GBP/USD Technical Analysis: Cable pressuring weekly lows near 1.2820 level

- The cable is turning negative for the week.

- The level to beat for sellers is the 1.2820 support.

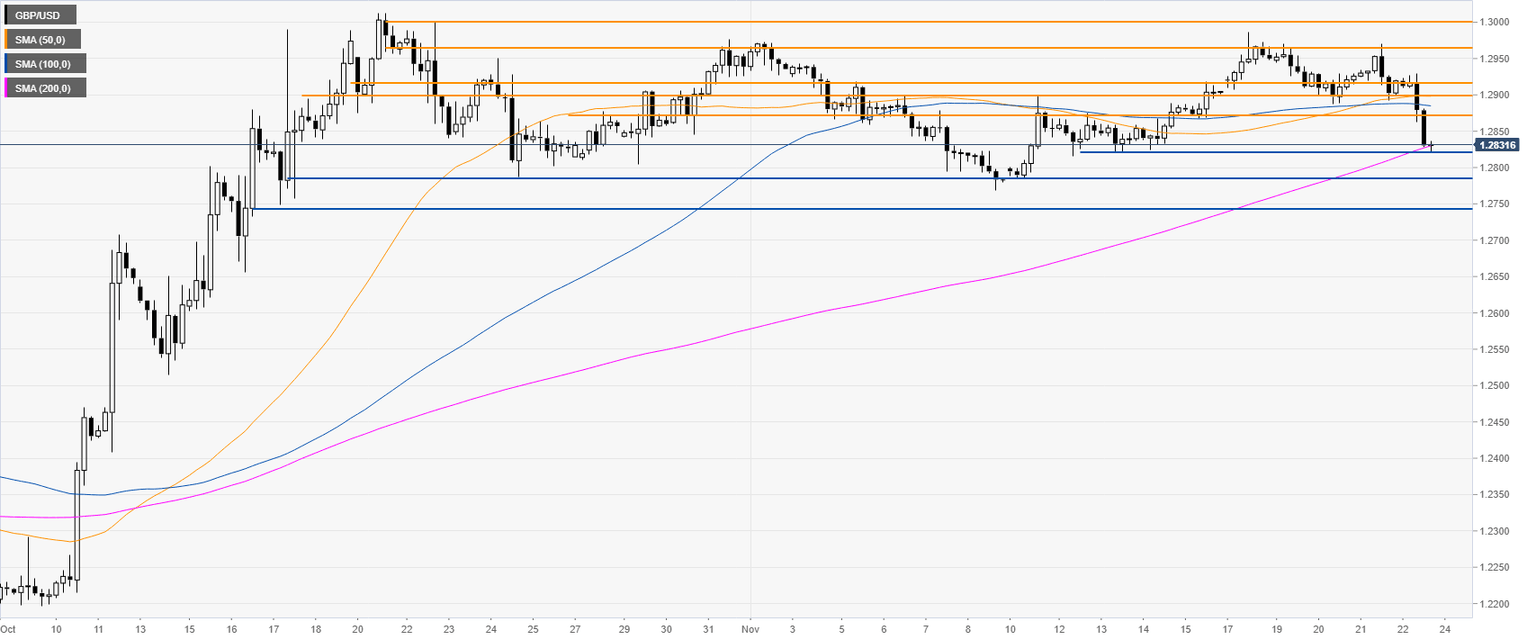

GBP/USD daily chart

GBP/USD is rejecting the 1.2900 handle as the market is easing from the November highs. The spot is trading well above its main daily simple moving averages (DMAs).

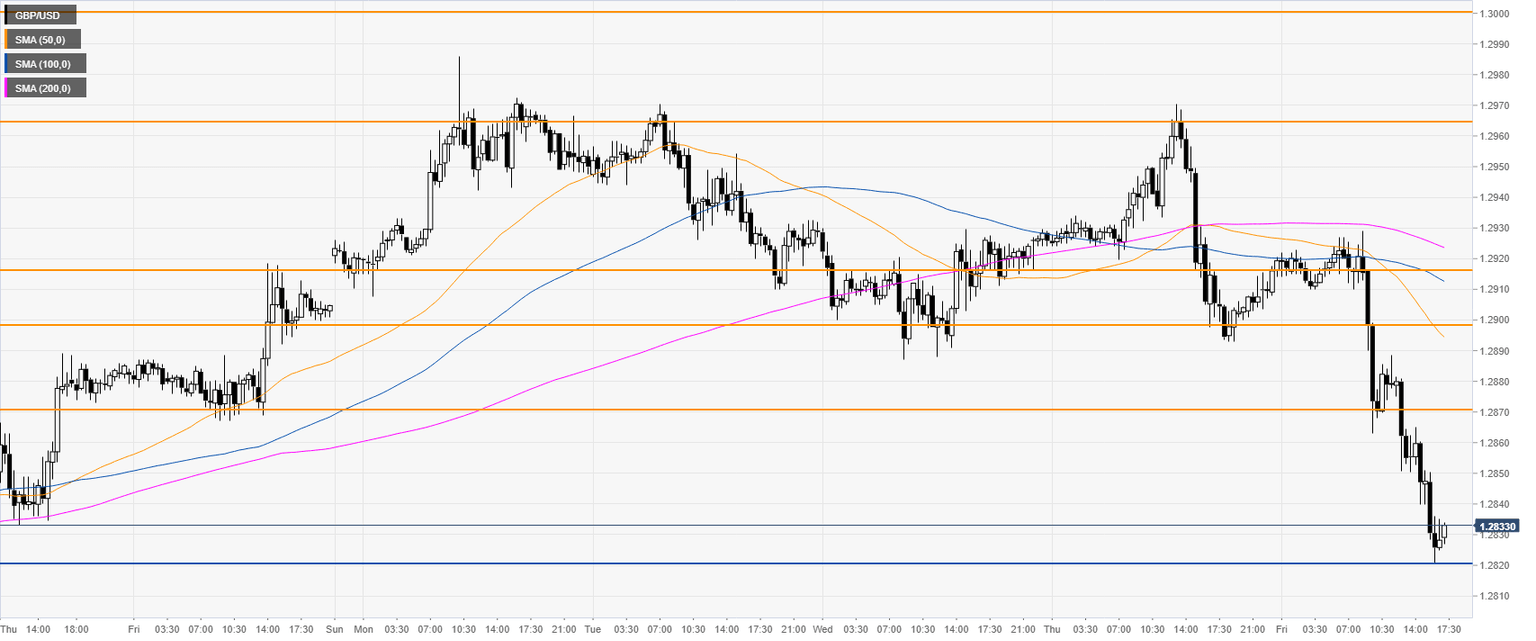

GBP/USD four-hour chart

GBP/USD 30-minute chart

Additional key levels

Author

Flavio Tosti

Independent Analyst