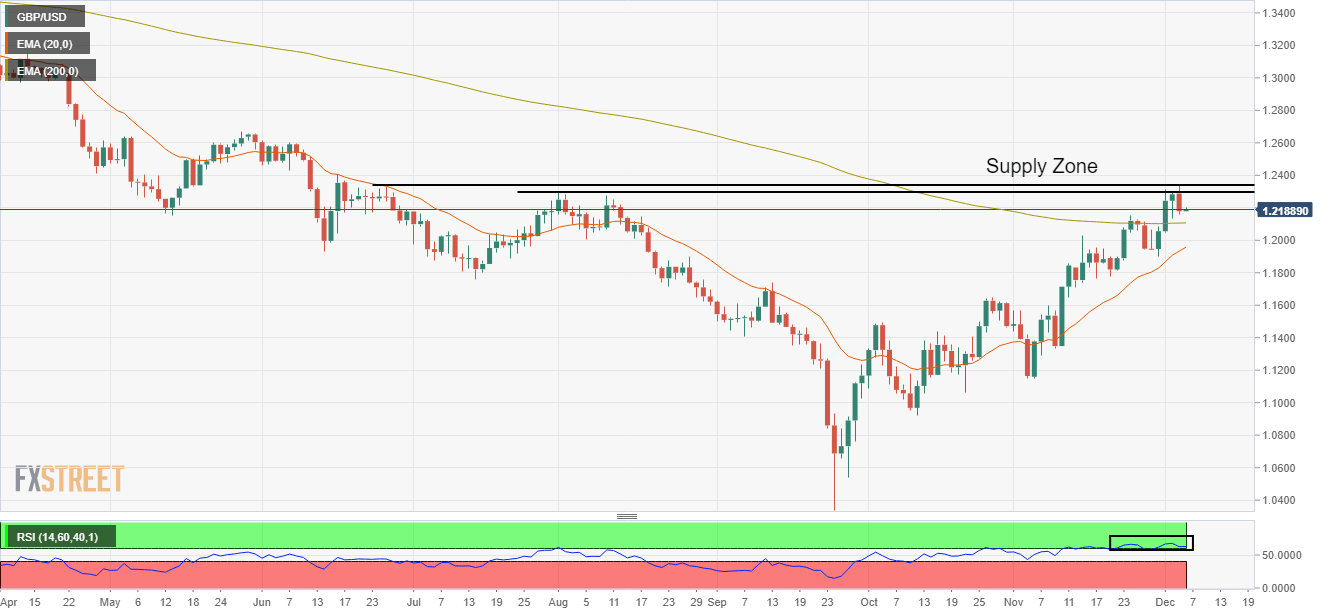

GBP/USD Price Analysis: Mean reversion to 20-EMA looks imminent

- Sour market sentiment has dragged the Cable below 1.2200.

- An oscillation in the bullish range by the RSI (14) indicates that the bullish momentum is still solid.

- A mean reversion to the 20-EMA around 1.1970 is highly expected.

The GBP/USD pair has sensed barricades around the immediate hurdle of 1.2200 in the early Tokyo session. The three-day winning streak of the Cable ended on Monday after it failed to extend its rally above 1.2340. A cautious market mood hammered the Pound Sterling and sent it to lower below the round-level cushion of 1.2200.

Meanwhile, the US Dollar Index (DXY) has witnessed a significant buying interest and has advanced to near 105.40 after refreshing its fresh- foe-month low at 104.10.

On a daily scale, Cable has faced selling pressure after testing the supply zone placed in a narrow range of 1.2292-1.2351. The gap between the Cable and the 20-period Exponential Moving Average (EMA) has escalated, therefore, a mean reversion cannot be ruled out. The Cable is still holding the 200-EMA at 1.2108, which indicates that the long-term trend is still bullish.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in a bullish range of 60.00-80.00, which indicates that the bullish momentum is still active.

Going forward, a decline below Friday’s low at 1.2134 will drag the Cable toward the psychological resistance at 1.2000, followed by the 20-EMA around 1.1971.

On the flip side, a break above Monday’s high at 1.2345 will drive the Cable toward June 16 high of around 1.2400. A breach of the latter will send the major toward June 1 low at 1.2460.

GBP/USD daily chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.