GBP/USD Price Analysis: Downside looks favored as US PCE data supports more rates from Fed

- GBP/USD is looking vulnerable above 1.1940 amid the risk-off market mood.

- The USD Index is gathering strength to reclaim the immediate resistance of 105.00 amid hawkish Fed bets.

- Downward-sloping 20-and 50-period EMAs add to the downside filters.

The GBP/USD pair is displaying a volatility contraction around 1.1940 in the early Tokyo session. The Cable looks set to deliver further weakness as a fresh renewal in the Federal Reserve’s (Fed) hawkish bets has strengthened the US Dollar.

S&P500 futures witnessed immense pressure last week on hopes that more rates are in pipeline by the Fed as the United States inflation has turned persistent due to the strong labor market. The US Dollar Index (DXY) is gathering strength to reclaim the immediate resistance of 105.00. A jump in the monthly US core Personal Consumption Expenditure (PCE) price index by 0.6% sent 10-year US Treasury yields to near 3.95%.

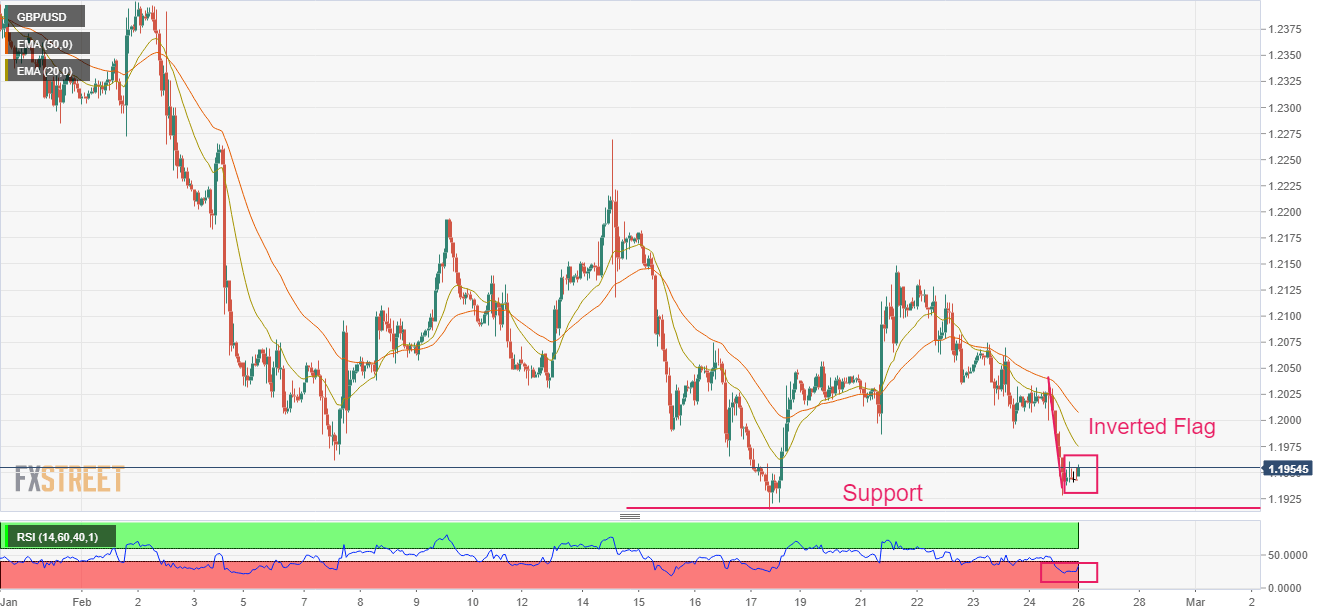

GBP/USD is auctioning in an Inverted Flag chart pattern on an hourly scale. The chart pattern indicates a sheer consolidation that is followed by a breakdown. Usually, the consolidation phase of the chart pattern serves as an inventory adjustment in which those participants initiate shorts, which prefer to enter an auction after the establishment of a bearish bias.

It is worth noting that the Inverted Flag is forming around the horizontal support plotted from February 17 low at 1.1915. An inventory adjustment near crucial support indicates that bulls US Dollar bulls are gathering strength to discover more losses.

Downward-sloping 20-and 50-period Exponential Moving Averages (EMAs) at 1.2007 and 1.975 respectively, add to the downside filters.

The Relative Strength Index (RSI) (14) is oscillating in the 20.00-40.00 range, which indicates that the downside momentum is active.

A confident break below February 17 low at 1.1915 will drag the Cable firmly towards January 5 low at 1.1875 followed by the round-level support at 1.1800.

On the contrary, a move above February 24 high at 1.2040 will drive the asset towards February 23 high around 1.2080. A breach of the latter will expose the asset to February 21 high of around 1.2140.

GBP/USD hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.