GBP/USD drops hard to fresh session lows following a hot Nonfarm Payrolls report, doubling market expectations

- NFP beats market expectations and sends the US dollar higher.

- GBP/USD bulls pushed back to the London open and session lows.

On the back of the US Nonfarm Payrolls that have come in at the hotter end of expectations, the US dollar has rallied, weighing heavily on its peers, including sterling.

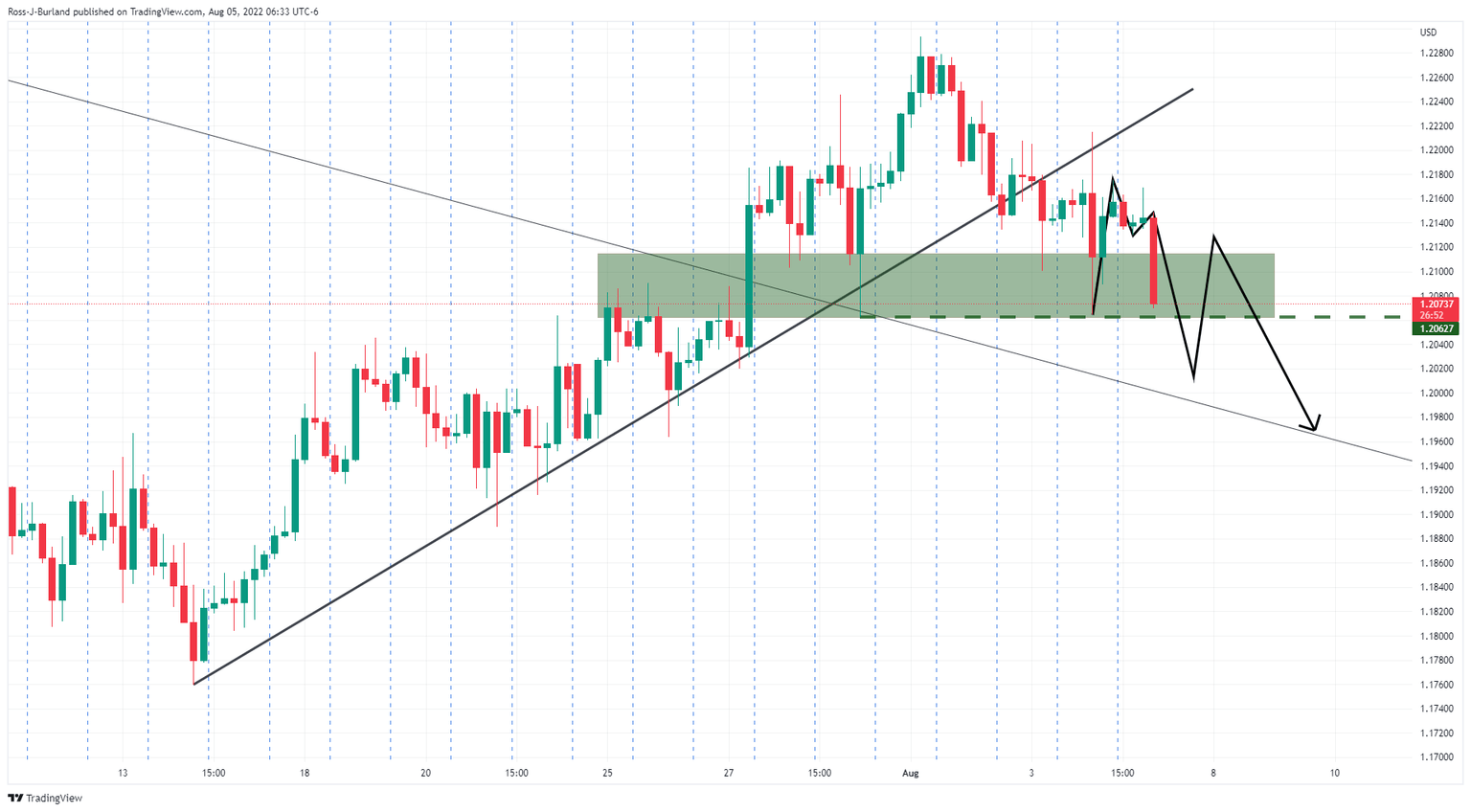

GBP/USD has dropped to test the lows of the day on the knee-jerk. GBP/USD had been trading within a 45 pip box during the London morning between 1.2170 and 1.2125 ahead of the data, setting a meanwhile range for the day ahead, but bears are penetrating this box to the downside with a potential bearish breakout below 1.2050 now on the cards.

NFP doubles market expectations

Nonfarm Payrolls in the US rose by 528,000 in July, the data published by the US Bureau of Labor Statistics revealed on Friday. This reading followed June's increase of 398,000 (revised from 372,000) and came in better than the market expectation of 250,000. The Unemployment Rate edged lower to 3.5%.

Further details of the publication revealed that the annual wage inflation, as measured by the Average Hourly Earnings, remained unchanged at 5.2%, compared to analysts' estimate of 4.9%. Finally, the Labor Force Participation Rate declined to 62.1% from 62.2%.

