GBP/JPY snaps losing streak as Yen weakens across the board

- The British Pound rises nearly 1% against the Japanese Yen, snapping a three-day losing streak.

- The Japanese Yen weakens across the board, with all major G10 currencies posting gains against it.

- The 20-day SMA near 196.62 provides dynamic support, with the broader uptrend intact above 195.00.

The British Pound (GBP) gains ground against the Japanese Yen (JPY) on Thursday, supported by stronger-than-expected US Non-Farm Payrolls (NFP) data, which lifted global risk sentiment and weighed on traditional safe-haven currency.

The GBP/JPY cross snaps a three-day losing streak and surges nearly 1% on the day. The pair has now erased all the losses incurred earlier in the week, currently hovering around the 198.00 mark during the American trading session.

The broad-based weakness in Yen remains a key driver of GBP/JPY strength. The Japanese currency extended losses across the board on Thursday.

The British Pound also draws some support after Prime Minister Keir Starmer, earlier in the day, defended Chancellor Rachel Reeves amid speculation about her future, affirming she would remain Chancellor “for a very long time to come.” This reassurance helped ease market concerns that a potential replacement might pursue a looser fiscal stance with increased borrowing. Despite recent turbulence surrounding the welfare reform bill and internal party rebellion, markets have taken comfort in Reeves’ firm commitment to fiscal responsibility. Her refusal to abandon key budget targets, even after making concessions, has helped stabilize bond markets and reinforce investor confidence in the UK’s economic management.

Adding to the bullish momentum in the Pound, recent comments from Bank of England (BoE) policymaker Alan Taylor further reinforced expectations of a cautious and measured policy path ahead. Taylor warned that the UK’s economic soft landing is at risk due to weakening demand, but argued against aggressive rate cuts, noting, “I don’t think bigger cuts are necessarily needed or desirable.” He instead advocated for a gradual easing cycle, suggesting five rate cuts this year might be warranted if downside risks persist. Markets interpreted his comments as a signal that the BoE remains focused on balancing inflation control with support for growth, another factor supporting the Pound’s relative resilience.

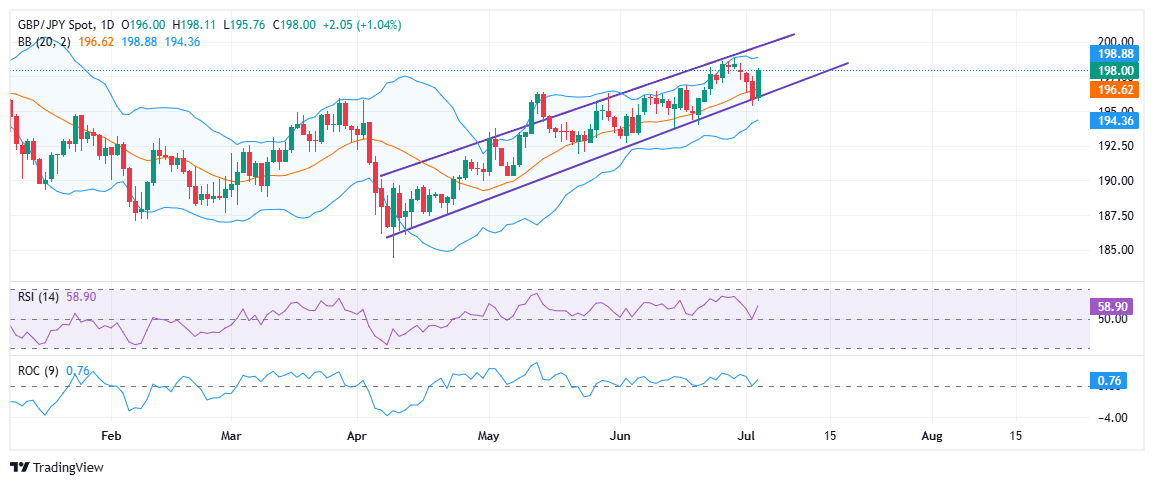

GBP/JPY Daily chart

From a technical standpoint, GBP/JPY is staging a solid rebound after testing the lower boundary of its ascending channel, which has guided price action since April. The pair is now approaching the upper Bollinger Band near 198.88, indicating potential for further upside if momentum remains strong. A daily close above 198.88 could expose the psychologically important 200.00 level.

The 20-day Simple Moving Average (SMA), which also serves as the middle Bollinger Band, is offering dynamic support near 196.62, reinforcing the pair’s bullish bias. The broader uptrend remains intact as long as GBP/JPY holds above the key 195.00 psychological region, which closely aligns with ascending channel support. A daily close below this confluence zone could expose the pair to further downside toward the lower Bollinger Band at 194.36.

Momentum indicators also favor the bulls. The Relative Strength Index (RSI) has turned higher and is currently holding above 58, while the Rate of Change (ROC) remains in positive territory at 0.76, reflecting steady upside momentum following the recent pullback.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.