GBP/USD continues to climb as trade deal hopes fuel Greenback declines

- GBP/USD stepped into a third straight day of gains on Wednesday, knocking on 1.3600.

- Hopes for last-minute trade deals to avert hefty tariffs are kicking investor sentiment higher.

- As traders bank on another tariff threat walkback, the Greenback is taking a fresh beating.

GBP/USD climbed on Wednesday, posting strong gains for a third straight day and clawing back toward the 1.3600 handle. The US Dollar (USD) is taking a beating across the board, driven higher by broad-market expectations of last-minute trade deals between the Trump administration and everybody else before the August 1 “reciprocal” tariff deadline. Greenback selling pressure across the FX space gave the Pound Sterling (GBP) a leg up, bolstering cable action further into the bullish side.

The US has a tentative trade agreement on the board with Japan, which would include a 15% reciprocal tariff on all Japanese goods, and the Trump administration may have made it harder, not easier, for foreign companies, at least those based in Japan, to move their production chains into the US. Rumors abound of another possible trade deal in the works with the European Union (EU), but key personnel within the Trump team have splashed cold water on those rumors, branding them speculation.

A double-header Purchasing Managers Index (PMI) print is on the docket for Thursday. United Kingdom (UK) and US PMI figures in both the Manufacturing and Services components are expected to tick higher in June.

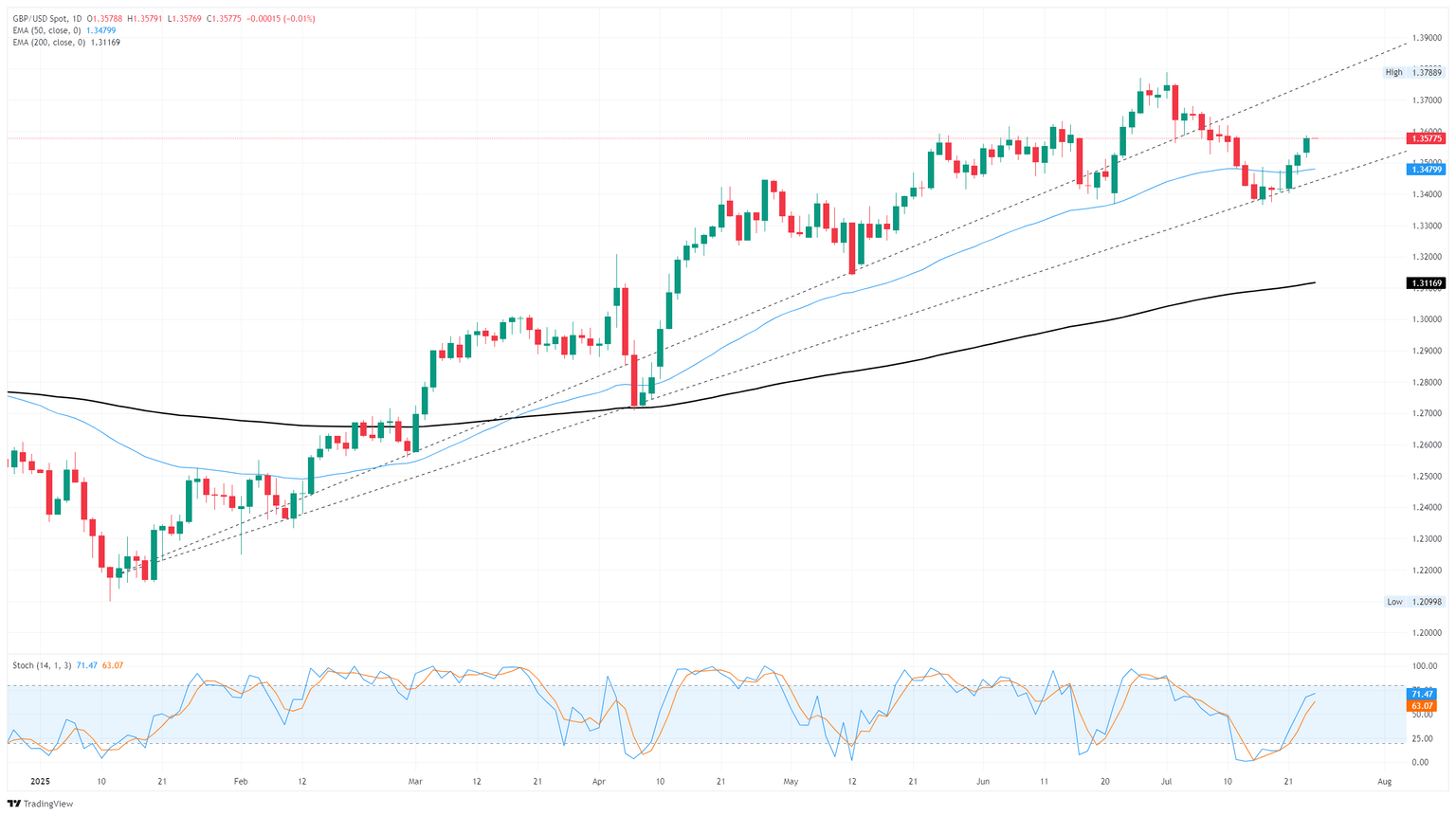

GBP/USD price forecast

GBP/USD continues to grind its way into a firm uptrend, however Cable needs to clear the 20-day SMA at 1.3564. Momentum indicates that buyers are gathering steam as depicted by the Relative Strength Index (RSI).

If Pound bidders are able to muscle GBP/USD back over the 20-day SMA, the next resistance would be the 1.3600 figure. A breach of the latter will expose the 1.3650 mark, followed by 1.3700. Conversely, if GBP/USD drops below the 50-day SMA at 1.3520, the next support would be 1.3500. Further demand levels lie underneath, with the 1.3402 July 21 daily low.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.