GBP/USD finds higher ground on Tuesday, steps over 1.2700

- GBP/USD climbs over 1.2700 on Tuesday.

- US PMI, Factory Orders misses push down Greenback.

- US politics to dominate headlines on Super Tuesday.

GBP/USD gained ground on Tuesday, marking in an intraday high of 1.2735 after the US ISM Services Purchasing Managers Index (PMI) and Factory Orders both missed expectations. The US Dollar (USD) softened on reaction, but market sentiment is hanging in the midrange as markets gear up for two showings from Federal Reserve (Fed) Chairman Jerome Powell this week.

US politics are also on the cards as Super Tuesday gets underway. The US Republican Party is broadly expected to select Donald Trump as the nominee for the party’s ballot in the upcoming US federal election in November.

The UK’s BRC Like-For-Like Retail Sales for the year ended February entirely missed expectations, printing at an even 1.0% early Tuesday, flubbing the forecast increase 1.6% from the previous period’s 1.4%. The US ISM Services PMI for February fell more than expected, printing at 52.6 versus the forecast 53.0 and the previous 53.4.

Fed chair Powell will be appearing twice this week, on both Wednesday and Thursday as the head of the US central bank testifies about the Fed’s Semi-Annual Monetary Policy Report to the US government’s House Financial Services Committee. Headlines are expected throughout both days as the Fed chairman answers policymaker questions about the US economy and the Fed’s outlook.

US labor figures are also due to make a splash this week. ADP Employment Change figures are due Wednesday and forecast to increase to 150K from the previous 107K, and Friday’s US Nonfarm Payrolls (NFP) is expected to decline to 200K from the previous 353K, and revisions to previous prints are expected.

