GBP/USD bulls are guarding 1.1950 and eye 1.22s

- GBP/USD bulls have stepped in at the open.

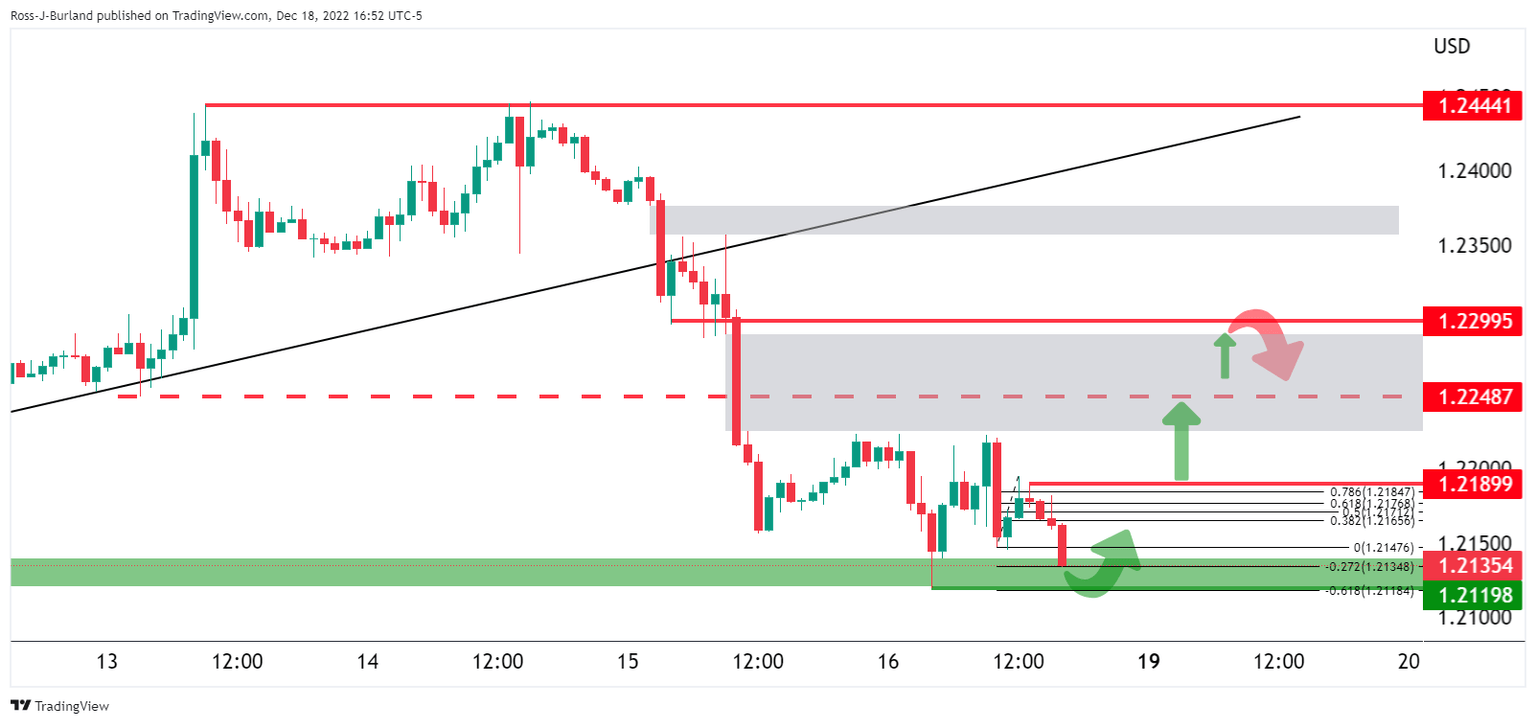

- Bulls look to the 1.2220s and 1.2300 which could be up for mitigation.

GBP/USD is moving higher in the open, up some 0.2% having popped from a low of 1.2135 and reaching 1.2159 so far on the day. Markets are backing the greenback, however, as risk appetite sours into the final weeks of the year while investors fret over the prospect that borrowing costs still have a long way to climb following a slew of hawkish rate hikes.

The Bank of England (BoE) hiked the Bank Rate by 50bp to 3.50% with 6 members voting for a 50bp hike, one member voting for 75bp and two members voting for keeping the Bank Rate unchanged. There was no news in regards to QT-communication as outright selling of government bonds commenced on 1 November.

However, analysts at Danske Bank expect the BoE to deliver a final 25bp hike in February. ''Our expectations fall below current market pricing (currently 100bps until August 2023) as we expect the rest of the BoE committee to eventually turn less hawkish amid a weakening growth backdrop and easing labour market conditions.''

GBP/USD technical analysis

Meanwhile, at a critical support structure and should the bulls move in, the price imbalance between the 1.2220s and 1.2300 could be up for mitigation.

Zoomed in:

If the bears commit, then the thesis will be that the highs are locked in and the focus will be on a downside continuation towards 1.2000.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.