GBP/USD rises as Fed rate cut odds boost Sterling

- GBP/USD climbs above key moving averages, signaling potential for further gains.

- US inflation data and consumer sentiment support expectations for a Fed rate cut next week.

- Bank of England expected to lower rates in December, easing cost-of-living pressures.

GBP/USD resumes its uptrend on Friday, trimming some of Thursday’s losses as the US Dollar (USD) recovers some ground. Inflation data in the US kept steady the chances of a Federal Reserve (Fed) cut at the December meeting, weighing on the Greenback. At the time of writing, the pair trades at 1.3349, up 0.19%.

GBP/USD rallies as US Core PCE reaffirms Fed rate cut in December

The Core Personal Consumption Expenditures (PCE) Price Index, the Fed’s favorite inflation gauge, which excludes food and energy, rose by 0.2% MoM in September, unchanged from August and aligned with estimates. In the twelve months to September, it ticked lower from 2.9% to 2.8%.

At the same time, the University of Michigan Consumer Sentiment in December rose to 53.3, above estimates of 52 and up from November’s final reading of 51. Joanne Hsu, the Director of the Surveys of Consumer, noted that “consumers see modest improvements from November on a few dimensions, but the overall tenor of views is broadly somber.”

Americans' one-year inflation expectations in December dipped from 4.5% to 4.1%. For a five-year period, it decreased from 3.4% in November to 3.2%.

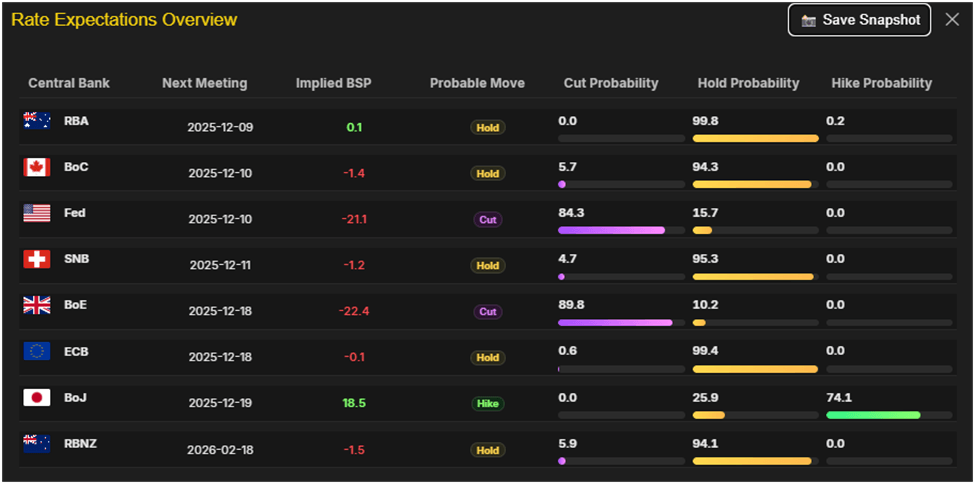

Given the backdrop, expectations for a 25 basis points (bps) Fed rate cut next week remained unchanged at 84%, as revealed by Capital Edge Rate Expectations Overview data.

After the data release, GBP/USD bounced towards 1.3350 after meandering around 1.3340 as the US Dollar tumbled to expectations of further easing.

In a note, Morgan Stanley said it expects a 25-bps cut in December, in January, and in April of 2026. They expect the Fed funds rate to end at 3%-3.25%.

The British Pound (GBP) shrugged off worries about last month’s budget, while business activity showed some improvement, according to S&P Global.

Despite this, the Bank of England is projected to reduce rates by 25 bps to 3.75% in the December 18 meeting after pausing its easing cycle in November.

