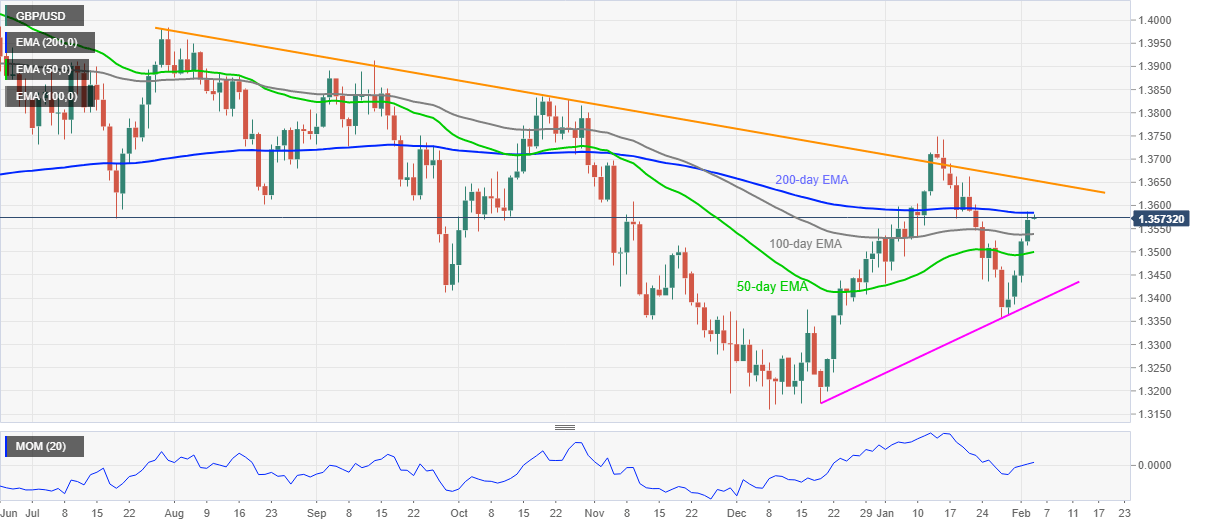

GBP/USD Price Analysis: Bulls flirt with 200-day EMA with eyes on BOE

- GBP/USD struggles to extend four-day uptrend around a two-week high.

- Bullish Momentum, sustained trading beyond 100-day, 50-day EMAs keep buyers hopeful.

- Six-week-old support line adds to the downside filters, descending trend line from July lures buyers.

- Bank of England Interest Rate Decision: Gilts are the crucial topic

GBP/USD seesaws around a fortnight high near 1.3575 as traders brace for the Bank of England (BOE) monetary policy decision during Thursday’s Asian session.

The cable pair rose during the last four consecutive days to cross the 100-day EMA and the 50-day EMA but is struggling to surpass the 200-day EMA ahead of the key event. However, the upbeat Momentum line and likely hawkish outcome from the BOE keep GBP/USD buyers hopeful.

That said, a clear upside break of the 200-day EMA level of 1.3585 becomes necessary for the pair buyers to aim for a descending resistance line from late July, around 1.3635 at the latest.

Following that, an upward trajectory towards the January high of 1.3748 can’t be ruled out. Though, October 2021 tops near 1.3835 may test the GBP/USD bulls afterward.

Meanwhile, pullback moves will initially test the 100-day EMA level of 1.3538 before revisiting the 50-day EMA surrounding 1.3500.

Even if the quote drops below 1.3500, an ascending trend line from late December 2021, close to 1.3390, will be in focus.

GBP/USD: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.