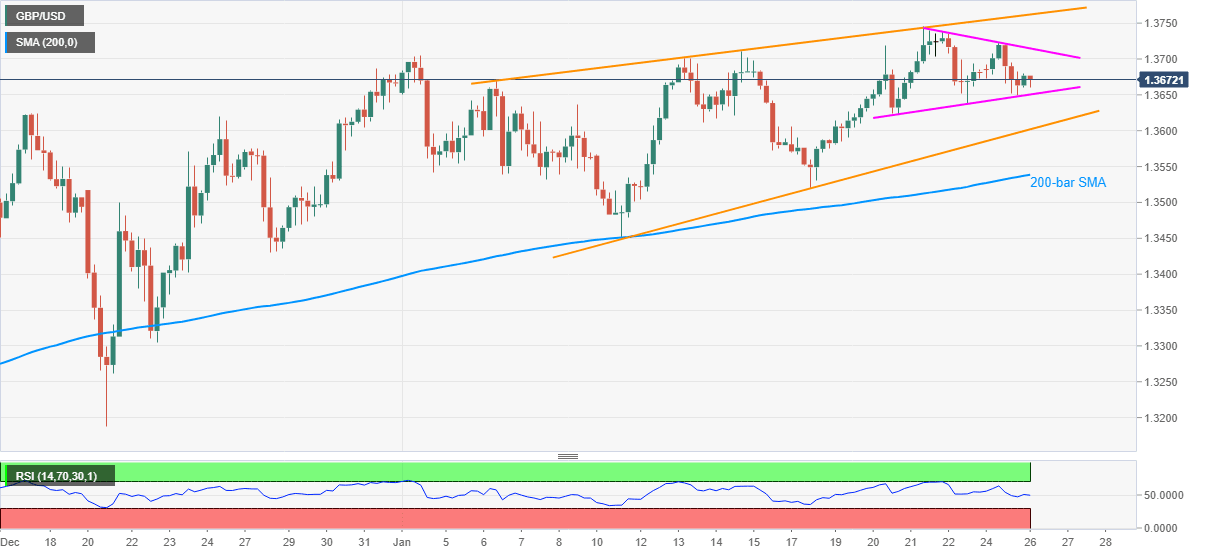

GBP/USD Price Analysis: Stays inside rising wedge on 4H ahead of UK jobs report

- GBP/USD recovers from intraday low of 1.3660 in the latest uptick.

- Short-term symmetrical triangle restricts immediate moves inside a bearish chart pattern.

- 200-bar SMA adds to the downside filter, multiple upside barriers probe bulls beyond 1.3700.

- UK Employment report suggests another positive surprise for December.

GBP/USD picks up bids to near 1.3675, up 0.05% intraday, during the latest bounce amid Tuesday’s Asian trading. In doing so, the cable takes a U-turn from the support line of a one-week-old symmetrical triangle.

Although normal RSI conditions and sustained trading beyond 200-bar SMA keep GBP/USD buyers hopeful, the pair’s three-week-old rising wedge pattern probe the bulls.

Even so, the latest corrective pullback eyes the upper line of the stated triangle, at 1.3715 now, before directing GBP/USD bulls to the monthly high near 1.3750.

Also acting as the upside filter is the upper line of the bearish chart pattern as well as the early February 2018 low near 1.3765.

On the contrary, a downside break of the triangle, while breaking 1.3655 immediate support, will tease the rising wedge’s lower line around 1.3600.

It should be noted that the 200-bar SMA near 1.3540-35 acts as extra support to validate the pair’s south-run targeting December 22 low near 1.3300.

To sum up, GBP/USD technical perspective gets interesting ahead of the key jobs report for December.

Read: UK Jobs Preview: Another positive surprise? GBP/USD could use a shot in the arm

GBP/USD four-hour chart

Trend: Sideways

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.