GBP/USD approaches 1.2300 as USD Index bulls loose grip ahead of UK/US PMIs

- GBP/USD is looking to recapture the 1.2300 resistance as the USD index has lost its upside momentum.

- Federal Reserve would continue to weigh on US inflation by keeping rates higher for a longer period.

- Bank of England would hike rates further if evidence claims persistent inflation.

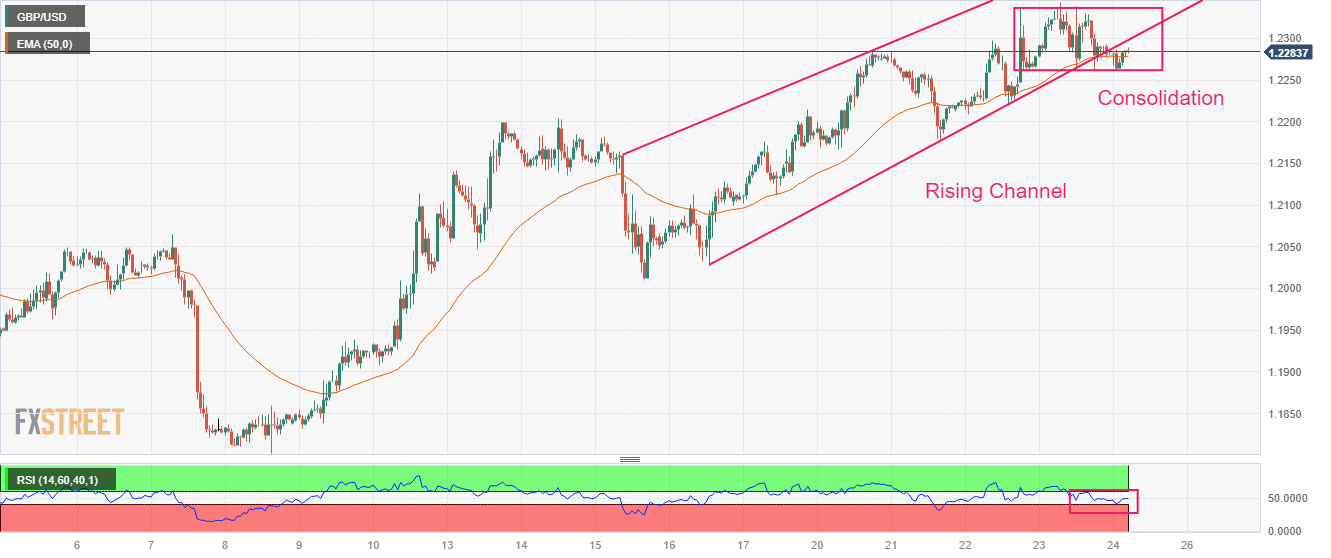

- GBP/USD has slipped out of the Rising Channel but has not weakened yet.

GBP/USD has attempted a recovery after dropping to near 1.2260 in the early European session. The recovery move in Cable is backed by a loss of upside momentum in the US Dollar Index (DXY). The Cable remained topsy-turvy after the interest rate decision by the Bank of England (BoE).

The Pound Sterling was heavily volatile on Thursday after Bank of England Governor Andrew Bailey delivered a promise of rapid inflation softening from the second quarter with 25 basis points (bps) interest rate hike and dovish interest rate guidance.

The USD Index is demonstrating exhaustion after a decent rally to near 102.68. The mighty US Dollar is sensing the heat as investors are anticipating that the United States inflation has entered into an Armageddon, and qualitative and quantitative tools against Consumer Price Index (CPI) would be extremely sharpened.

S&P500 futures have generated mild gains in the Asian session after a solid recovery on Thursday as investors have cheered signs of policy-tightening termination by the Federal Reserve (Fed) amid banking woes. Two-year US Treasury yields that closely follow the US equities benchmark have dropped below. 3.8%. Also, 10-year yields have dropped below 3.39%, which indicates a sheer improvement in the demand for US government bonds.

Also, commentary from US Treasury Secretary Janet Yellen for widening the insurance blanket for deposits has infused some confidence among market participants. The US Secretary Yellen cited that the government is ‘prepared for additional deposits actions if warranted’.

Major central banks are saying no to further rate hikes

The street has started making long-term bearish bets for the US Dollar as Federal Reserve chair Jerome Powell delivered signs of concluding the year-long rate-hiking spree to avoid any further mess in the banking crisis. Also, rates have reached a point where room for further escalation is less. Like the Federal Reserve, other central banks are also eyeing a pause in the rate-hiking cycle such as the Bank of England, and the Reserve Bank of Australia (RBA). Above all, the Bank of Canada (BoC) has already paused its policy-tightening cycle, citing that current monetary policy is restrictive enough to tame price pressures. So, it would not be justified to corner the US Dollar for concluding the tightening spell.

US Inflation to be hammered by Fed rates and banks' credit tightening

The US inflation has been in a declining trend for the past few months as the Federal Reserve has pushed rates significantly to 4.75-5.00% after eight consecutive rate hikes. Room for further rate hikes looks small as Federal Reserve Powell has confirmed only one rate hike for now but a big no to consideration of rate cuts this year. Therefore, higher rates for a longer period by the Federal Reserve would continue to weigh on inflationary pressures.

Apart from that, US banks are likely to be more precautionary while disbursing loans to households and businesses, which would impact the overall demand, inflation, and the scale of economic activities.

Bank of England would consider more hikes if inflation remains persistent

Bank of England Bailey went for an eleventh consecutive rate hike on Thursday despite global banking shakedown. Out of the seven-member team, Monetary Policy Committee (MPC) members Swati Dhingra and Silvana Tenreyro voted for an unchanged monetary policy while others favored a 25bp rate hike.

About the surprise jump in February’s inflation, the Bank of England said that the surprise jump in the price index was the outcome of volatile clothing prices, which could prove less persistent. The central bank is very much confident that inflation will start decelerating rapidly from the second quarter. However, the labor shortage and higher food prices might continue to keep inflation at elevated levels.

Analysts at Danske Bank consider that both growth and domestic inflation have surprised to the upside and given BoE’s message, they pencil in an additional 25 bps hike in May 2023.

On Friday, a decent action is expected from the Cable as preliminary S&P Global PMI (March) figures for the US and the UK will be released. The Manufacturing PMI is expected to trim to 47.0 from the former release of 47.3. And, Service PMI might soften to 50.5 from the prior release of 50.6.

As per the consensus, UK Manufacturing PMI would improve to 49.8 from the former release of 49.3. While Services PMI will drop to 53.0 vs. the prior figure of 53.5.

GBP/USD technical outlook

GBP/USD is oscillating in a narrow range of 1.2262-1.2336 on an hourly scale after failing to extend recovery further. The Cable is slipped out of the Rising Channel chart pattern but has not weakened yet as the 50-period Exponential Moving Average (EMA) at 1.2278 is still supporting the Pound Sterling.

Meanwhile, the Relative Strength Index (RSI) (14) has found a cushion near 40.00.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.