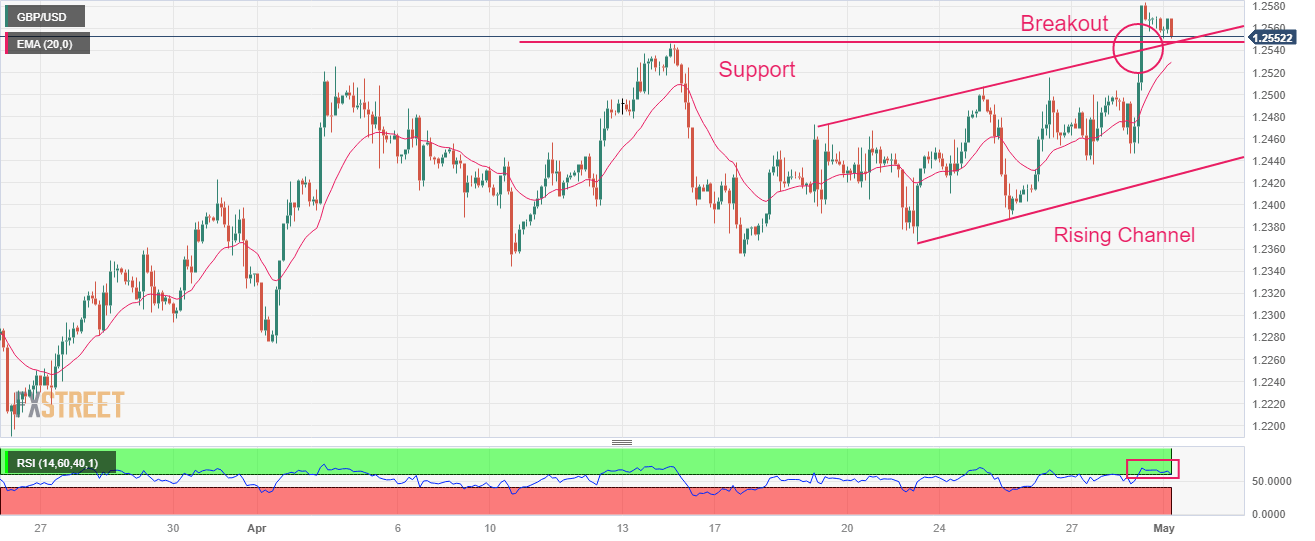

GBP/USD Price Analysis: Testing breakout of a rising channel pattern below 1.2550

- GBP/USD is showing signs of exhaustion in the upside momentum after failing to extend the upside above 1.2583.

- The risk profile is favoring risk-sensitive assets amid solid quarterly performance from US tech-savvy stocks.

- GBP/USD has delivered a breakout of the Rising Channel chart pattern and is testing it with a minor correction to near 1.2546.

The GBP/USD pair is showing signs of exhaustion in the upside momentum after failing to extend the upside above 1.2583. The Cable has turned sideways around 1.2560 as investors are preparing for monetary policy by the Federal Reserve (Fed), which is scheduled for Wednesday.

The risk profile is favoring risk-sensitive assets as S&P500 futures are having minimal gains after a bullish Friday. Investors were gung-ho for United States equities after a solid quarterly performance from tech-savvy stocks.

The US Dollar Index (DXY) is eyeing a further stretch in recovery above 101.80 as the Fed is expected to raise interest rates further to tame sticky core inflation. US Consumer spending is resilient amid higher outlays for services.

GBP/USD has delivered a breakout of the Rising Channel chart pattern on a two-hour scale. An upside break of the Rising Channel chart pattern indicates sheer strength in the Pound Sterling. The immediate support is plotted from April 14 high at 1.2546.

Advancing 20-period Exponential Moving Average (EMA) at 1.2530 indicates more upside ahead.

Also, the Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00, hinting that the upside momentum is active for now.

A successful test of breakout near April 14 high at 1.2546 will drive the asset towards a fresh 10-month high at 1.2597, which is 08 June 2022 high. A breach of the latter will expose the asset to May 27 high at 1.2667.

On the flip side, a slippage below April 10 low at 1.2345 will expose the asset to March 30 low at 1.2294 followed by March 27 low at 1.2219.

GBP/USD two-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.