GBP/USD dips from 1.3770 high as US PCE, sentiment data lift Dollar

- GBP/USD retreats to 1.3700 after Core PCE rises 2.7% YoY, slightly above expectations.

- US Consumer Sentiment improves in June; long-term inflation expectations revised lower.

- Trade deal progress with China and EU adds tailwind to Dollar amid month-end flows.

The GBP/USD retreats by over 0.10% after hitting a near four-year high of 1.3770 on Thursday, dipping to 1.3700 as the US Dollar recovers some ground following the release of the US Core Personal Consumption Expenditures (PCE) Price Index for May. This, along with an improvement in Consumer sentiment among US households, provides a lifeline to the buck.

Sterling eases after near 4-year high as firmer US inflation and upbeat consumer sentiment support Greenback rebound

Market mood remains upbeat, as Core PCE in May rose by 2.7% YoY, a tenth above estimates and April’s data. Headline inflation for the same period increased by 2.3% YoY as expected.

Recently, the University of Michigan (UoM) revealed that Consumer Sentiment in June improved moderately. The Index rose from 60.5 to 60.7, while inflation expectations were downwardly revised, with households expecting prices to rise from 5.1% to 5% over the next year. For the next five years, inflation is projected to be around 4%, down from 4.1%.

Aside from this, trade news revealed by the US Commerce Secretary Lutnick said that the US and China finalized a trade deal two days ago and added that more deals are about to be closed. Bloomberg revealed that the European Union and the US could clinch a trade agreement before the July 9 deadline.

Sterling's uptrend has continued as the US Dollar remains battered. The US Dollar Index (DXY), which tracks the buck’s performance against a basket of six currencies, is down 0.07% at 97.28. Although month-end flows usually favor the Greenback, Barclays mentioned that it could weaken towards the end of June.

In the UK, dockets were scarce. However, most analysts are examining Prime Minister Keir Starmer's fiscal budget, which, according to Rabobank, is described as “the overhang of a huge debt/GDP ratio and a UK current account deficit.”

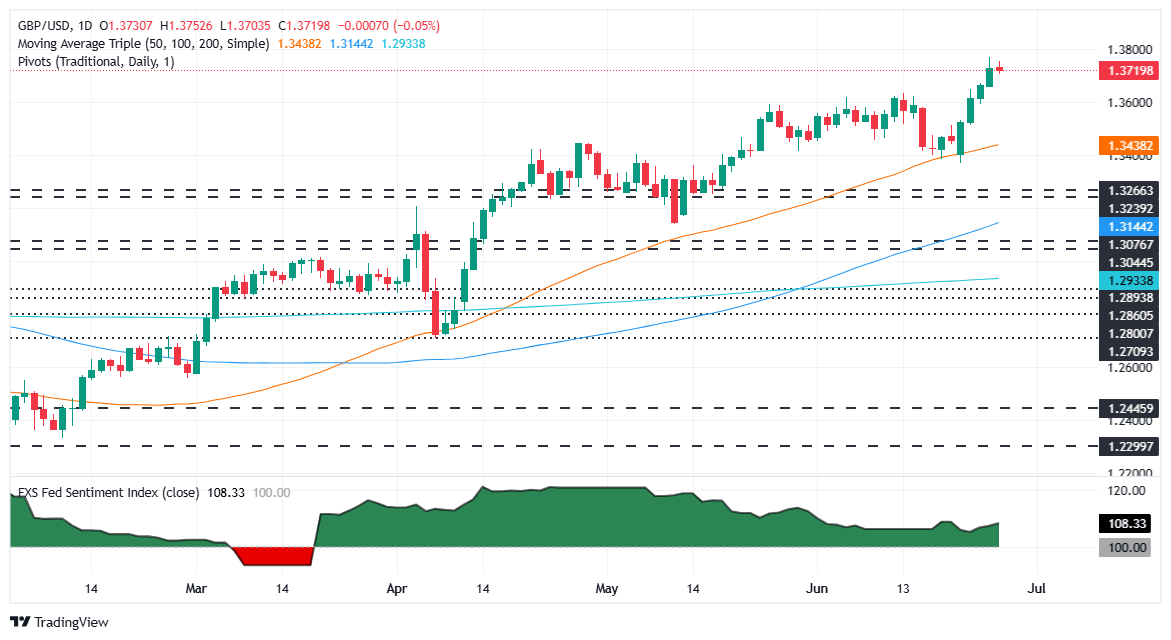

GBP/USD Price Forecast: Technical Outlook

The GBP/USD upward bias remains intact, but buyers appear to be losing some momentum after reaching multi-year highs near 1.3770. However, momentum as portrayed by the Relative Strength Index (RSI) hints that bulls could test the 1.3800 figure in the near term.

On the other hand, if GBP/USD tumbles below 1.3700, expect a drop towards 1.3600, with further downside seen beneath the 20-day Simple Moving Average (SMA) at 1.3561. If surpassed, the next stop would be the June 24 low of 1.3510.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -2.25% | -2.29% | -1.39% | -0.72% | -1.61% | -1.88% | -2.29% | |

| EUR | 2.25% | -0.06% | 0.93% | 1.58% | 0.62% | 0.39% | -0.07% | |

| GBP | 2.29% | 0.06% | 1.05% | 1.65% | 0.68% | 0.45% | -0.01% | |

| JPY | 1.39% | -0.93% | -1.05% | 0.65% | -0.27% | -0.46% | -1.01% | |

| CAD | 0.72% | -1.58% | -1.65% | -0.65% | -0.86% | -1.17% | -1.62% | |

| AUD | 1.61% | -0.62% | -0.68% | 0.27% | 0.86% | -0.25% | -0.69% | |

| NZD | 1.88% | -0.39% | -0.45% | 0.46% | 1.17% | 0.25% | -0.45% | |

| CHF | 2.29% | 0.07% | 0.01% | 1.01% | 1.62% | 0.69% | 0.45% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.