Asian session below the 1.2900 handle

- Brexit optimism sent GBP/USD on a rollercoaster this Tuesday. However, the Currency pair is about to end the day virtually unchanged.

- Breaking: UK election will be 12 Dec (GBP positive).

GBP/USD daily chart

GBP/USD four-hour chart

GBP/USD 30-minute chart

Additional key levels

Author

Flavio Tosti

Independent Analyst