Investors had been in anticipation of the report for further hints of how the US economy is faring. The jobs report is a relief for the greenback when taking into consideration the data on Thursday showed that the number of Americans filing new claims for unemployment benefits increased last week. However, the data now raises the prospects of a 75 bp hike from the Federal Reserve, which is not going to be favourable for risk sentiment nor the pound. The odds of a 75 bps hike have leaped to 61% from 40% on the release.

The data coincides with a stark warning from the Bank of England earlier this week, which raised rates by the most in 27 years to fight surging inflation in a dovish 50 bp hike to 1.75%. The central bank followed up by saying that a long recession was coming, beginning in the fourth quarter of this year, highlighting the bleak outlook for the UK economy and the pound.

"The central bank clearly believes a deep recession is not only inevitable but also necessary to bring down inflation. This will put it on a collision course with 10 Downing Street,'' analysts at Rabobank said.

US dollar rallies on NFP

Meanwhile, ahead of the jobs data, the US dollar edged higher on Friday in a correction of some of the sharpest daily drop in more than two weeks, sliding 0.68% on Thursday, the largest fall since July 19. The US dollar index (DXY), which measures the greenback against a basket of currencies, was up 0.15% to 105.90 just ahead of the data release, a touch below the day's high of 106.00. While the data is being digested, the index is rallying to a high of 106.5510 so far, now up over 0.68% on the day so far.

GBP/USD technical analysis

The price has moved out of a 4-hour rising channel with 1.2063 as a potentially key level on the downside. A break there could open the avenue for a significant sell-off in the coming week with 1.1950 daily trendline support eyed:

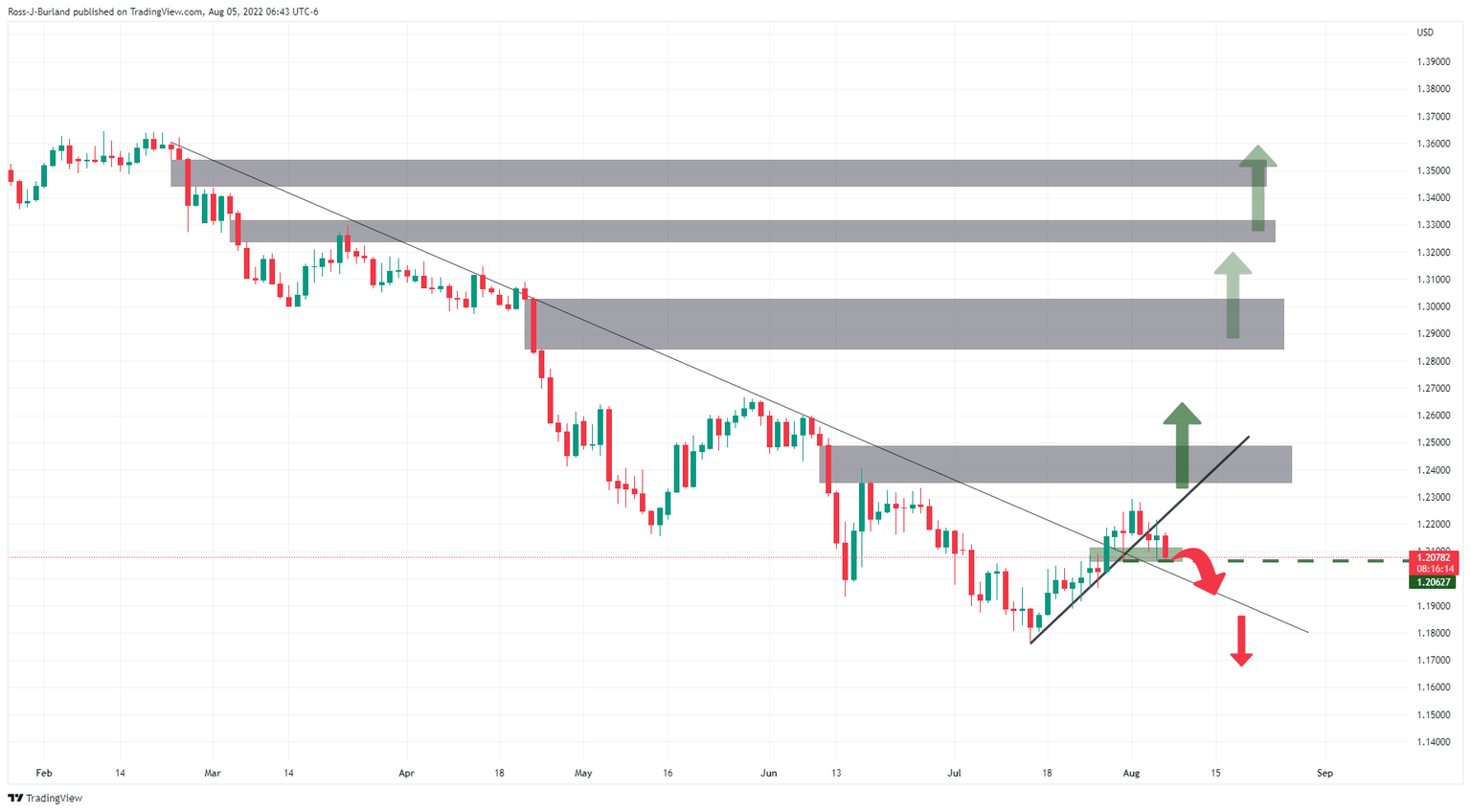

GBP/USD daily chart

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.