GBP/USD plummets as BoE cut rates unanimously

- GBP/USD falls 0.93%, hitting a session low of 1.2359 after BoE's rate cut decision.

- BoE's dovish stance intensifies with forecasts of significant easing by the end of 2025, stirring market reactions.

- Contrast in Fed and BoE policies likely to favor USD strength.

The Pound Sterling (GBP) fell during Thursday’s North American session, down 0.79% after the Bank of England (BoE) reduced the Bank Rate by 25 basis points. Therefore, the GBP/USD pair tumbled below 1.2400 and hit a daily low of 1.2359. At the time of writing, the pair trades at 1.2405.

GBP/USD nosedives below 1.2400 following a surprising 25 basis point cut by the Bank of England

As expected, the BoE lowered rates to 4.50%, though surprisingly. Two members voted for a “larger size” rate cut, with Catherine Mann, one of the hawkish members, being one of them. Following the UK’s central bank decision, investors rushed to price 65 basis points (bps) of easing towards the end of 2025.

Additionally, the BoE updated its forecasts. The British economy is expected to grow by 0.75% and inflation to rise from 2.5% to 3.7%. BoE’s Governor Andrew Bailey said he hopes to be able to cut rates further, yet they would take their decisions “meeting by meeting.” He added that although headline inflation edged higher, he sees “continued gradual easing of underlying inflationary pressures.”

Across the pond, US Initial Jobless Claims missed the mark for the week ending February 1. The number of Americans filing for unemployment benefits rose by 219K, up from 208K the previous week, exceeding forecasts of 213K.

Given the backdrop, further GBP/USD downside is seen. The Federal Reserve (Fed) is expected to keep rates on hold while the BoE continues to ease policy. Therefore, the divergence amongst central banks might benefit the Greenback.

The UK economic docket will comprise BoE officials crossing the wires this week. In the US, Nonfarm Payrolls figures for January and Fed speakers could dictate the direction of GBP/USD.

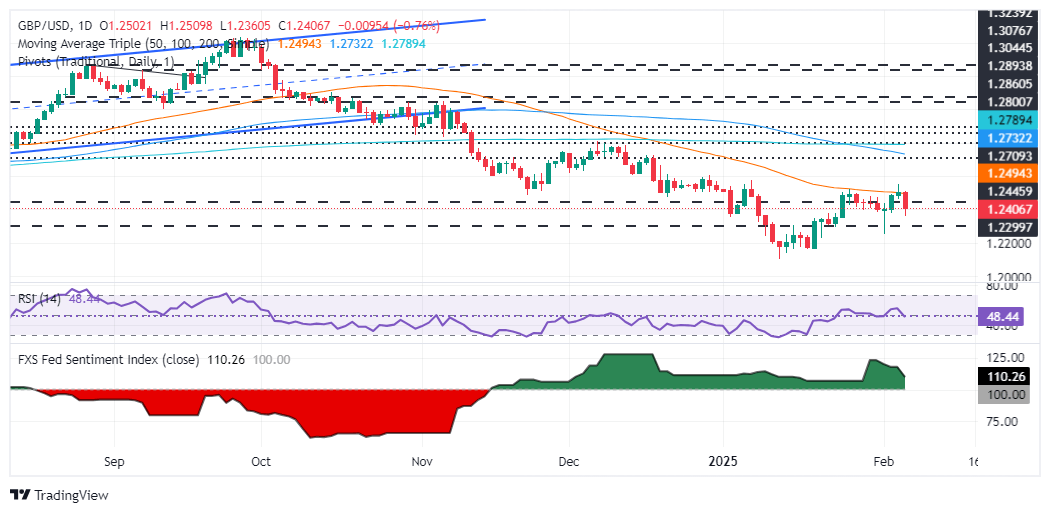

GBP/USD Price Forecast: Technical outlook

After the BoE’s decision, the GBP/USD pair hit a three-day low of 1.2359 before recovering some ground. Nevertheless, failure to clear the 50-day Simple Moving Average (SMA) of 1.2497 has opened the door for further downside. A daily close below 1.2400 would shift the trend downwards and pave the way for challenging the February 3 low of 1.2248.

On the other hand, if GBP/USD stays above 1.2400, buyers must clear the 50-day SMA to test the 1.2500 mark in the near term.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.34% | 0.77% | -0.46% | 0.18% | 0.33% | 0.52% | 0.46% | |

| EUR | -0.34% | 0.43% | -0.80% | -0.16% | -0.01% | 0.18% | 0.10% | |

| GBP | -0.77% | -0.43% | -1.24% | -0.59% | -0.44% | -0.24% | -0.31% | |

| JPY | 0.46% | 0.80% | 1.24% | 0.65% | 0.81% | 0.96% | 0.93% | |

| CAD | -0.18% | 0.16% | 0.59% | -0.65% | 0.16% | 0.34% | 0.29% | |

| AUD | -0.33% | 0.01% | 0.44% | -0.81% | -0.16% | 0.19% | 0.11% | |

| NZD | -0.52% | -0.18% | 0.24% | -0.96% | -0.34% | -0.19% | -0.06% | |

| CHF | -0.46% | -0.10% | 0.31% | -0.93% | -0.29% | -0.11% | 0.06% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.