GBP/USD pauses rally as traders eye Fed, BoE’s decisions

- US Treasury Secretary to meet Chinese Vice Premier in Switzerland, lifting market sentiment.

- Fed is expected to hold rates steady; markets price first cut in July with two more by year-end.

- UK-India trade pact finalized; speculation grows over a potential UK-US agreement amid global tariff shifts.

The Pound Sterling (GBP) retreated after posting back-to-back days of gains versus the US Dollar (USD). Still, positive news related to a possible de-escalation of the China-US tensions lent a lifeline to the Greenback, which remains firm in early trading. At the time of writing, GBP/USD trades at 1.3360, virtually unchanged.

GBP/USD holds near 1.3360 as easing US-China tensions lift Dollar ahead of Fed decision and BoE meeting

Risk appetite improved in hopes of easing tensions between Beijing and Washington. The US Treasury Secretary Scott Bessent said that he would meet a Chinese delegation led by Vice Premier He Lifeng in Switzerland this weekend.

The trader’s focus shifted to the US Federal Reserve (Fed) monetary policy decision at 18:00 GMT. Before the meeting, policymakers expressed that the policy is appropriate to balance the central bank’s dual mandate. The swaps markets so far had priced in the first 25 basis points (bps) interest rate cut for the July meeting, and they expect two additional reductions towards the end of the year.

Across the pond, news emerged on Tuesday that the UK and India had agreed to a free trade pact, spurred by US President Donald Trump's enactment of tariffs worldwide.

Analysts suggested that a trade deal between the US and the UK could be announced soon.

Aside from this, investors are watching the Bank of England's (BoE) monetary policy decision on Thursday. The markets had priced in 94 bps of easing, including 25 bps on Thursday.

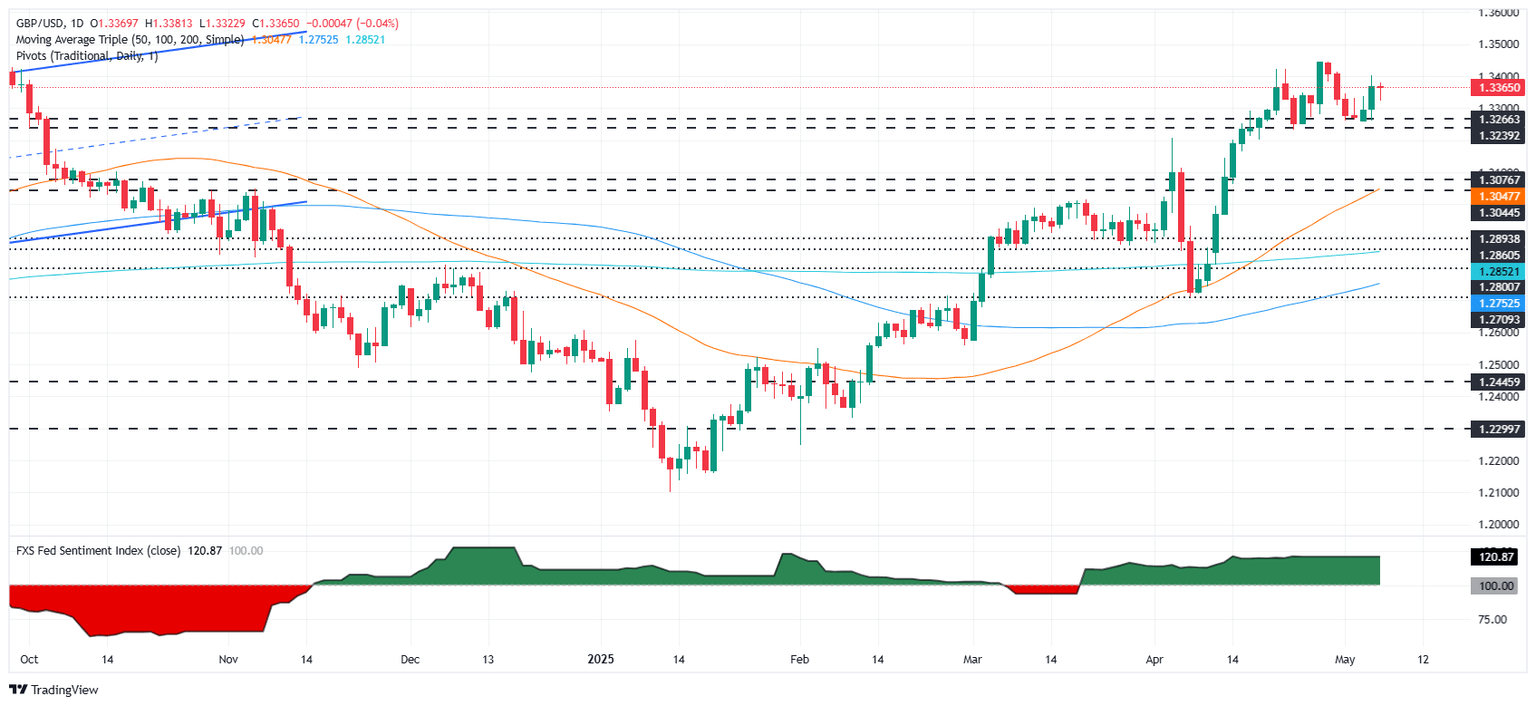

GBP/USD Price Forecast: Technical outlook

From a technical perspective, the GBP/USD pair consolidated within the 1.3320 – 1.3400 range for the last five trading days amid the lack of a catalyst that could trigger a move outside that area. A hawkish hold by the Fed could drive the pair toward the low 1.33 and pave the way for a breakout below the latter.

In that outcome, GBP/USD could test the April 23 daily low of 1.3233 ahead of 1.3200. On further weakness, prices could drop all the way toward the 50-day Simple Moving Average (SMA) at 1.3044.

Conversely, if GBP/USD climbs past 1.3400, buyers could test the year-to-date (YTD) high at 1.3443, followed by 1.3450. Once these levels are breached, the next resistance will be 1.3500.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.27% | -0.75% | -0.99% | -0.15% | -0.13% | -0.50% | -0.61% | |

| EUR | 0.27% | -0.22% | -0.47% | 0.39% | 0.40% | 0.04% | -0.08% | |

| GBP | 0.75% | 0.22% | -0.46% | 0.60% | 0.61% | 0.25% | 0.14% | |

| JPY | 0.99% | 0.47% | 0.46% | 0.85% | 0.87% | 0.58% | 0.50% | |

| CAD | 0.15% | -0.39% | -0.60% | -0.85% | -0.28% | -0.36% | -0.46% | |

| AUD | 0.13% | -0.40% | -0.61% | -0.87% | 0.28% | -0.36% | -0.47% | |

| NZD | 0.50% | -0.04% | -0.25% | -0.58% | 0.36% | 0.36% | -0.12% | |

| CHF | 0.61% | 0.08% | -0.14% | -0.50% | 0.46% | 0.47% | 0.12% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.