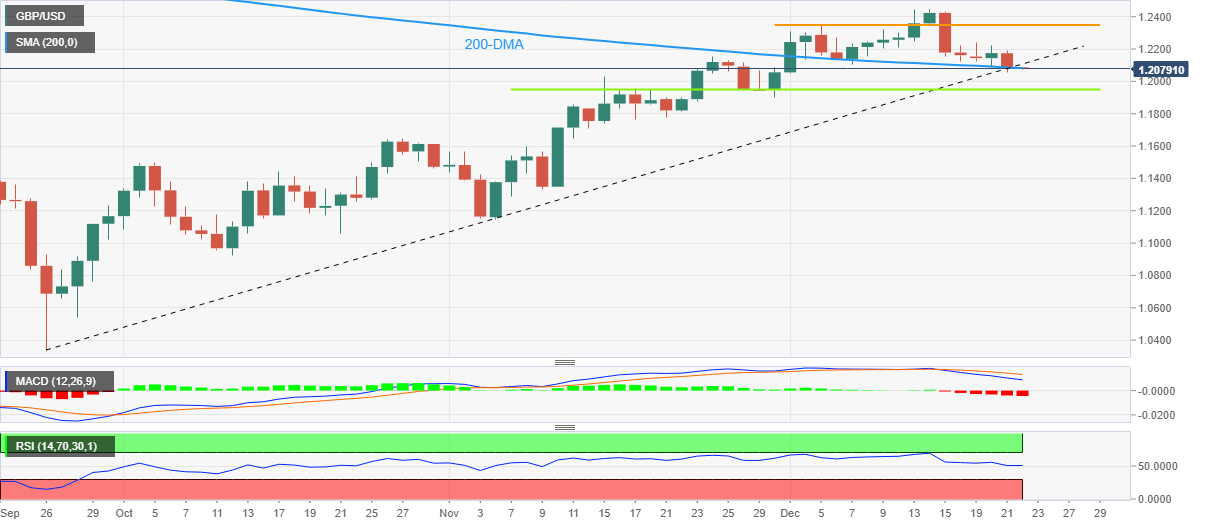

GBP/USD Price Analysis: 200-DMA probes bears ahead of UK/US GDP

- GBP/USD bears poke 200-DMA after breaking short-term key support line.

- Bearish MACD signals, steady RSI conditions keep sellers hopeful.

- Buyers remain off the table beyond 1.2350, monthly high adds to the upside filters.

GBP/USD bears struggle to keep the reins around 1.2080 during early Thursday, following a clear downside break of the three-month-old ascending support line, now resistance.

Even so, the bearish MACD signals join mostly steady RSI (14) to keep the sellers hopeful of breaking the 1.2080 immediate support, comprising the 200-DMA.

It’s worth noting that the 1.2000 psychological magnet acts as an immediate downside support for the Cable pair.

However, a horizontal area comprising multiple levels marked since mid-November, around 1.1950, could challenge the GBP/USD bears afterward.

In a case where the quote remains bearish past 1.1950, the odds of witnessing a south run towards October’s peak near 1.1640 can’t be ruled out.

Alternatively, recovery moves need to stay beyond the adjacent support-turned-resistance line, close to 1.2100 by the press time, to convince intraday buyers.

Following that, a gradual rise towards the 13-day-old horizontal region surrounding 1.2355-60 could gain the GBP/USD buyer’s attention. Also acting as an upside filter is the monthly high near 1.2445.

Overall, GBP/USD recently broke short-term key support and the oscillators are favorable to the pair sellers. However, sustained trading below the 200-DMA becomes necessary for the bears to keep the reins as Cable traders await the final readings of the US/UK Gross Domestic Product (GDP) for the third quarter (Q3).

GBP/USD: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.