GBP/USD pressured to key support despite a crucial drop in US yields

- GBP/USD is now pressured by bears at critical support.

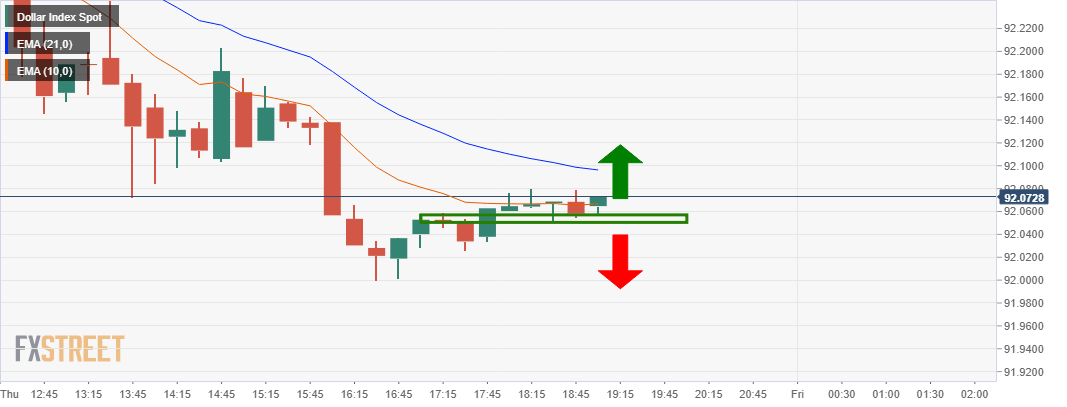

- DXY also meets a key support level on the daily chart.

At the time of writing, GBP/USD is trading at 1.3736 between a range of 1.3718 and 1.3782 and around flat on the day.

It is really more of a US dollar story than anything else on Thursday, with the markets soaking up the Federal Reserve's commitment for lower for longer rates.

In yesterday's Federal Open Market Committee minutes, various participants noted that changes in the path of policy should be based primarily on observed outcomes rather than forecasts.

This has given rise to a topping in US yields with the benchmark 10-year Treasury yield down by some 2.5% at the time of writing, off its lows of the day of 1.6280%.

Meanwhile, the US dollar traded near its lowest in more than two weeks versus major peers, tracking Treasury yields lower.

The dollar index DXY which measures the US currency against a basket of six currencies extended its losses to a low of 91.999 after dipping as low as 92.134 on Wednesday for the first time since March 23.

Technical analysis, GBP/USD & DXY

Technically, the DXY is now at critical support which has enabled cable to stabilize a bit on broad dollar weakness.

''Still, the break below $1.3765 sets up a test of the March 25 low near $1.3670,'' analysts at Brown Brothers Harriman argued.

''While cable remains hostage to broad movements in the dollar, it traded today at a new low for this move near $1.3720 and is on track to test the March low near $1.3670 and then the February low near $1.3565.''

GBP/USD daily chart

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.