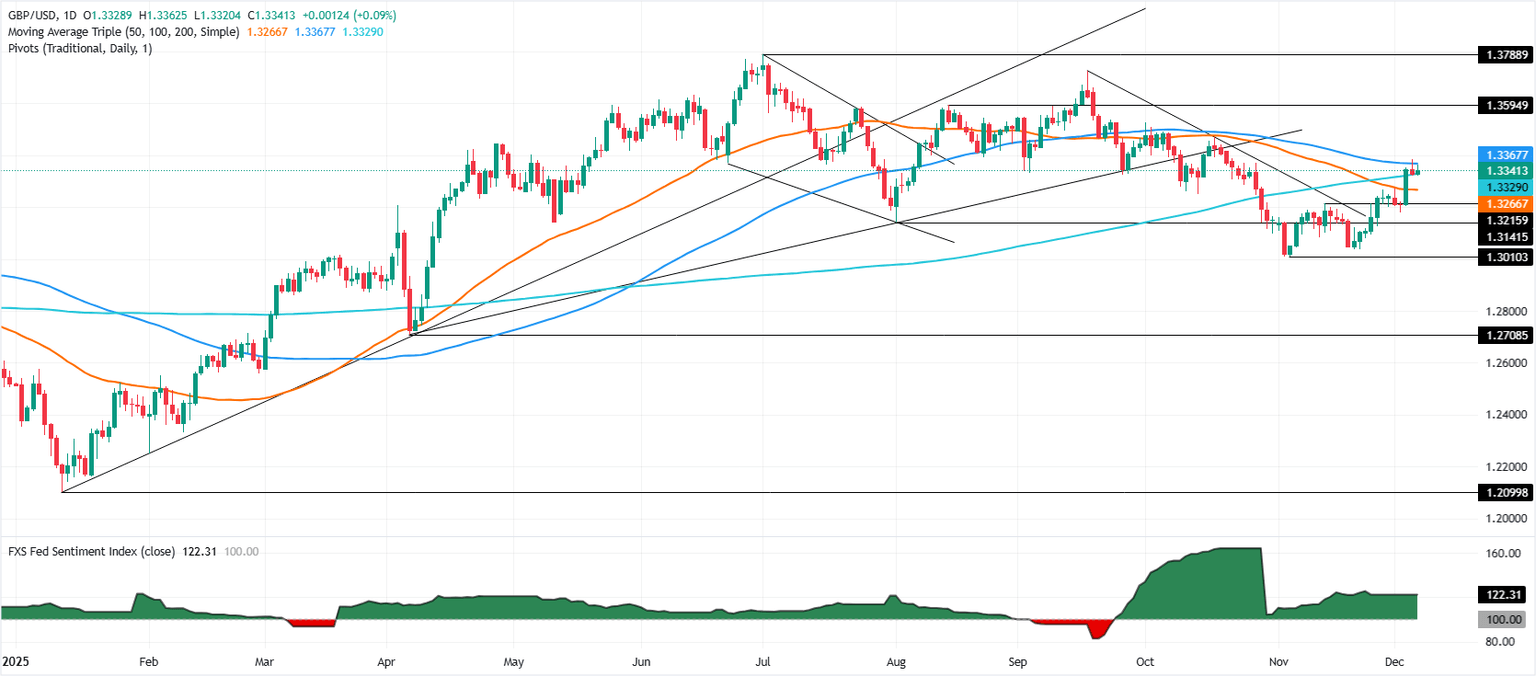

GBP/USD Price Forecast: Technical outlook

GBP/USD seems capped by the 100-day Simple Moving Average (SMA) at 1.3365, even though the pair crossed above the 200-day SMA at 1.3326. Therefore, further consolidation lies ahead, and with the Fed's next meeting looming, a breach of the 100-day SMA is likely.

In that outcome, the next key resistance is 1.3400. Once surpassed, the next stop would be the October 17 high at 1.3471 ahead of 1.3500. On the flip side, GBP/USD’s drop below 1.3300 exposes the 50-day SMA at 1.3264, followed by 1.3200.

Pound Sterling Price This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.42% | -0.77% | -0.54% | -0.89% | -1.39% | -0.79% | 0.12% | |

| EUR | 0.42% | -0.35% | -0.11% | -0.47% | -0.98% | -0.37% | 0.54% | |

| GBP | 0.77% | 0.35% | 0.50% | -0.12% | -0.63% | -0.03% | 0.90% | |

| JPY | 0.54% | 0.11% | -0.50% | -0.35% | -0.87% | -0.26% | 0.65% | |

| CAD | 0.89% | 0.47% | 0.12% | 0.35% | -0.56% | 0.10% | 1.01% | |

| AUD | 1.39% | 0.98% | 0.63% | 0.87% | 0.56% | 0.61% | 1.53% | |

| NZD | 0.79% | 0.37% | 0.03% | 0.26% | -0.10% | -0.61% | 0.92% | |

| CHF | -0.12% | -0.54% | -0.90% | -0.65% | -1.01% | -1.53% | -0.92% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.