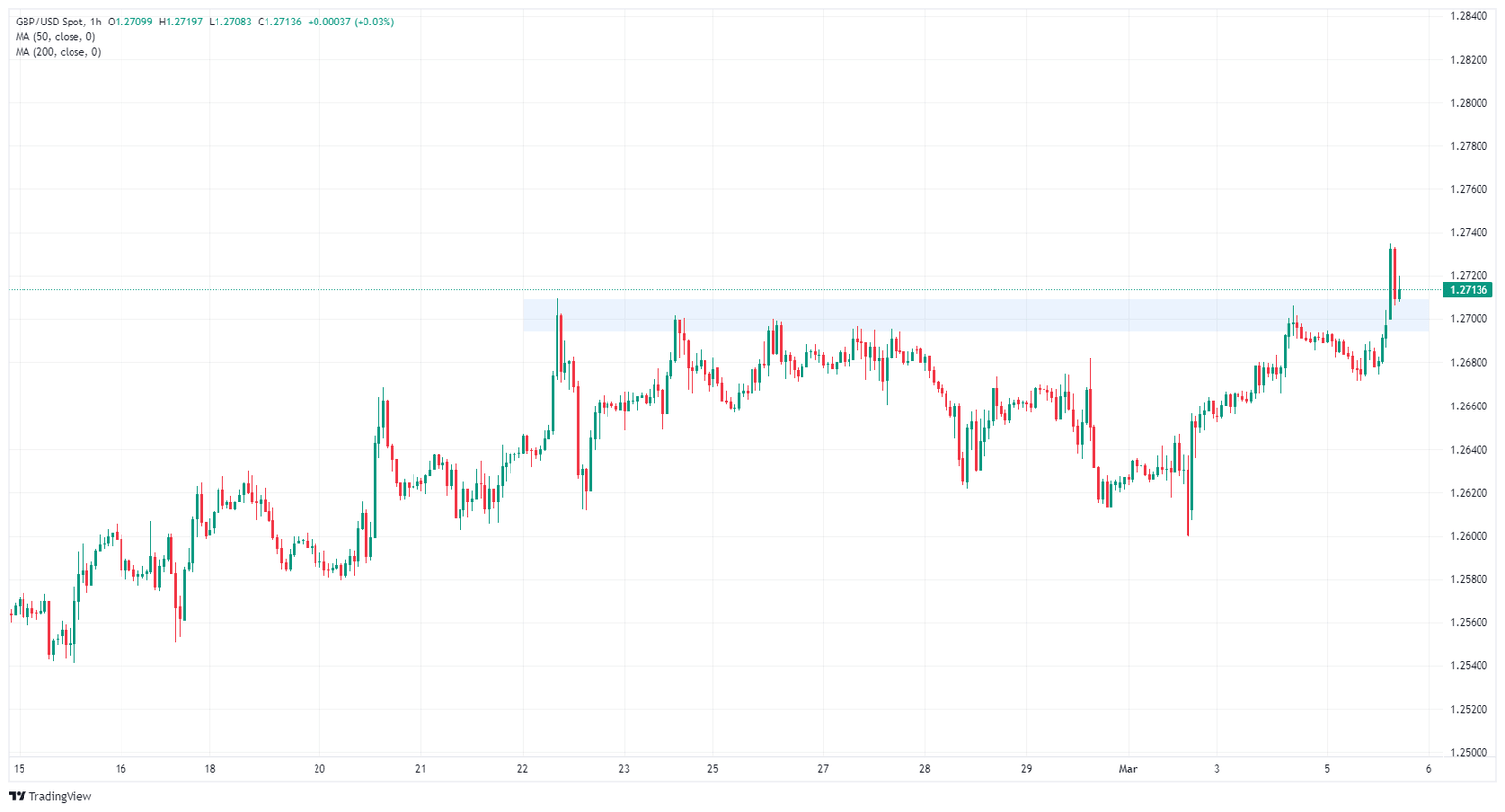

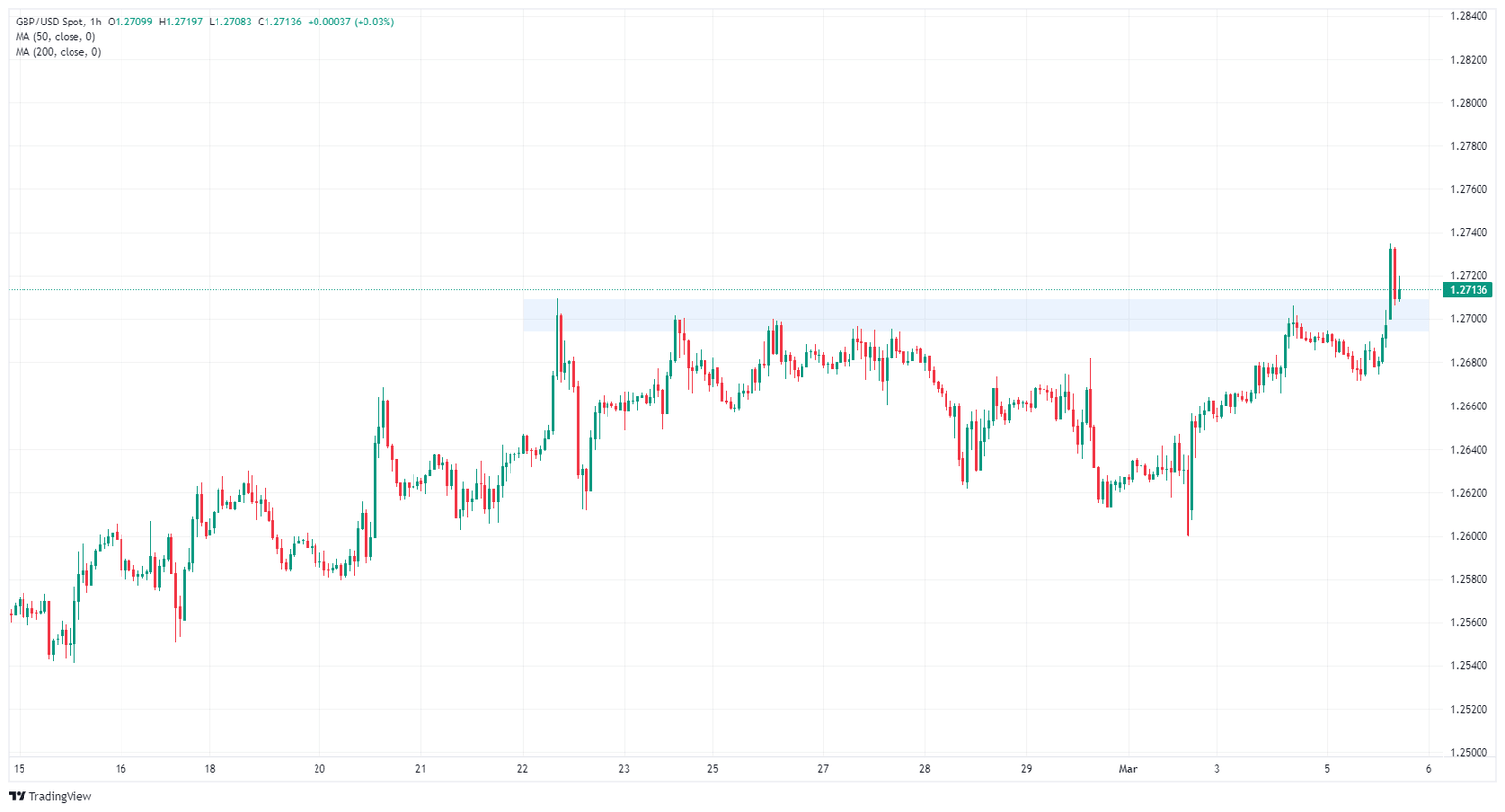

GBPUSD tests higher, but topside limited near 1.2700

GBP/USD rose through Tuesday’s trading, testing north of 1.2700 but mixed market sentiment is keeping the pair close to key levels as momentum remains limited. The pair broke through a key resistance layer, and a pullback could see bullish momentum extend as long as declines remain limited to the 1.2700 region.

