GBP/JPY retreats as markets await UK GDP data

- UK GDP and output data come into focus on Friday as recession concerns linger.

- BoJ remains cautious as trade tensions mount, but safe-haven demand provides some relief for the Yen.

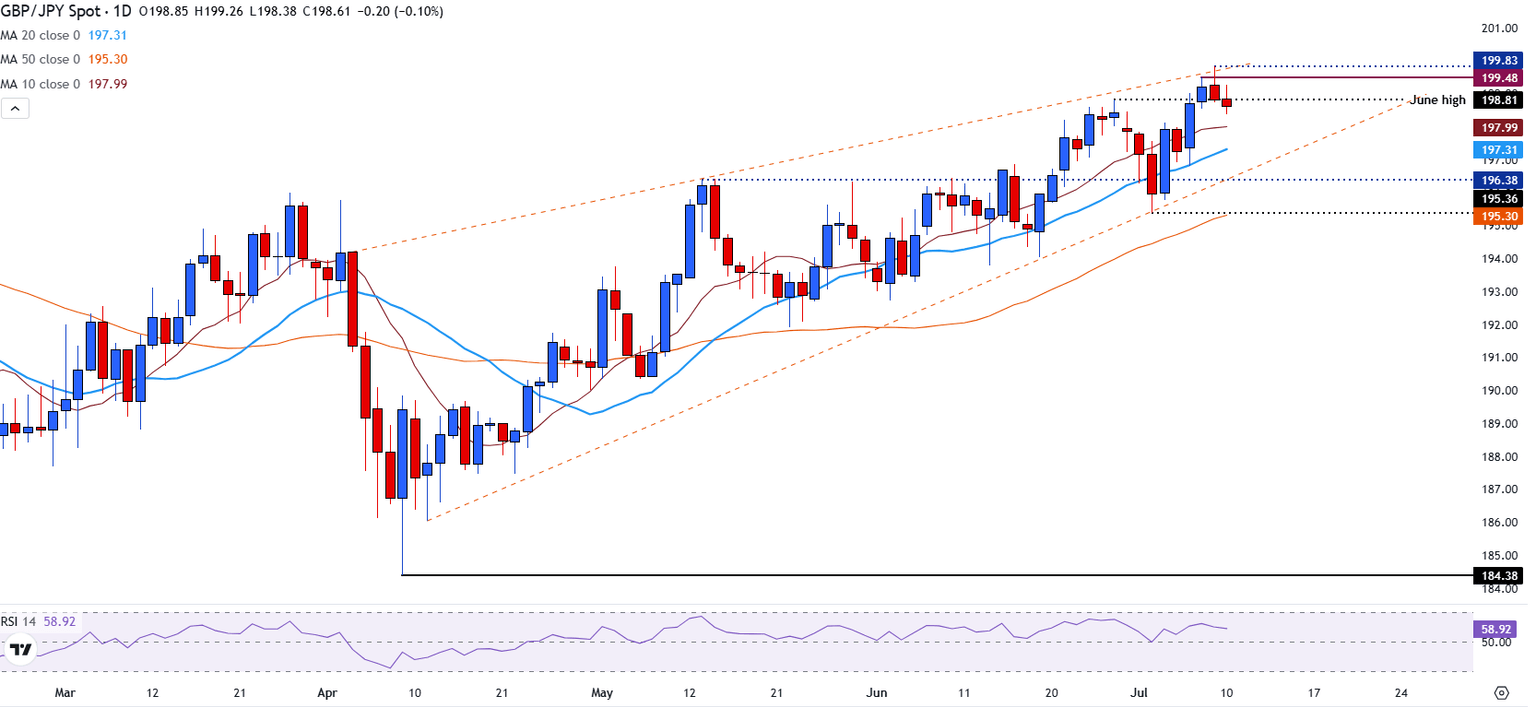

- GBP/JPY retreats below 199.00 resistance, within the confines of a rising wedge.

The Pound Sterling (GBP) is trading slightly lower against the Japanese Yen (JPY) on Thursday as risk sentiment shifts in response to renewed trade tensions.

After reaching a multi-month high of 199.83 on Wednesday, GBP/JPY has retreated, with price action remaining below 199.00 at the time of writing.

BoJ remains cautious as trade tensions mount, JPY firms modestly on defensive flows

Although the Bank of Japan (BoJ) has maintained its interest rate at 0.5% since increasing it in January, policymakers continue to express concern about the economic impact of rising US trade tariffs.

In response, the BoJ has maintained a cautious stance on hiking interest rates, allowing its counterparts to benefit from investors seeking higher yields on their investments.

While this narrative remains, Thursday's tone in JPY pricing reflects a light defensive bid.

UK GDP and output data in focus Friday as recession risks rise

Looking ahead, market focus will shift to a crucial batch of UK economic data scheduled for Friday.

At 06:00 GMT, the May Gross Domestic Product (GDP), Industrial production, and the Goods trade balance data will be released. These figures come at a delicate moment for the UK economy, as policymakers assess whether recent weakness is transitory or signals a broader slowdown.

Consensus expectations indicate a slight rebound in monthly GDP to 0.1%, following a contraction in April. Meanwhile, manufacturing and industrial production are expected to stabilize following back-to-back declines.

A disappointing set of figures, especially if both output and trade fall short of expectations, could reinforce concerns about stagnant growth. Such a scenario could lead to speculation about a potential Bank of England rate cut later this quarter.

For GBP/JPY, weak UK data could amplify downside pressure, particularly if it coincides with defensive positioning ahead of next week’s key geopolitical meetings. A positive surprise, however, may help the pair reclaim the 199.80–200.00 zone if risk appetite holds firm.

GBP/JPY retreats below 199.00 resistance, within the confines of a rising wedge

At the time of writing, GBP/JPY is trading just under 198.80 after briefly touching the upper boundary of an ascending channel earlier this week.

The failure to establish momentum beyond the psychological 200.00 mark has prompted some profit-taking, while a modest bid returns to the Japanese Yen amid heightened geopolitical caution.

Technically, the GBP/JPY pair is navigating between familiar levels. The June high at 198.81 now acts as short-term support.

A move lower could see prices retest the 10-day Simple Moving Average (SMA) near the 198.00 psychological level and the 20-day SMA at 197.32.

On the upside, a move above the 199.00 psychological resistance level and a retest of 199.83 could provide bulls the opportunity to push prices above channel resistance at 200.00.

With the Relative Strength Index (RSI) reading just below 60, conditions remain bullish; however, the momentum of the uptrend appears to be weakening.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.