GBP/USD Price Analysis: Bulls set medium-term target on the 1.22 area

- GBP/USD bulls are in control with eyes on the 1.22 areas.

- The price is stalling on the bid on the short-term, however.

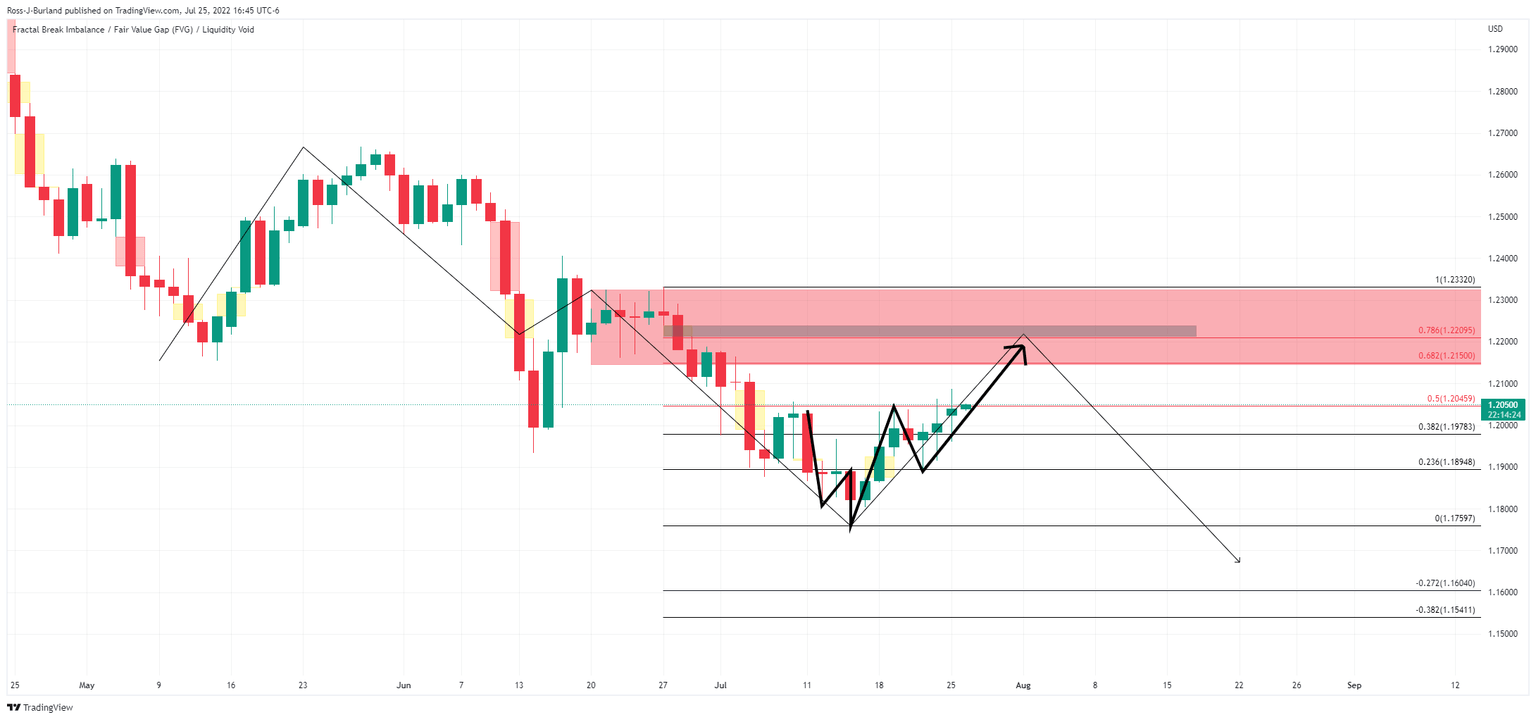

GBP/USD is offering mixed signals across the time frames, from bullish on the weekly to meanwhile bearish lower down on the 4-hour, but ultimately the bulls are in control. The following illustrates the prospects of a correction in the coming hours from which bulls might appear in droves for a continuation into the 1.22 areas.

GBP/USD weekly chart

The weekly chart's M-formation's neckline is a compelling target area for the bulls to aim for where it aligns with key Fibonaccis.

GBP/USD daily chart

Within the resistance area, there is a price imbalance on the daily chart which could lure the price in following the recent rally from the neckline of the W-formation.

GBP/USD H4 chart

The 4-hour chart has a price imbalance just below the recent lows as per the greyed-out area. A move into mitigating this where the 61.8% Fibo lies could be the next move on the cards before bulls fully engage.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.