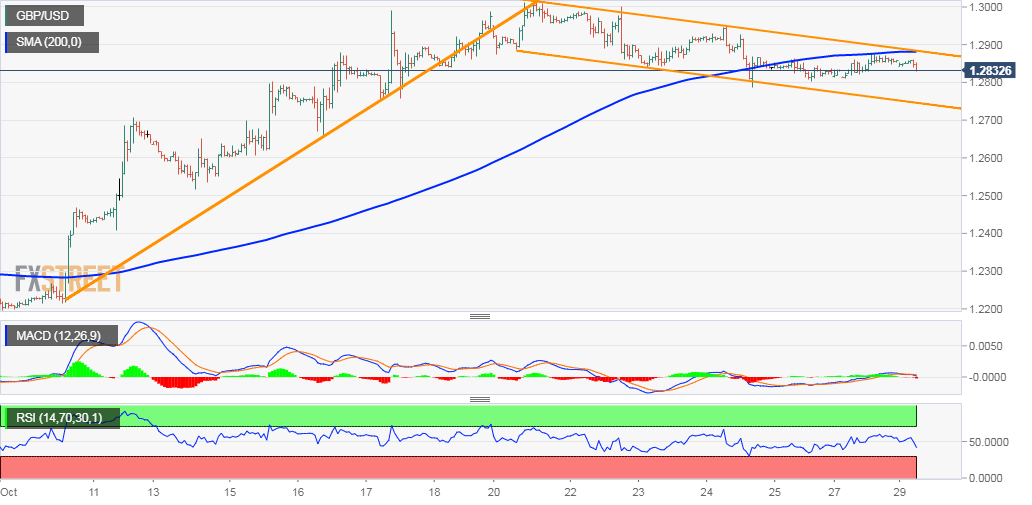

GBP/USD technical analysis: Bullish flag pattern spotted on short-term charts

- The pair failed to build on the overnight bounce from the 1.2800 neighbourhood.

- Sustained move beyond 200-hour SMA needed for a fresh bullish confirmation.

The GBP/USD pair showed some resilience near the 1.2800 handle and staged a goodish intraday bounce on the first day of a new trading week, albeit lacked any strong follow-through. The pair was seen consolidating in a range through the early European session on Tuesday as investors seemed reluctant ahead of yet another UK parliamentary vote on an early election.

Meanwhile, the recent pullback from multi-month tops had been along a descending trend-channel on hourly charts. Given the recent strong move up from the 1.2200 neighbourhood, tested earlier this month, the mentioned channel seemed to constitute towards the formation of a bullish continuation flag chart pattern and support prospects for a further near-term positive move.

However, bulls are likely to wait for a sustained breakthrough the trend-channel resistance, currently near the 1.2870 region, and a subsequent strength beyond 200-hour SMA before positioning for momentum towards the 1.2970-75 intermediate resistance en-route the key 1.30 psychological mark.

On the flip side, any meaningful pullback might continue to find some support near the 1.2800 handle, below which bears are likely to aim towards challenging the trend-channel support, currently near the 1.2750-45 region. Failure to defend the trend-channel support will negate the constructive set-up and pave the way for an extension of the recent corrective slide.

GBP/USD 1-hourly chart

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.