GBP/USD attempts a bounce amid firmer USD, bearish bias intact below 50-DMA

- The cable remains at the mercy of the US dollar dynamics.

- The UK’s easing of the covid restrictions fails to inspire GBP bulls.

- Daily chart suggests that the downside appears more compelling.

GBP/USD remains offered below 1.3800, although attempts a bounce from near 1.3750 support amid persisting upbeat mood around the US dollar.

Markets remain unnerved, thanks to the massive fund liquidation, benefiting the safe-haven appeal of the greenback. Archegos Capital, a hedge fund that had significant positions in CBS/Viacom among other firms, was forced to liquidate late on Friday, in response to the margin calls.

On the GBP-side of the story, the bulls ignore easing of the covid restrictions in the UK and higher vaccination rates when compared to those of the European Union (EU). The sell-off in oil prices is likely to weigh on the commodity-heavy UK’s FTSE 100 index, which in turn could exert additional pressure on the pound.

Markets now look forward to the broader market sentiment and the US dollar price action for fresh trading cues, as the data docket remains scarce heading into the NFP week.

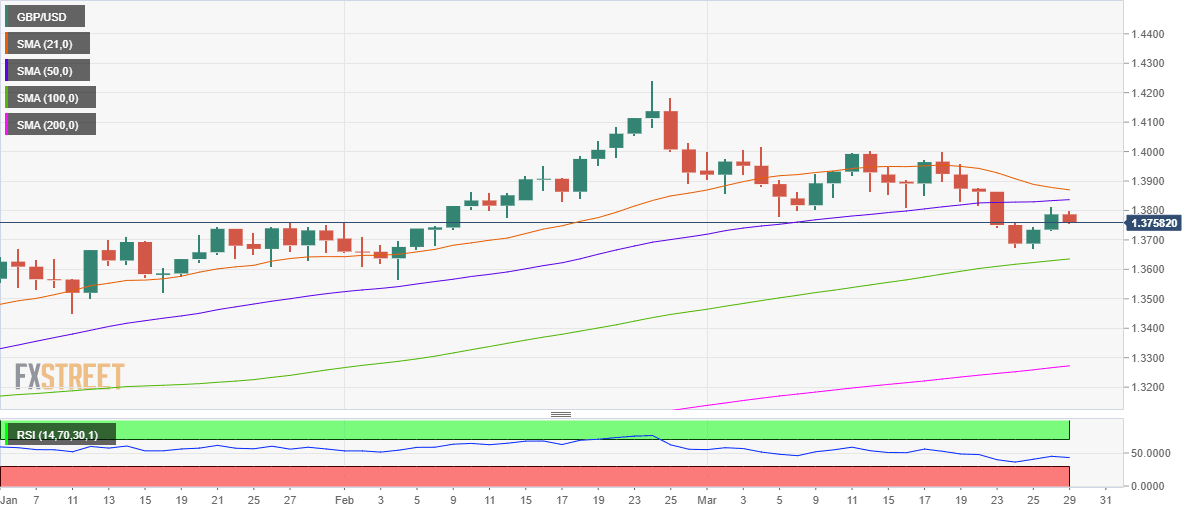

GBP/USD: Technical Outlook

From a near-term technical perspective, GBP/USD’s path of least resistance appears to the downside.

The spot remains trapped between the 50-daily moving average (DMA) and 100-DMA for the fifth straight day on Monday.

The 14-day Relative Strength Index (RSI) edges lower below the midline, currently at 43.07, suggesting that the bears could eye deeper losses.

Therefore, a test of the upward-sloping 100-DMA support at 1.3635 could be in the offing.

Meanwhile, acceptance above the 50-DMA at 1.3836 is needed to reverse the ongoing downside momentum.

GBP/USD: Daily chart

GBP/USD: Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.