GBP/USD Price Analysis: Rebounds at 37-year lows, reclaims the 1.1500 figure

- GBP/USD is recording decent gains after nosediving to a 1985 daily low.

- The British pound found some base around 1.1400, rallying more than 130-pips on the day.

- The major might record a leg-up before extending its fall for a re-test of the YTD low at a1.1406.

The GBP/USD refreshed a 37-year low but bounced off and reclaimed the 1.1500 figure after meandering around the 1.1400 round figure during the day. The GBP/USD recovered some ground and settled at current exchange rates, trading at 1.1531, above its opening price by 0.18%, at the time of writing.

GBP/USD Price Analysis: Technical outlook

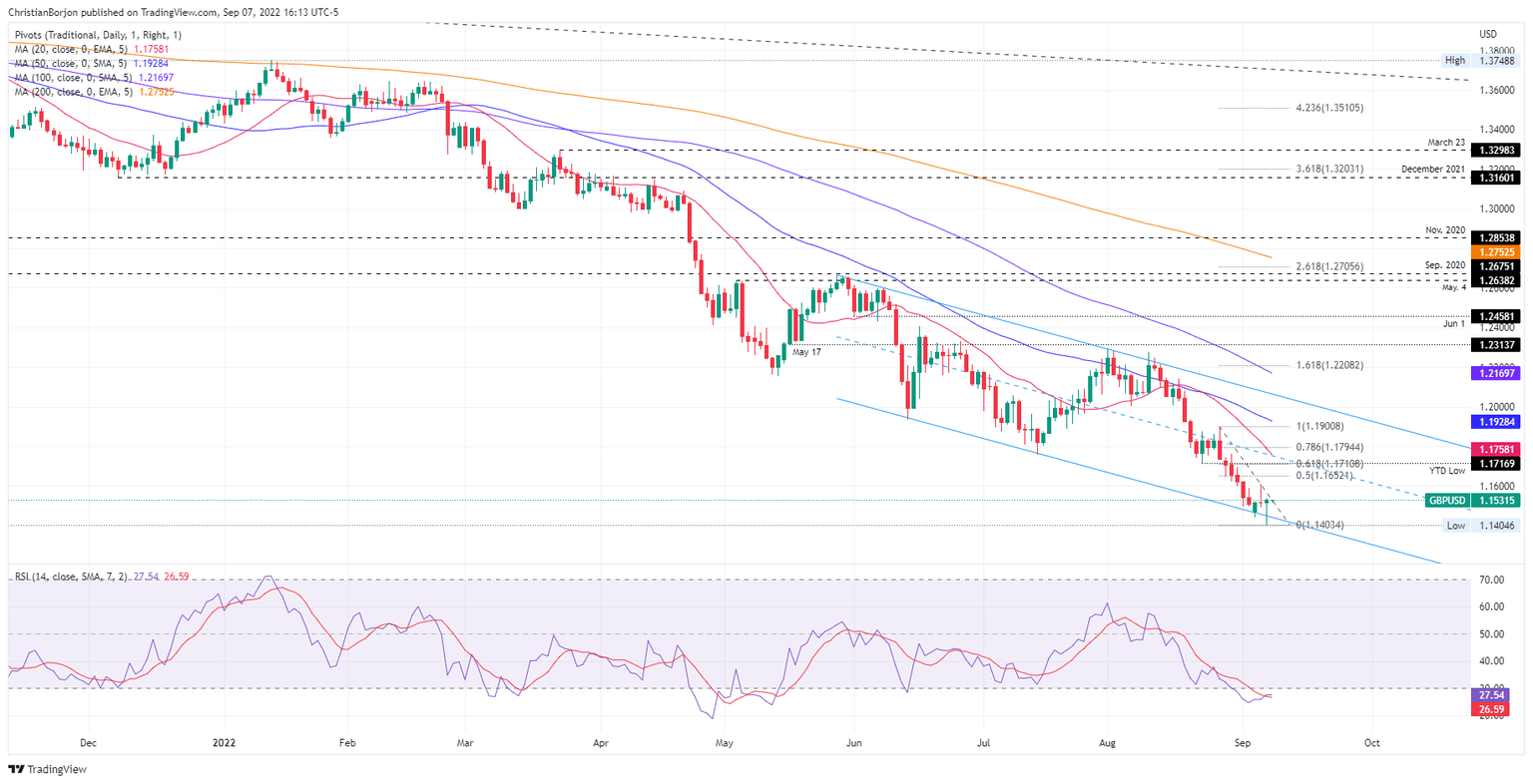

The GBP/USD trades were volatile during Wednesday’s trading session. The major is still downward biased, despite recovering more than 100-pips losses. It is worth noting that the Sterling dropped below the descending channel, where the major has been trading since late May, when the British pound began its downfall throughout 2022.

GBP traders should know that the Relative Strength Index (RSI) is within the oversold territory, so the pair might print a leg-up before resuming its downward path. Therefore, the GBP/USD’s first resistance would be the September 6 daily high at 1.1608. Once cleared, the next supply zone would be the 50% Fibonacci retracement at 1.1652, followed by the 61.8% Fibonacci level at 1.1710.

On the downside, the GBP/USD first floor would be the 1.1500 figure. The break below will expose the YTD low at 1.1400, followed by the psychological 1.1300 figure.

GBP/USD Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.