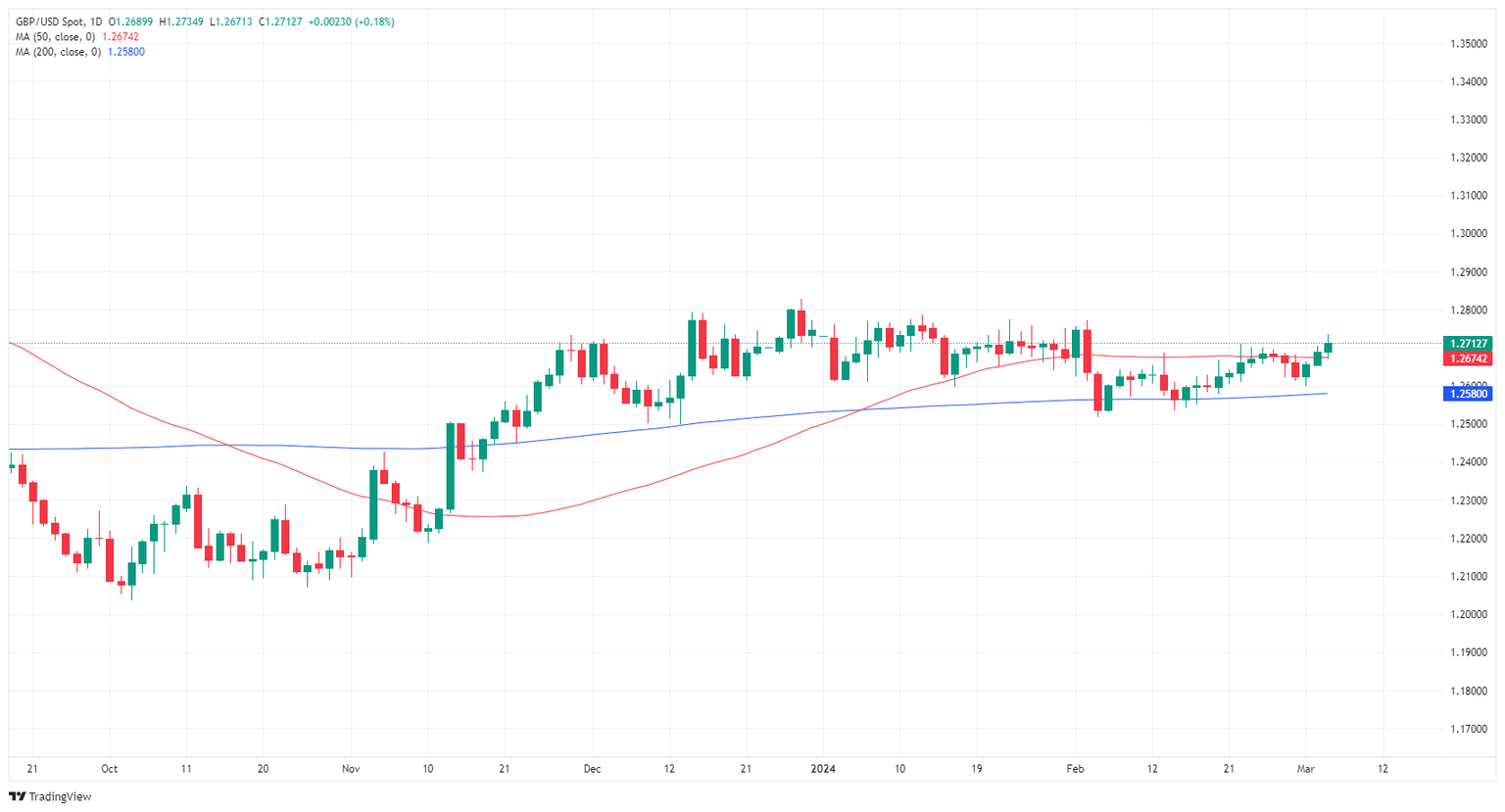

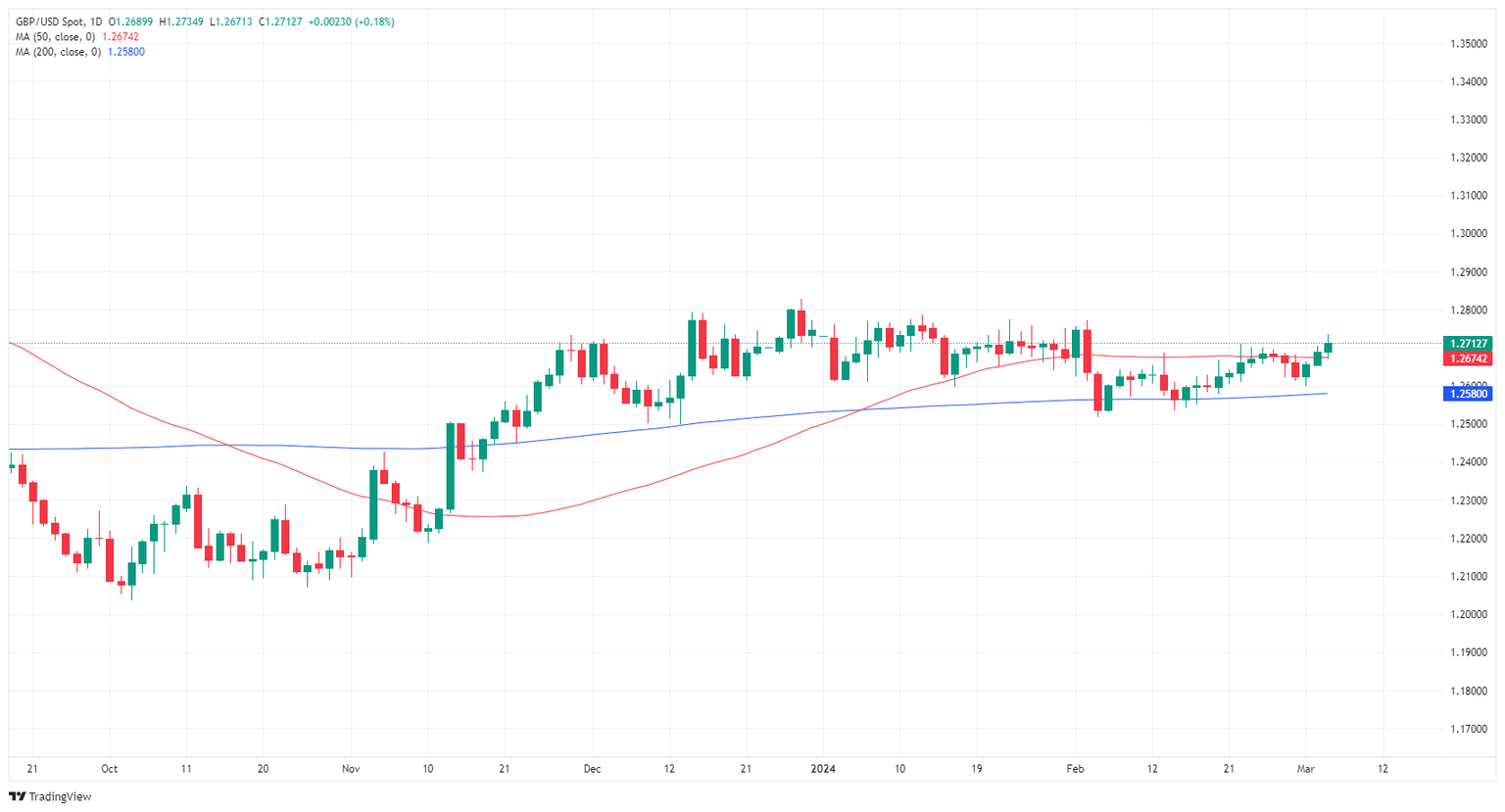

Plenty of longer-term technical resistance is baked into daily candlesticks. 1.2800 remains a key level for bulls to beat, and the 200-day Simple Moving Average (SMA) continues to grind slowly higher, reaching 1.2580.

GBP/USD hourly chart

GBP/USD daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.